Investment Thesis

Chocoladefabriken Lindt & Sprüngli AG (OTCPK:LDSVF) is one of the largest producers of luxury chocolates in the world. Their high-quality confectionaries generate a narrow economic moat for the firm, which allows Lindt to generate solid returns and profits from their operations.

FY23 was a pretty successful year for Lindt with the chocolatier generating a 4.6% increase in total sales and a superb 17% YoY increase in net profits.

Nevertheless, the stock currently trades at a pretty steep premium, with shares potentially overvalued by up to 33% even in my base-case valuation model.

Therefore, I must rate the stock a hold at present time, despite my admiration for the company (and their chocolate!).

Business Overview

Lindt is perhaps the most well-known brand of high-end chocolates. Since the Swiss chocolatier’s founding in 1845, Lindt has had a huge impact on the confectionary business by helping to arguably create the now world-wide demand for premium chocolates and treats.

By focusing on improving the quality of their product as well as creating an exclusive and desirable brand image, Lindt has managed to transform their chocolates from being simply consumer discretionary products into what I believe can be considered luxury goods.

Since the 1994 acquisition by Lindt & Sprüngli of Austrian chocolatier Hofbauer, the Swiss chocolatier has focused on acquiring other high-end chocolate brands in the pursuit of bolstering their own portfolio of luxury banners under which to sell their products.

Today, Lindt and their subsidiaries sell chocolates under the Lindt, Ghirardelli, Russell Stover, Caffarel, Hofbauer and Küfferle brands. Perhaps most iconic are Lindt’s own gold bunnies along with their Lindor truffles.

Economic Moat – In Depth Analysis

Lindt & Sprüngli have developed what I believe is a narrow economic moat within the confectionary business.

The confectionary industry is traditionally a highly competitive business environment, with the entire sector being essentially split into two categories: mass-market products and luxury products.

Lindt as a brand has played an important role in the development of the luxury segment within the greater industry. By focusing on the development of a higher-end image for their chocolates (while also ensuring their products actually are made of the finest ingredients), Lindt has managed to separate their confectionaries from the competition.

Such differentiation is incredibly difficult to achieve within an industry as competitive as the confectionary business. Ultimately, it is both easy for new entrants to begin manufacturing chocolates due to low barriers of entry, while consumers face zero switching costs when making their purchasing decision.

I believe that the longevity and strength of the Lindt brand has come from an acute ability for the management team to maintain their luxurious brand image. Considering that flavor perception is an incredibly complex and subjective process, Lindt’s focus on ensuring consumers are primed with expectations of being about to enjoy the best quality and taste possible helps ensure consumers feel content with their purchases.

Ultimately, the luxury brand image Lindt has created for their product allows the firm to enjoy significant pricing power within the market, especially compared to more mass-market competitors.

This should in the long-run allow Lindt to generate greater margins from their operations while also achieving a greater return on invested capital compared to their competitors, ceteris paribus.

However, I also believe the emotional connection Lindt’s brand creates with their consumers provides the firm with less elastic demand during economic downturns. Considering that consumers view Lindt products as gifts, special treats and luxury items, it is not inconceivable that even during periods of constrained economic activity, consumers would continue with the purchase of their chocolates.

Overall, I like Lindt’s business operations and the brand the company has built for their product. The perceived switching costs and emotional connection made between the chocolatier and their consumers helps generate real pricing power, thus allowing Lindt to generate greater margins from their products compared to rival brands.

Fiscal Analysis

Lindt & Sprüngli is fundamentally what I consider to be a high-quality enterprise. The chocolatier has five-year running average ROA, ROE and ROICs of 6.50%, 11.30% and 9.00% respectively, which are robust in my opinion.

The 9% ROIC handily outpaces their current 6.90% weighted average cost of capital (‘WACC’) which illustrates that Lindt is able to generate greater returns on their invested capital compared to the cost needed to raise said capital in the first place.

Gross, operating and net margins for the same running five-year period were 66.40%, 13.75% and 11.00% respectively. The gross margin is very positive in my opinion with the large gap between gross and operating margins being primarily illustrative of the relatively high marketing costs associated with their sales.

Considering their positioning at the high-end of the market, I believe it comes as no surprise that the firm must devote a significant portion of revenues to the upkeep (marketing) of their luxury image.

March 6 saw Lindt release their end-of-year 2023 fiscal results, which were mostly positive in my opinion given the prevailing macroeconomic conditions.

Lindt FY23 Earnings Report

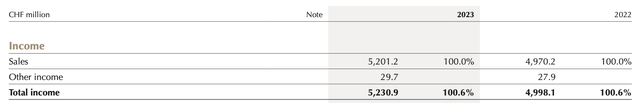

Total net sales increased 4.6% YoY to CHF5.2 million (CHF is Swiss Francs). This came thanks to strong performance by their core Lindt brand, with the firm seeing 10.3% organic growth YoY.

A continued preference by consumers to purchase Lindt products over those of competitors helped ensure demand remained strong despite a sluggish macroeconomic environment.

The overall 4.6% increase in sales also includes a 5.4% negative currency impact due to the continued strengthening of the Swiss Franc against the U.S. dollar and Euro.

Lindt’s management team were particularly positive about their double-digit organic growth figures, which came despite an overall slowdown in the global chocolate market.

Both the chocolatier’s domestic European market and North American segment saw 4.9% YoY and 4.1% YoY sales growth. Lindt views the U.S. market in particular as offering a truly remarkable opportunity for growth, given that it is the world’s largest chocolate market.

Lindt aims to further expand their operations in the U.S. both through continued marketing of their core Lindt brand as well as through their 2014 acquisition of the popular Russell Stover confectionary company.

Lindt FY23 Earnings Report

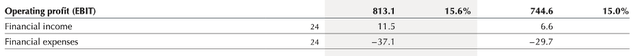

EBIT – which can be considered as operating income as more commonly referred to in U.S. GAAP metrics – also increased substantially in FY23. Total end-of year operating income was up 9.2% YoY thanks to both an improved product mix along with positive impacts from a substantial cost initiative pursued by the chocolatier.

Lindt FY23 Earnings Report

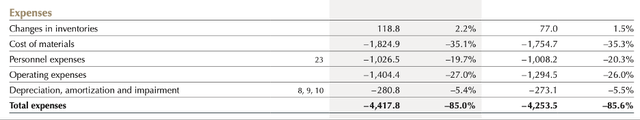

On the expense front, Lindt has managed to essentially maintain both materials and personnel costs flat lined in FY23 despite a tricky inflationary business environment and the overall increase in sales recorded at the firm.

Material costs remained at around 35% of total sales, as Lindt noted a stabilization in both sugar prices and a decrease in energy and packaging material costs.

While the poor cocoa and sugar harvests seen over the past year have placed some pressure on Lindt’s EBIT, the chocolatier noted that strategic long-term supply contracts combined have mitigated the threat of a sudden risen in input prices.

Personnel expenses were essentially flat YoY too as Lindt saw only a small 2% increase in their headcount.

Lindt FY23 Earnings Report

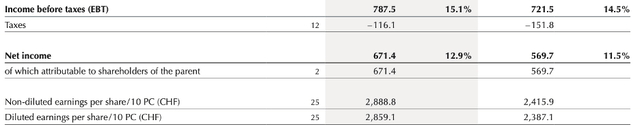

Overall, FY23 saw net income increase 17% YoY which is truly superb in my opinion. The overall ability for Lindt to continue selling more chocolates, all the while keeping costs flat, illustrates just how well the firm has managed both their business operations and the brand image among consumers.

Examination of Lindt’s balance sheets reveals what I consider to be an exceptional capital allocation strategy.

Total current assets amount to $3.10 billion, while current liabilities total just $2.19 billion. This leaves Lindt & Sprüngli with a wonderful current ratio of 1.42x and a superb quick ratio of 1.25x.

I also want to highlight that Lindt has over $549 million dollars in cash and equivalents at the end of FY23, which illustrates the conservative and risk-averse enterprise management style present at the firm.

Total assets amount to $9.35 billion, with total liabilities only being $4.28 billion. Lindt also has about $5.1 billion in shareholders equity. This wonderful liquidity means Lindt operates with a financial leverage ratio of just 1.85x all the while maintaining a debt/equity ratio of just 0.25x.

While some business analysts may deem such conservative utilization of debt as being excessively conservative, I couldn’t be happier about their current capital allocation strategies.

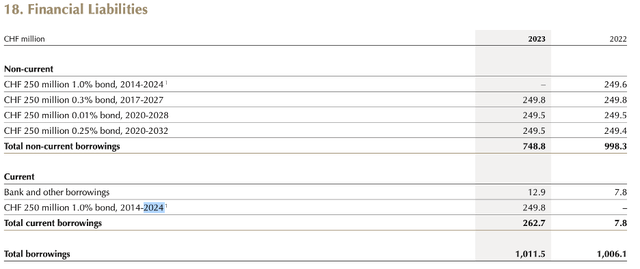

Lindt FY23 Earnings Report

Most of Lindt’s long-term debentures are in the form of corporate bonds, with over 2/3 only maturing post 2027. I really like their debt structure at present time and believe the firm is well positioned to weather even a long-term increase in borrowing costs.

It must also be noted that this wonderful economic position has been achieved all the while Lindt has continued to expand their manufacturing footprint. Upgrades are being undertaken across production plants in New Hampshire, Switzerland, Germany and Italy so as to allow Lindt to manufacture a greater volume of confectionaries.

From a cashflow perspective, FY23 saw Lindt & Sprüngli generate over CHF369 million in unlevered FCF, which is exceptional given their conservative debt profile and limited current liabilities.

Considering Lindt’s overall fiscal profile, I believe that the chocolatier is a truly wonderful company. Solid returns on invested capital, sound business fundamentals and outstanding liquidity present what I consider to be the hallmarks of a superb management team.

Planned expansion into the U.S. market should allow Lindt to successfully grow annual sales figures, while a continued focus on operational efficiency could yield even further margin expansion in coming years.

Valuation

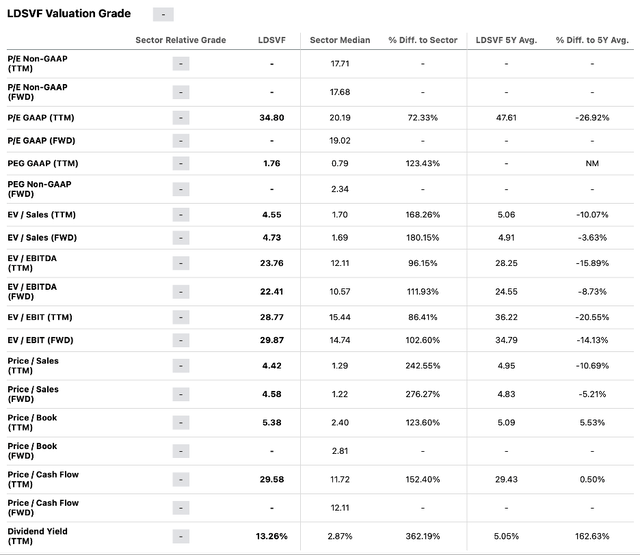

Seeking Alpha | LDSVF | Valuation

While Seeking Alpha’s Quant does not currently assign Lindt with a valuation grade, the valuation metrics presented are still a great place to start our examination of what value may lie in LDSVF shares.

Lindt’s current P/E GAAP TTM ratio of 34.80 is certainly quite rich and over 72% above the consumer staples sector mean. While Lindt has a history of generating solid YoY revenue and net income growth, such a high P/E ratio may be indicative of an overbought state for the chocolatier’s shares.

The 29.58x P/CF TTM is also very high in my opinion with a P/S TTM ratio of 4.42x illustrating just how much growth is already baked-in to Lindt & Sprüngli’s shares.

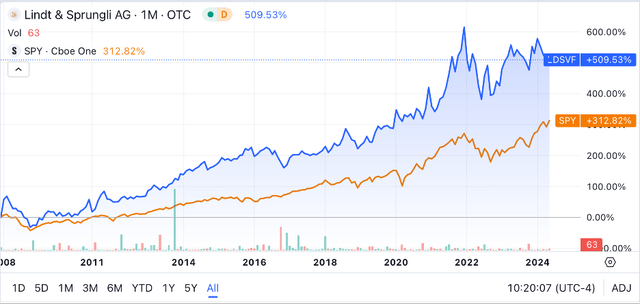

Seeking Alpha | LDSVF | 14Y Advanced Chart

A quick look at a 14Y chart illustrates just how well LDSVF stock has performed over the past decade and a half, with shares posting returns of over 509% (36% annualized returns). In the same period, the hugely popular S&P 500 index tracking ETF (SPY) only generated 312% returns.

The chart above illustrates Lindt’s consistency in generating ever-increasing annual profits, which may partly be a reason for the hugely rich stock valuation currently present in shares.

The Value Corner

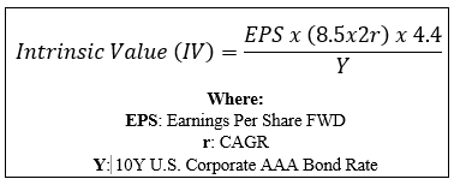

In order to obtain a more objective and quantitative perspective on the value present in LDSVF stock, I used The Value Corner’s Intrinsic Value Calculation.

Using the chocolatier’s current share price of $11,581.04, an estimated 2024 EPS of $460, a realistic “r” value of 0.07 (7%) and the current Moody’s Seasoned AAA Corporate Bond Yield ratio of 5.28, I derive a base-case IV of $8,707. This suggests that shares may currently be trading at a 33% premium.

I then used a more pessimistic CAGR value for r of 0.05 (5%) to model a scenario where a prolonged economic slowdown in the U.S. limits some of Lindt’s growth objectives. In such a model, shares were valued at around $7,160 representing a whopping 62% overvaluation in the stock.

Considering these models, I believe it is quite clear that Lindt’s stock is currently trading at a real overvaluation relative to the intrinsic value present in shares. While the firm’s ability to continue growing revenues and profits amidst a sluggish macro environment is impressive, the stock certainly appears expensive at present time.

Therefore, I find it impossible to make any real short-term (1-12 months) predictions regarding the direction of share prices.

In the long-term (2-10 years), I believe Lindt is uniquely positioned to continue generating exceptional shareholder returns thanks to their strategically (and fiscally) sound approach to expansion.

An increased presence in the U.S. market should allow Lindt to increase their global presence even further, while continued refinement of their operational processes may lead to even further margin expansion.

Lindt & Sprüngli Risk Profile

Lindt faces real risks from a cyclical demand environment, a highly competitive market landscape and the impacts of supply side inflation on their operations.

During economic slowdowns or recessions, consumers often experience a contraction in the amount of disposable income they have available to spend on non-essential goods such as chocolates. As a result, it is quite probable that Lindt’s overall ability to grow their revenues depends on the general health of both the Swiss, EU and U.S. economies.

Lindt also faces real competitive pressures from competing chocolatiers. While matching the scale and global brand reputation held by Lindt would be very difficult, smaller firms could potentially steal some of Lindt’s consumers in regional markets, which ultimately would still hurt the firm’s bottom line.

Finally, fluctuations in the prices of both sugar and cocoa can present a real challenge for Lindt. While the company has multiple long-term contracts in place with key suppliers of sugar and cocoa, a long-term increase in the cost of either of these two critical inputs could significantly hamper Lindt’s operational efficiency.

Quite simply, if Lindt’s cocoa input prices increased 30%, I believe the firm would be unable to shift this burden onto consumers without experiencing a sharp contraction in demand, market share or both.

Analysis of Lindt’s ESG related activities illustrates to me that the company is acutely aware of the ability and responsibility for their operations to beneficially impact both the environment and the societies in which it operates.

Lindt’s dedication to only sourcing fairly produced cocoa along with multiple objectives designed to decrease their carbon footprint are just an example of the positive attitude Lindt has taken towards real ESG concerns.

Considering these factors, I rate Lindt as having a medium risk exposure rating. Of course, the topic of risk and ESG matters are highly subjective and I therefore implore you to conduct your own research into the subjects should they be of concern to you.

Summary

I like Chocoladefabriken Lindt & Sprüngli AG. The chocolatier has a wonderful product (I have taste tested it many times!), solid business fundamentals and a truly exceptional asset allocation strategy.

The most recent annual results were very robust, given the difficult macroeconomic environment and the continuously strengthening Swiss Franc. Management’s outlook for 2024 is a little more conservative, although I still believe the business is in a great position to continue growing in the coming fiscal year.

Nevertheless, the current valuation is very rich with shares trading at what I believe to be a material overvaluation.

As a result of the premium share price, I am unable to suggest building a position in the stock at present time, despite my admiration for the enterprise these shares represent.

I will continue to analyze their business over the coming months and look forward to a fairer valuation creating an opportunity to invest in this wonderful chocolate producer.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here