It is always interesting when commodity prices rise. The market produces various narratives to suggest why prices will keep growing indefinitely. Such applies to all commodities, from oil to orange juice or cocoa beans. For example, Michael Hartnett of BofA recently noted:

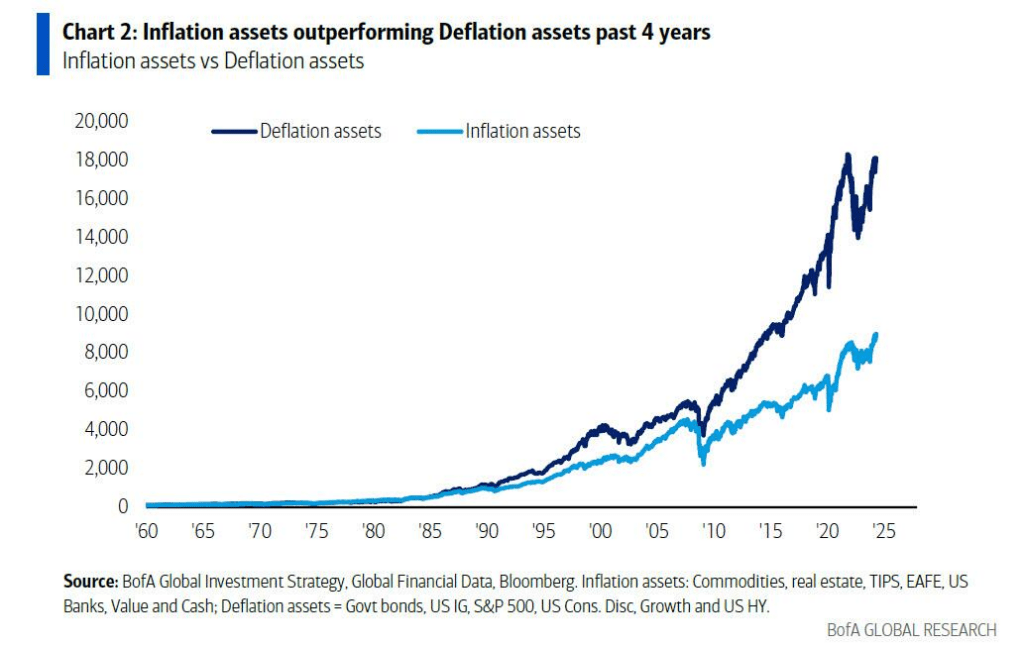

The 40-year period from 1980 to 2020 was the era of disinflation: thanks to fiscal discipline, globalization, and peace, markets saw ‘deflation assets’ (government and corporate bonds, S&P, growth stocks) outperform ‘inflation assets’ (cash, commodities, TIPS, EAFE, banks, value). As shown below, ‘deflation’ annualized 10% vs. 8% for ‘inflation’ over the 40-year period.

But the regime change of the past 4 years has roles reversed, and now ‘magnificent’ inflation assets are annualizing 11% returns vs 7% for deflation assets.”

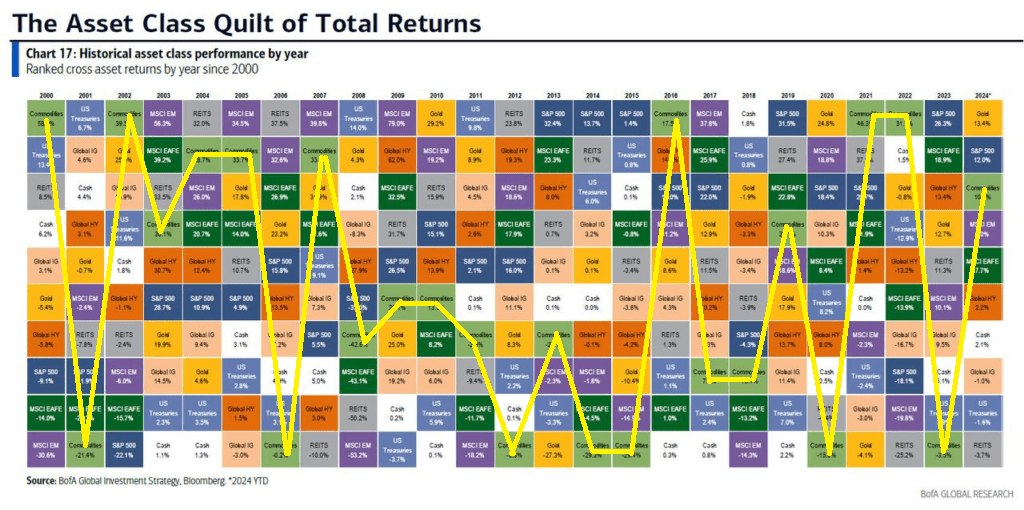

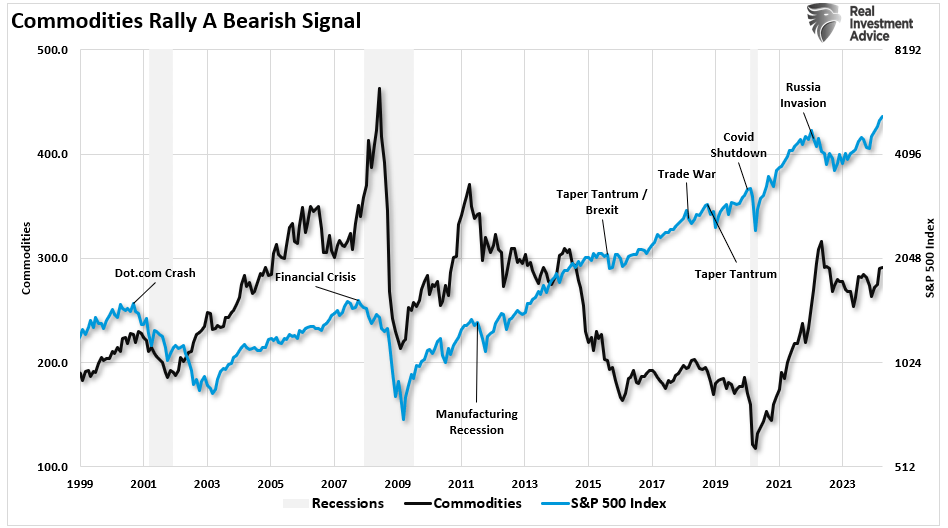

Mind you, this is not the first time that markets have gone “cuckoo for commodities.” The most recent episode in 2007 was “Peak Oil.” However, crucially, this time is never different. As shown below, commodities regularly have surges in performance and are the best-performing asset class in a given year or two. Then, that performance reverses sharply to the worst-performing asset class.

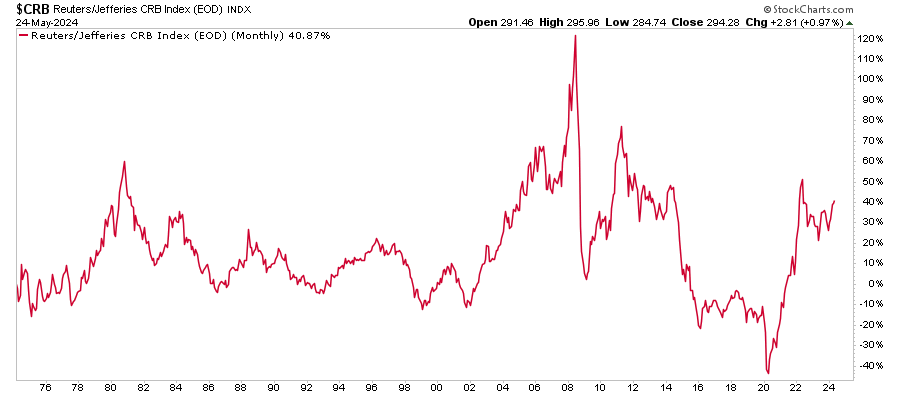

That performance “boom and bust” has remained since the 1970s. The chart below shows the Commodities Index’s performance over the last 50 years. On a buy-and-hold basis, investors received a 40% total return on their investment. This is because, along the way, there were fantastic rallies in commodities followed by huge busts.

Such brings us to the big question? Why do commodities regularly boom and bust?

Why Do Commodities Boom And Bust

The problem with the idea of a structural shift to commodities in the future and why it hasn’t happened in the past is due to the drivers of commodity prices.

Here is a simplistic example.

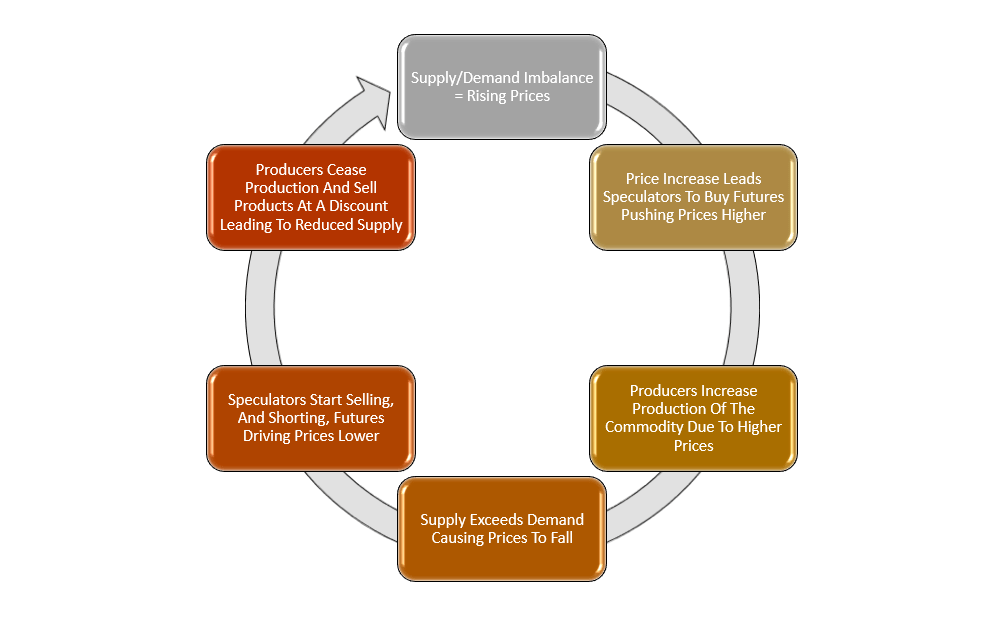

- During a commodity cycle, the initial phase of a commodity price increase is due to rising demand exceeding existing supply. This is often seen in orange juice, where a drought or infestation wipes out a season’s crops. Suddenly, the existing demand for orange juice massively outweighs the supply of oranges.

- As orange juice prices rise, Wall Street speculators start bidding up the price of orange juice futures contracts. As orange juice prices increase, more speculators buy futures contracts driving the price of orange juice higher.

- Farmers scrap plans to produce lemons and increase the orange supply in response to higher orange juice prices. As more oranges are produced, the supply of oranges begins to outstrip the demand for orange juice, leading to an inventory glut of oranges. The excess supply of oranges requires producers to sell them at a cheaper price; otherwise, they will rot in the warehouses.

- Wall Street speculators begin to sell their futures contracts as prices decline, pushing the price lower. As prices fall, more speculators dump their contracts and sell short orange futures contracts, causing prices to fall further.

- With the price of oranges crashing, farmers stop planting orange trees and start growing lemons again.

- The cycle then repeats.

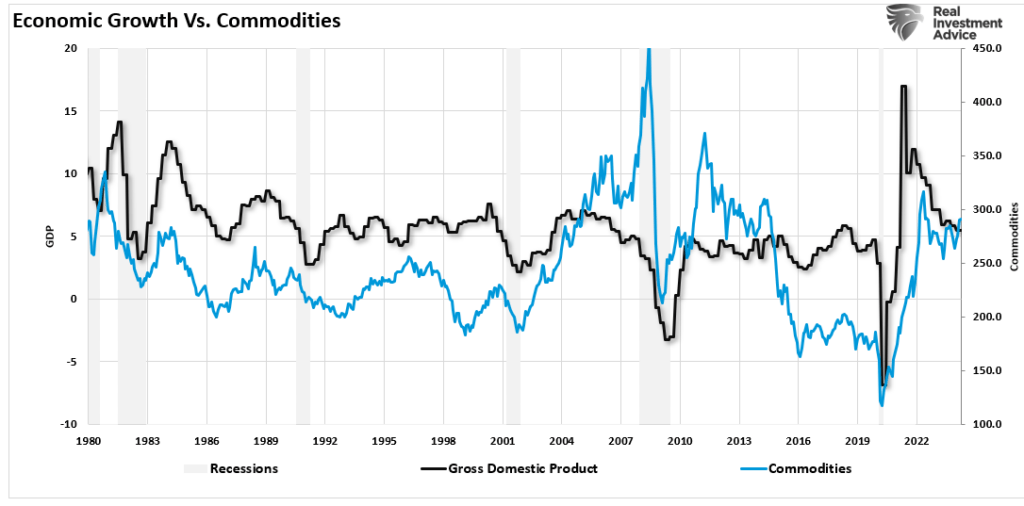

Furthermore, high commodity prices threaten themselves. As always, “high prices are a cure for high prices.” If orange juice prices become too expensive, consumers will consume less, leading to declining demand and supply buildup. The following chart of commodities compared to nominal GDP shows the same. Whenever there was a sharp rise in commodity prices, it slowed economic growth rates. Such is unsurprising since consumption drives ~70% of GDP.

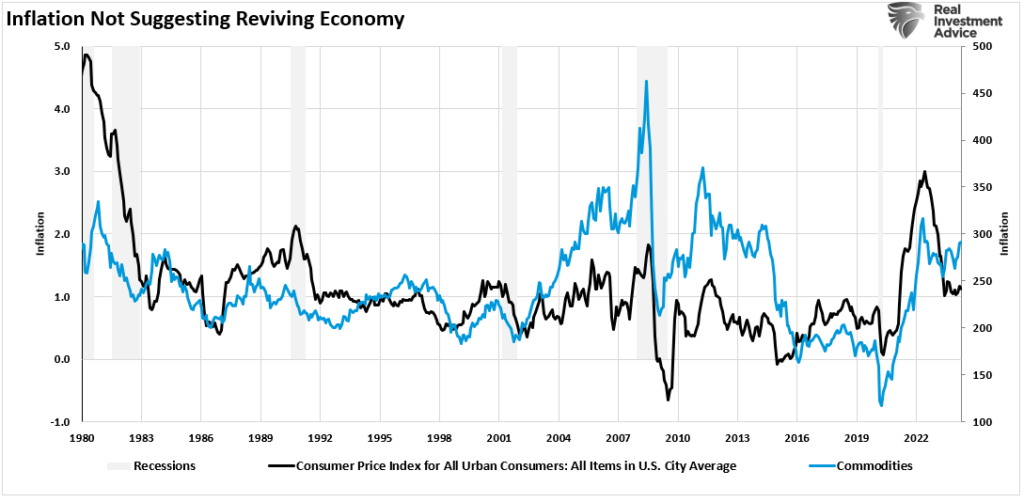

There is also a high correlation between commodities and inflation. It should be self-evident that when commodity prices rise, the cost of goods and services also rises due to higher input costs. However, the price increase is constrained as consumers are unable to purchase those goods and services. As noted, the consequence of higher prices is less demand. Less demand leads to lower prices or disinflation.

Such is why hard asset trades repeatedly end badly, despite the more ebullient media coverage.

Hard Asset Trades Tend To End Badly

Commodities, and hard assets in general, can be an exhilarating and profitable ride on the way up. However, as shown in the long-term chart above, that trade tends to end badly. Commodities have repeatedly led market downturns and recessions.

Will this time be different? Such is unlikely to be the case for two reasons.

As discussed, high prices (inflation) are the cure for high prices as it reduces demand. As shown above, as the consumer retrenches, demand will fall, leading to lower inflation in the future.

Secondly, as the country moves toward a more socialistic profile, economic growth will remain constrained to 2% or less, with deflation remaining a consistent long-term threat. Dr. Lacy Hunt suggests the same.

“Contrary to conventional wisdom, disinflation is more likely than accelerating inflation. Since prices deflated in the second quarter of 2020, the annual inflation rate will move transitorily higher. Once these base effects are exhausted, cyclical, structural, and monetary considerations suggest that the inflation rate will moderate lower by year-end and undershoot the Fed Reserve’s target of 2%. The inflationary psychosis that has gripped the bond market will fade away in the face of such persistent disinflation.“

As he concludes:

“The two main structural impediments to traditional U.S. and global economic growth are massive debt overhang and deteriorating demographics both having worsened as a consequence of 2020.“

The last point is crucial. As liquidity drains from the system, the debt overhang weighs on consumption as incomes are diverted from productive activity to debt service. As such, the demand for commodities will weaken.

While the commodity trade is certainly “in bloom” with the surge in liquidity, be careful of its eventual reversal.

For investors, deflation remains a “trap in the making” for hard assets.

There is nothing wrong with owning commodities; just don’t forget to take profits.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here