Interactive Brokers’ (NASDAQ:IBKR) shares are up about 38% since I initiated coverage in October 2023, compared to a gain of about 22% for the S&P 500 (SP500) over the same period. And as IBKR stock has overshot my previously guided target price of about $98, I think it is time to revisit my thesis. Overall, fueled by a strong Q4 report and a promising monthly metric performance from through the first three months of 2024, outperforming expectations, I remain very bullish on IBKR. While I previously argued that higher interest rate benchmarks will drive net interest income for Interactive Broker, which I expect to continue, I now also argue that higher margin balances and trade volume will compound the NIM-implied earnings growth over the next 12–24 months. Amid increasing commercial momentum for Interactive Brokers, I revisit my EPS forecasts for the company up to 2026. Based on these updates, I now estimate a fair share price of $127.

For context: Interactive Brokers’ stock has outperformed the broader U.S. stock market, YTD. Since the start of the year, IBKR shares are up approximately 33%, compared to a gain of about 7% for the S&P 500 (SP500).

Seeking Alpha

IBKR Delivers Exceptional FY 2023 Results

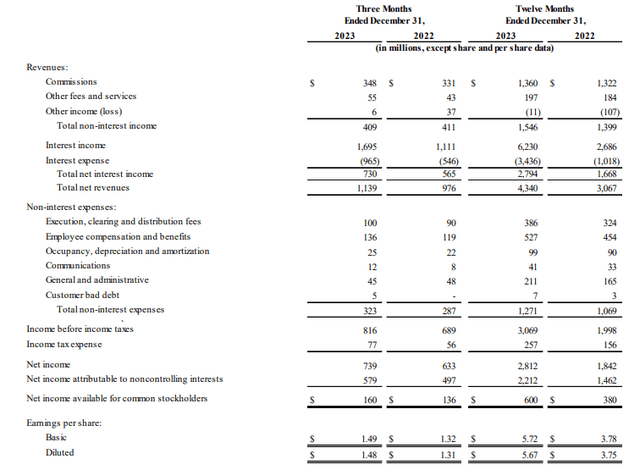

Interactive Brokers reported strong Q4 and FY 2023 results, beating analyst expectations on both top-line and broadly meeting expectations on earnings. During the period from September through the end of December, the leading e-brokerage firm generated a total of $1.14 billion of revenues, compared to about $980 million for the same period one year earlier (up 16% YoY). An expected, net interest income drove the expansion, jumping from $565 million in Q4 2022 to $730 million for the most recent quarter. Commissions increased to $348 million, up from $331 million, while other fees and services remained about flat on aggregate. On the bottom line, after accounting for $323 million of non-interest expenses (compared to $287 million in the same quarter a year earlier), IBKR generated $740 million of net income, up 11% YoY.

Q4 closed, a trend of strong commercial momentum throughout 2023. For the full year, IBKR increased total revenues from $3 billion to $4.3 billion, up 43% YoY, while net income surged about 55%, to $2.8 billion.

IBKR Q4 2023 reporting

Early Insights In 2024 Look Bullish

Looking into 2024, I argue there is more room for Interactive Brokers to surprise to the upside, as January, February and March provide early evidence that margin balances are increasing, and trade volume is picking up. This expansion of brokerage activity is, in my opinion, set to drive the next leg in IBKR’s earnings growth narrative. Zooming in on Interactive Brokers’ most recent release in monthly metrics, I point out that in March, account growth at IBKR was impressive, increasing by 25% YoY, with more than 60,000 new accounts added. Moreover, trading in options and equities went up daily: Daily Average Revenue Trades (DARTs) reached 2.412 million, marking a 14% increase year over year. Client equity ended at $465.9 billion, up 36% from last year and 4% from the prior month, while margin loan balances closed at $51.2 billion, 30% higher YoY and 8% up from last month.

Pointing to the February metrics, I highlight that higher benchmark interest rates, paired with increased trading activity and margin financing, provides an enormously explosive cocktail for growth in earnings for the next 12–24 months. In fact, enclosing the below graph from Refinitv, it is important to note that IBKR EPS estimates for 2025 have increased by about 5% through the past few months, accompanying the share price higher.

Refinitv

Raise Target Price To $127/ Share

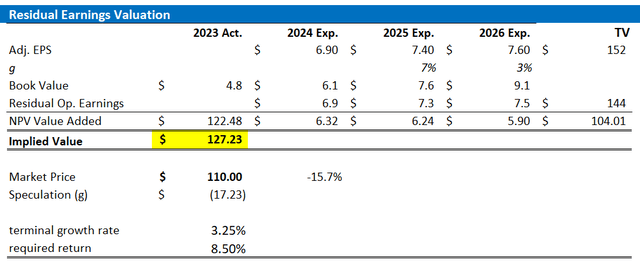

Buoyed by a robust financial performance in FY 2023 and positive early trends in Q1 2024, I am updating my residual earnings model for IBKR stock. For FY 2024, I now estimate IBKR’s earnings will range from $6.8 to $7.0 (non-GAAP), and I expect earnings to reach $7.4 in FY 2025 and $7.6 in FY 2026, with a subsequent earnings compound annual growth rate (CAGR) of 3.25% post FY 2026. Additionally, I have slightly lowered my cost of equity assumption by 25 basis points to 8.5%, primarily due to revised expectations for lower interest rates. Based on these revised assumptions, I now value IBKR stock at a fair implied price of $127.23, an increase from the previous estimate of $98.

For context, the value “Speculation” is just the difference to fair implied value. A negative value implies a discount.

Refinitiv; Company Financials; Author’s Calculations

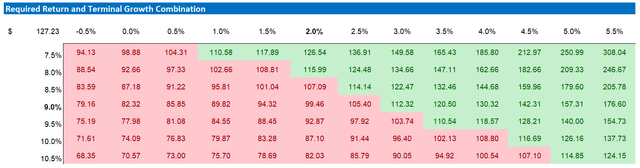

Below also the updated sensitivity table.

Refinitiv; Company Financials; Author’s Calculations

A Note On Risks

Overall, I view IBKR as the leading e-brokerage firm in the world. And given the company’s strong momentum with new and existing customers, I am not really concerned about competitive risks. Moreover, highlighting IBKR’s complete dedication to a digital-only approach, I also do not expect major disruption risks to the company’s business model. In my opinion, the major potential downside in IBKR’s growth and earnings narrative relates to macro factors. Specifically, I highlight that the bull thesis for IBKR stock builds on the assumption of accelerating margin financing and trade volume. This, however, is broadly dependent on a continuation of the ongoing bull market. If the stock market sees a major correction in the forecasted time period, demand for IBKR’s services would likely fall.

Conclusion

Since initiating coverage in October 2023, Interactive Brokers’ shares have surged 38%, beating the S&P 500’s 22% increase in the same time-frame. Despite the strong performance, however, there is still upside in share price appreciation ahead, in my view. In fact, the company’s strong Q4 report and impressive early 2024 metrics strengthen my bullish view on the net interest income thesis, as increased margin balances and trading volumes are poised to compound the impact of rich margin rates. On the backdrop of supportive and accelerating commercial momentum for Interactive Brokers, I updated my EPS estimates for the company through 2026, and calculated a fair implied share price of $127.

Read the full article here