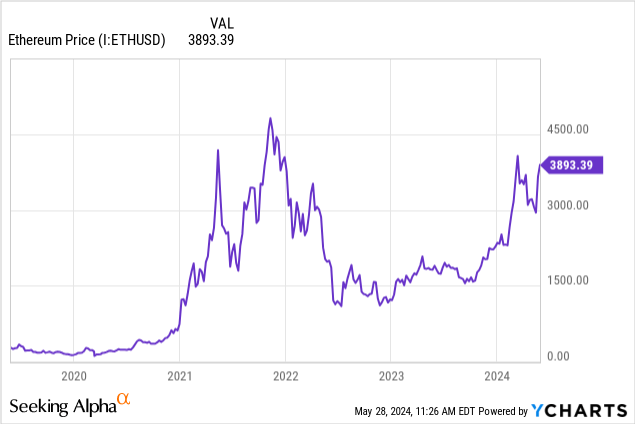

In a surprise move last week, the SEC signed off on exchange proposals to list Ethereum-based ETFs. This means that Ethereum (ETH-USD) will soon be tradable for millions of investors in their brokerage accounts with just a few clicks. The approval of Bitcoin ETFs (BTC-USD) in January was a watershed moment for crypto, and Ethereum ETFs were a logical next step. Even earlier this month, the idea of an Ethereum ETF had seemed like a longshot. But Donald Trump stepped up attacks on the SEC in early May and began accepting crypto donations, leading prominent Democrats to fear that crypto was becoming a political weakness. It seems that some political pressure may have been applied, and Ethereum soared on the approval news.

I’m a proponent of Bitcoin for its role as a decentralized currency that can’t be inflated away by central banks. However, there are 10,000+ other cryptocurrencies out there. I would argue that more than 99% of them are fundamentally worthless. It’s not clear whether the SEC will start allowing random altcoin cryptos to list on US exchanges– this seems like it would create way too much potential for all kinds of shenanigans.

But Ethereum has over $400 billion in market cap and has been around for 10+ years, so allowing the ETF to move forward seems like a reasonable compromise between protecting investors and allowing degrees of freedom with where people put their money. This said–key differences between Bitcoin and Ethereum make me skeptical about the utility of investing in Ethereum, especially via ETF.

ETF Conversion Will End Crypto Funds’ Premium/Discount Insanity

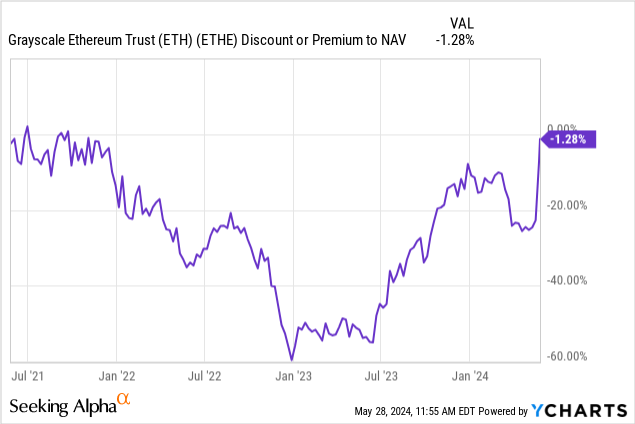

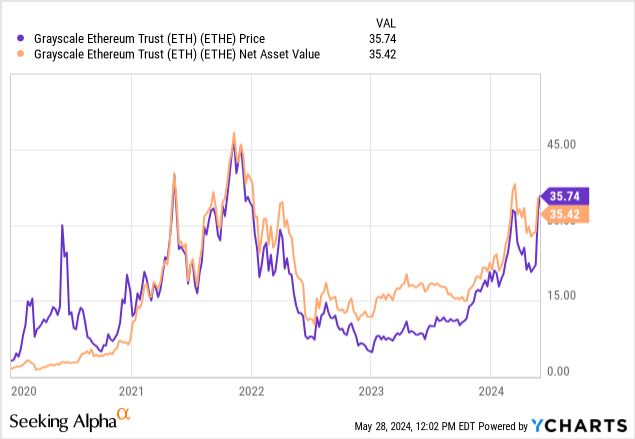

If you’d had perfect foresight about the Ethereum ETF being allowed, you could have made a boatload buying the Grayscale Ethereum Trust (OTCQX:ETHE). The discount to ETHE’s net asset value steadily shrank over the last year from 50%-plus to near 0% as of today.

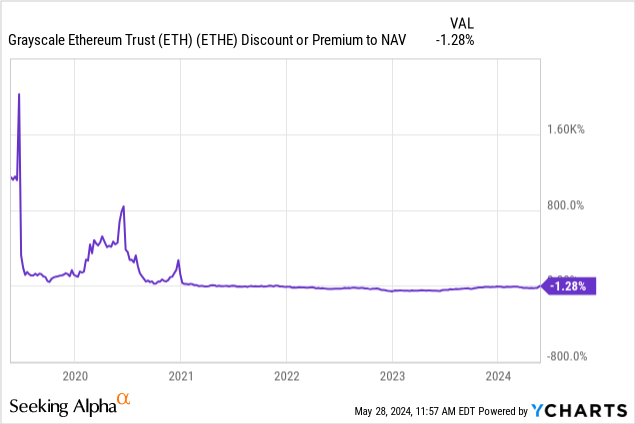

A longer-term view shows the insanity of the ETHE fund and how it traded at a massive premium, then a huge discount. For retail investors who don’t understand how NAV works, this is a way to lose tons of money.

Here we see that the fund traded for as much as an 800% premium to the value of its underlying Ethereum during COVID. I knew a few retail investors who insisted on buying this fund because it was “ethereum” and paid 2x or more the value of the underlying Ethereum, only to sell for less than the value of their Ethereum during the crypto bust in 2022. This caused massive losses.

Here’s another way to look at it– ETHE generally traded for huge premiums to the value of its underlying assets until 2021, then huge discounts in 2022 and 2023. In general, if you’re going to buy closed-end funds, you need to be aware of the net asset value of the assets you’re buying. Failure to do so can create ugly losses, and recognizing when assets are trading below NAV with a catalyst to move it back to NAV can make for great trades.

To this point, you can look at Grayscale’s remaining crypto funds and compare NAV to market price. What you’ll find is that there is little to no correlation between asset value and what people are paying. For example, Grayscale’s Litecoin Trust (OTCQX:LTCN) trades for roughly $29, but the underlying crypto is only worth $7. Don’t pay $29 when you can pay $7 on the open market!

Grayscale still does have a couple of funds trading well below NAV. The two funds under NAV are Grayscale’s Digital Large Cap Fund (OTCQX:GDLC) and the Ethereum Classic Trust (OTC:ETCG), but you’d have to do some due diligence to find catalysts. If there’s no catalyst you get stuck paying 2.5% in fees for life. If you have an opinion on these, share your thoughts in the comments! But most of these funds are trading well over NAV, which means you shouldn’t touch them with a ten-foot pole. It’s not clear whether the SEC will approve any more crypto ETFs after Ethereum, so my guess is that these trades are over.

Money Is Inside Baseball: Crawl Before You Walk

If you can’t spot who the sucker at the poker table is, the sucker is you. The same is true for crypto. I just showed you how crypto funds trade at huge premiums and discounts to NAV, and how people willingly paid huge NAV premiums for crypto funds only to get burned. This is also true for crypto itself. Financial returns for people I know who are involved in Ethereum are in large part due to staking/farming/lending. If you aren’t participating in this, you seem to be losing purchasing power to those who are. If you’re doing staking/lending wrong, you also risk losing your money to scams and counterparty risk.

The Ethereum ETFs won’t be allowed to do staking, per the SEC rules. I mean, would you invest in a US dollar ETF that didn’t pay interest? One similarity between the mainstream financial system and the crypto world is that it transfers wealth from people who don’t know what’s going on to people who do. For example, in the US, money market funds currently hold about $6.4 trillion in assets, while commercial banks hold $17.6 trillion. If consumers ever really caught on to using money market funds, it would be a serious issue for banks because they could cut out the invisible middleman en masse. Fortunately for banks, 90% of people are unaware or are too lazy to care. Bank of America (BAC) alone holds close to $1 trillion in consumer deposits and pays an average of 0.55% per year on them. This is something I see all the time. People will be making $80,000 per year and complain they have no money left over, but they have a $1,000 per month car payment, are paying for debit cards with everything and not getting any cash back, and then they have their money parked where it’s earning 0.05% APR. The problem isn’t the system, it’s them. For investors in crypto, these tendencies are only magnified. While I’m sure there are good staking opportunities out there using Ethereum, they require a high level of sophistication and the new ETFs won’t be able to get involved.

Bottom Line

My question for investors in crypto is– if the public understands the US banking system so poorly, do they have any business investing in crypto funds? Beyond some Bitcoin, probably not. I think putting some money in the iShares Bitcoin Trust (IBIT) or the Fidelity Wise Origin Bitcoin Fund (FBTC) is reasonable. However, people seem to get very quickly out over their skis in crypto, so unless you have a good idea of what the underlying mechanics are in Ethereum and other crypto markets, I think it’s best to stay clear.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here