The United States stock markets performed well in May, even though they went through a down period that looked a little bit ominous.

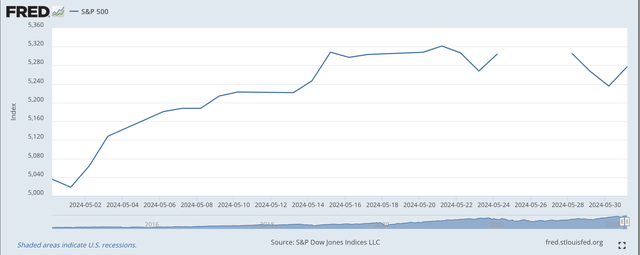

The S&P 500 index rose from 5,035.69 on April 30, 2024, to close at 5,277.51 on May 31, 2024.

The historical high for the S&P 500 is 5,321 and was reached on May 21. 2024.

Here’s the picture of the 4.8 percent rise.

S&P 500 Stock Index (Federal Reserve)

For the month, the Dow Jones Industrial Average rose 2.3 percent in May and the NASDAQ index rose 6.9 percent.

As can be seen from the chart, in the last half of the month of May, the stock market basically went sideways with two or three days showing sizeable drops.

What seems to have been going on?

Recently, investors have seemingly been concerned that the Federal Reserve was not going to cut its policy rate of interest this year.

The reason for any delay was laid at the feet of the inflation demon.

For a good portion of the month, investors were concerned that the inflation picture was not that positive which would mean that the possibility that the Federal Reserve would lower its policy rate of interest would be kept at its current level or…as some suggested…might even raise the policy rate.

On Friday, after a couple of days of drops, stocks opened higher.

The reason was that on Friday morning before the markets opened, information on the Fed’s preferred price index, the personal consumption expenditure price index or PCE, was released.

The news, the PCE price index was up only 2.7 percent over April 2023.

This increase, according to Charley Grant in the Wall Street Journal “was in line with the expectations of economists polled by the Wall Street Journal.”

The core price index rose by 2.8 percent, year-over-year, slightly higher than the 2.7 percent that was expected.

And, Mr. Grant added, “The new price data follows news that the economy grew less than previously thought to start the year.”

This information impacted the investor view on the possibility that the Fed will lower its policy rate of interest. Now, Mr. Grant tells us, investors believe that there is an 81 percent chance that the Fed will reduce its policy rate at least once before the end of 2024.

So, investors moved, and the stock market rose…because of the expectation that the Fed would lower its policy rate of interest at least once before 2024 was completed.

That’s it, folks!

The Federal Reserve is going to keep stock prices at these elevated levels…or even higher.

To Lydia DePillis, writing in the New York Times about the state of the economy and the future of inflation,

“Spending remains healthy…. The stock market has been strong and home prices are high, giving well-off consumers the confidence to take lavish vacations and buy new cars, even as delinquency rates rise for those who have maxed out credit cards.”

“Consumers are borrowing because they can, because their balance sheets are so healthy.”

“The ‘wealth effect’ is making them believe that they can do it.”

And, so the stock markets go up.

To me, the critical statement here is that “Consumers are borrowing because they can….”

Please note a recent “Federal Reserve Watch” post of mine: “Plenty of Money Around.”

The Federal Reserve has put the money into the economy. A lot of it is still there.

But, the presidential election is going to dominate the rest of the year. And, the major question is, what is the Fed going to do with the election coming up?

My response to this is that the Federal Reserve officials don’t want to cause the stock market, the financial markets, to make a sudden jerk downwards.

I have written a fair amount on this issue.

Going into a presidential election, Federal Reserve officials want to avoid making any kind of a decision that will cause the stock market to collapse…or, to move in a way that causes investors to believe that the officials are acting in a way to get the current president re-elected.

That is, we are entering a period of time when Federal Reserve officials want to have as low of a profile as possible.

The officials hope that they can get by with “more of the same.”

That is, the Federal Reserve officials would like to just disappear until the end of November…or even later if possible.

The Federal Reserve officials would like for the Federal Reserve to become invisible.

The stock markets and the other financial markets have been relatively sedate most of this year.

If they could only be sedate for the rest of 2024…I think most Federal Reserve officials would like that.

I think Fed officials would like to get by the rest of the year without moving the policy rate of interest. Moving the policy rate up, I think, is a real “no, no.” Moving it down…maybe…but don’t be too anxious.

Federal Reserve officials have already said that they will continue to reduce the size of the Fed’s portfolio of securities. They have also said that they would probably be reducing the size of the monthly reduction in the size of the Fed’s portfolio of securities.

But, the Fed will still try and keep the “cash reserves” of the commercial banking system relatively stable, managing these “excess reserves” to maintain market calm and stability.

I firmly believe that this is what Fed officials would like to achieve for the rest of 2024.

This would get the Federal Reserve officials through the presidential election with little or no blame placed upon their shoulders.

They may get “blamed” for something anyway, but they want to keep their “plates clean” so that they can strongly argue that they did nothing to impact the outcome of the election.

My feeling is that this would make the monetary policy of the next six months just about the same as it has been for the first five months of 2024.

For the first five months of 2024, the S&P 500 stock index rose by 10.4 percent.

Not too shabby.

I’m sure that the Federal Reserve officials would accept another rise of 10.0 percent or so in the second half of 2024.

Yes, the Fed could be accused of working to benefit the incumbent president, but they could point over and over to their statistics that they did nothing more than continue the policy they have had in place since March 2022.

This is, I think what the Federal Reserve will do moving forward.

If there are no major disturbances to the economy in the last half of 2024, I believe that the Fed could get this kind of market response.

Most of all, Federal Reserve officials want to get investors…and the public…from trying to anticipate every move they might be making over the next five months.

Federal Reserve officials…want to get out of the headlines.

Read the full article here