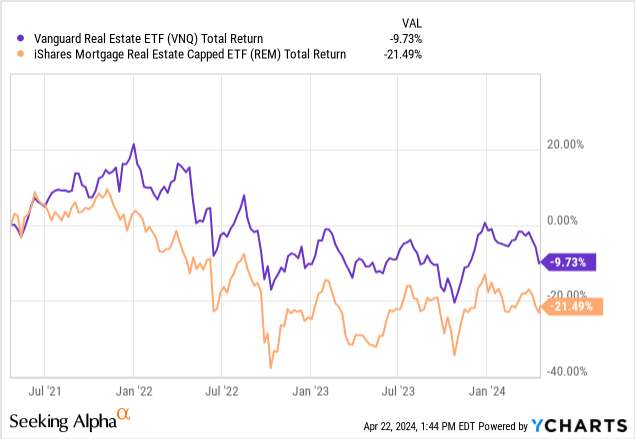

Elevated interest rates continue to wreak havoc across the real estate sector at large. Real estate values have declined and rising rates have pressured financing opportunities for large real estate investors, shrinking the amount of participants across the sector. REITs and real estate broadly have been impacted negatively over the past three years. The most accurate surrogate for real estate equity performance is the Vanguard Real Estate ETF (VNQ).

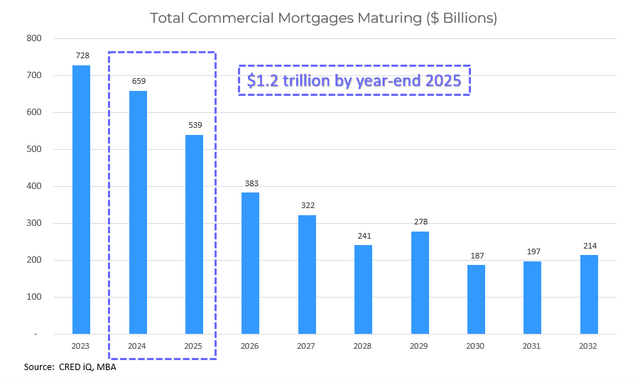

Looking within REIT subcategories, we will note that mortgage REITs or mREITs have been more significantly impacted than equity REITs. Their performance over the past two years has trailed more significantly. More specifically, recent performance has declined as the sector at large continues to face issues stemming from a wave of upcoming refinancings. Over the next two years, there are approximately $1.2 trillion in loans maturing.

Cred IQ

The financing environment is substantially more challenging than when many of these loans were originated. As a result, lenders have been challenged by non-performing loans which have become increasingly problematic. These issues have reached investors, such as shareholders of Ares Commercial Real Estate (ACRE) who recently received a dividend cut. The strongest across the sector appear to be well positioned, highlighting the importance of quality at the asset level.

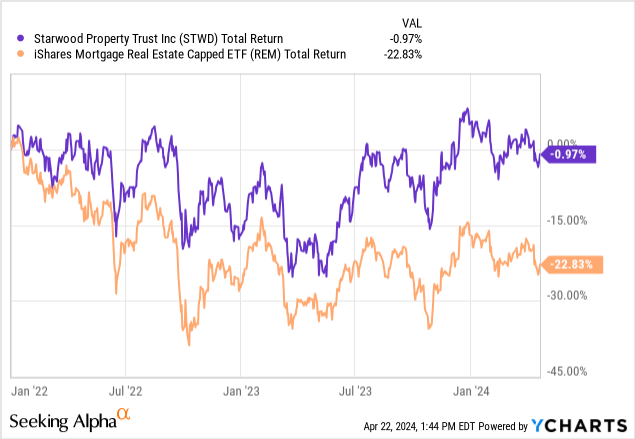

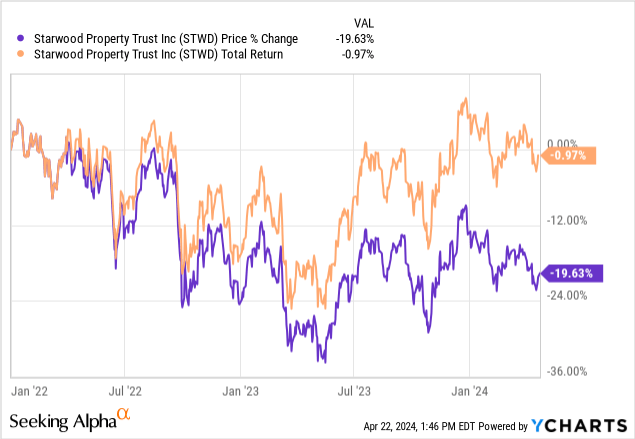

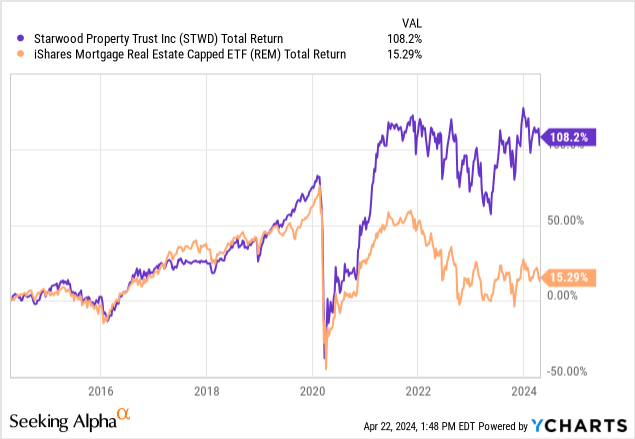

Today, we are going to revisit a leader in the real estate industry. Starwood Property Trust (NYSE:STWD) is an industry leading mortgage REIT backed by legendary real estate investor, Starwood Capital Group. We’ve covered STWD previously, issuing a “Buy” rating following a substantial share issuance at the end of 2021. Since our prior coverage, performance has been relatively flat, outperforming the sector materially.

The market has changed significantly since out last coverage. We will discuss changes to STWD’s underlying business and the sector outlook.

Starwood Property Trust

Starwood Capital is one of the largest and most respected asset managers in real estate. Starwood invests across a variety of platforms and funds. STWD is a diversified real estate and infrastructure fund which primarily targets commercial mortgages. Starwood’s platform provides expertise and support for STWD ensuring a proactive management team who can operate in a challenging market.

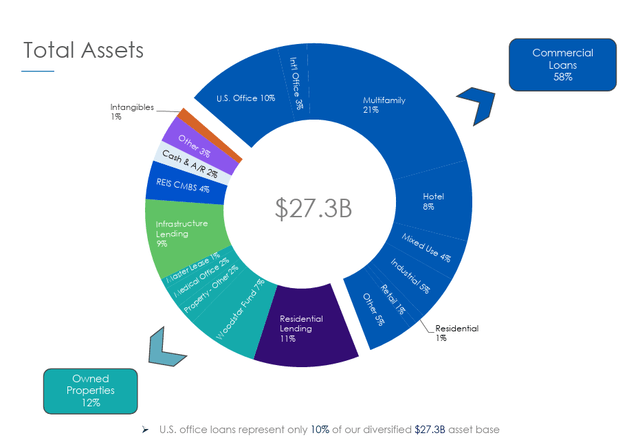

STWD is also large with a portfolio of around $27.3 billion across various asset classes. Originally, STWD was a commercial mortgage REIT, but their business has diversified into residential mortgage backed securities and infrastructure lending in 2016 and 2018, respectively. Today, the RMBS portfolio and infrastructure operations are both around $2.6 billion.

STWD

While commercial loans account for most of the portfolio, STWD also owns properties and maintains smaller investments in these other segments. Looking at the lending portfolio, we’ll note that multifamily is the largest segment followed by office at 21% and 13%, respectively. RMBS accounts for around 11% of STWD’s portfolio and their equity investments are slightly larger at 12%. Considering all sides of STWD’s business, the operation is closer to a diversified real estate and infrastructure fund than an mREIT.

STWD’s earnings are similarly spread across these segments. While maintaining a focus on their core business, roughly 34% of earnings are generated from the RMBS, infrastructure, owned properties, and real estate investing & services known as REIS. The REIS category includes commercial mortgage backed securities origination, loan servicing, and other REO activities.

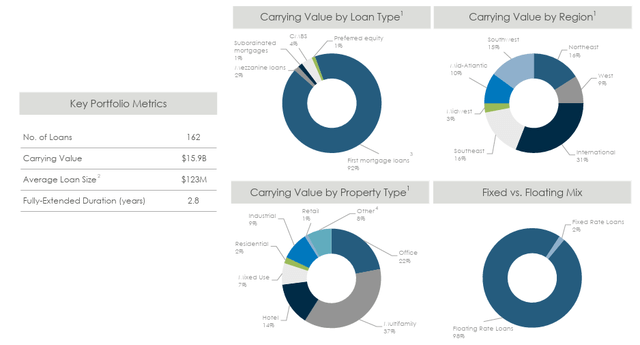

Diving into their commercial mortgage portfolio, we’ll see diversity across asset classes and geography. STWD’s commercial loan portfolio is spread across 162 loans. The largest asset class is multifamily representing 37% of the segment followed by office at 22%. Most of the properties are located in the United States at 69%. Within the United States, the properties are spread across regions with the Northeast accounting for the largest geography at 16%. Additionally, the overwhelming majority of loans are floating rate, which means they remain sensitive to movements in interest rates.

STWD

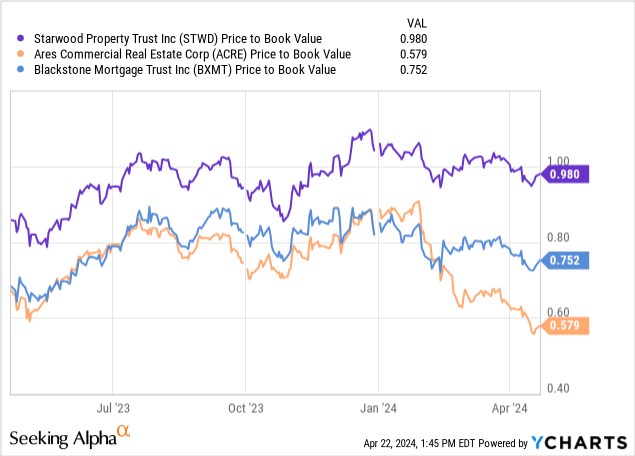

STWD continues to trade at book value. As madness continues across the mREIT sector, many REITs are trading at discounts to book value. STWD has maintained a better valuation than sector peers such as ACRE or Blackstone Mortgage Trust (BXMT), which trade at more generous discounts to book value. STWD’s diversified business model has helped maintain a better valuation through a difficult year. While these other REITs may offer discounts to book value, risks at the asset level may not be appropriately priced into book value. In reality, the REITs are likely priced appropriately based on their underlying assets.

Why Starwood Is Superior

STWD’s added layers of diversification including owned property and real estate services provide additional layers of cash flow to ride out the tumultuous lending environment. In the owned property segment, STWD focuses primarily on high quality stabilized assets such as this multifamily portfolio in Florida. STWD purchased a portfolio of 59 affordable housing communities in FL totaling 15,057 units.

Equity investments provide a diversified foundation of rising cash flow to support the REIT’s lending segment. As rents and values increase over long time frames, STWD is able to support their net interest margin with rental revenue and other streams of cash flow.

However, the real estate investing services may be STWD’s secret weapon in thriving during various economic conditions. As we mentioned, STWD’s platform is broad, touching every major asset class and geography. Accordingly, Starwood, STWD’s parent, is active across real estate capital markets and can provide value to smaller investors.

These services are more complex than most asset management services and include a special servicing segment and commercial real estate debt investment management. Since inception of the special servicing platform, called LNR, STWD has resolved over 7,000 non-performing loans with a principal balance over $88 billion. This type of specialized asset management can thrive during periods of stress which may otherwise negatively impact the REIT.

Outlook & Risks

Mortgage REITs have been broadly challenged by rising interest rates. Despite investing in floating rate loans, which many believed would benefit from rising interest rates, systemic issues have overshadowed any smaller benefits. Since rising rates began to impact on real estate borrowers at the beginning of 2022, shares of STWD have fallen by more than 20%.

STWD and similar REITs account for current and upcoming nonperforming loans by setting aside money to prepare for losses.

Accounting standards guide that lenders and debt investors manage reserves proactively based on what is happening within their portfolio and at the industry level. Recently, reserves are rising as refinancing challenges intensity. Remember, we are entering the early stages of this massive wave of refinancings.

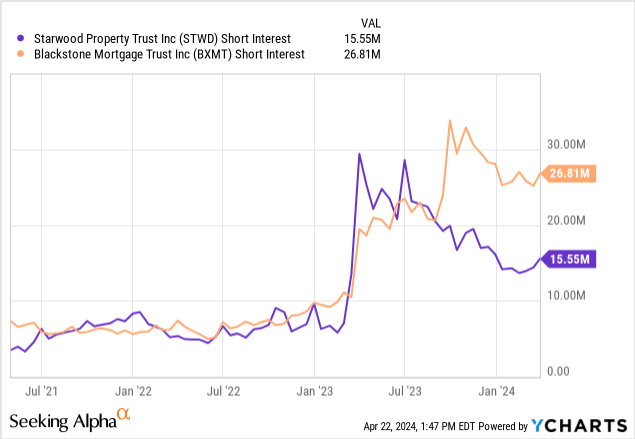

As mREITs continue growing CECL reserves as challenges emerge, the market is watching closely. Short interest across the sector has increased significantly. Shorting REITs can be expensive because of their high dividend yields which are added to the short seller’s borrowing costs. Betting against a best in class investor, such as Barry Sternlicht, is dangerous business.

Beyond accounting precautions, STWD has been proactive in acknowledging and reshaping their business to address a challenging commercial real estate market. As problems throughout commercial real estate begin to materialize, STWD’s management team acknowledges the reshaped market in their 2023 annual report.

The Federal Reserve’s aggressive rate hikes starting in 2022 to offset inflation caused by unprecedented government spending and stimulus led to higher loan-to-values on existing commercial real estate (CRE) loans. Our business line diversification and hedging policies have allowed us to remain nimble in this environment. We have continued to opportunistically invest every quarter, and with near record liquidity today, we believe we are prepared should elevated distress in CRE markets continue into 2024 and beyond.

STWD also notes additional changes such as reducing office exposure significantly, reducing construction loan commitments by 50%, and growing their energy infrastructure business.

Speaking broadly, STWD maintains a more positive outlook on the market. In their most recent earnings calls, CFO Rina Paniry provided additional color on the CECL situation:

Last quarter, I mentioned that our CECL balance doesn’t tell the whole story of our asset reserves because some of our loans have been moved to REO, and some loans that are still on our balance sheet have reported charge-offs. Although these have already been taken out of GAAP book value, neither of these appear in our CECL reserve. However, they are really no different than a specific reserve just on another financial statement line.

In the quarter, our general CECL reserve increased by $28 million to a balance of $307 million, of which 74% relates to U.S. office, while REO impairments increased by $101 million to a balance of $172 million. Together, these reserves represent 3% of our lending portfolio.”

With this additional color, we can see most of the CECL reserves are concentrated to the challenged office sector. The commentary was optimistic noting some reserves are not reflected in CECL reserves due to accounting procedures.

Moving into 2024, while the path clearly will not be linear, we see an improving backdrop with inflation receding, rates moving lower, and the economy showing stability. It will take time for the tale of legacy credit issues to work through the system and our portfolio, but macro momentum has shifted. Benchmark commercial real estate borrowing costs are down 150 basis points in the last four months.

The outlook remains cloudy as systemic issues continue impacting REITs of all shapes and sizes. The year ahead appears rocky as the tailwinds that provide support for commercial lenders seem further off than previously thought. As investors look to the Federal Reserve for potential rate cuts soon, commercial real estate could use some support.

Conclusion

STWD could be the best mREIT trading today. Long term performance supports this assertion as STWD has outperformed competitors over short and long time horizons.

As the industry remains broadly challenged, we are compelled to assign STWD a “Hold” rating. While it’s technically a downgrade, STWD is one of the best in the business. The company is worth holding, but an additional investment might wait until the broader market has calmed down.

Read the full article here