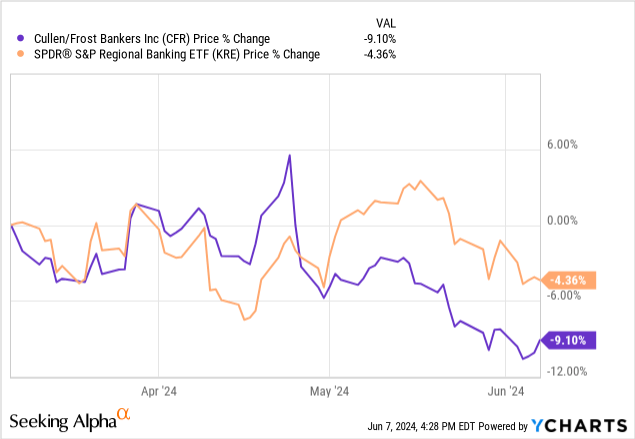

Over the past three months, the stock price of Texas regional bank Cullen/Frost Bankers (CFR) has underperformed even the poorly performing SPDR S&P Regional Banking ETF (KRE):

And yet, CFR is not cheaper than the regional bank average. The opposite is true.

Compared to an average price to book value of 0.94x for KRE’s holdings, CFR trades at a much higher price to book value of 1.85x.

Moreover, while KRE’s average P/E ratio sits at 10.3x, CFR’s P/E ratio is 11.9x.

Lastly, KRE’s index dividend yield stands at 3.7%, compared to CFR’s dividend yield of 3.65%, so they’re basically the same.

Does CFR deserve this slightly premium valuation over the regional bank index?

I would argue that CFR more than deserves it. In fact, I believe that even at a slight premium, CFR’s long-term strengths are undervalued at a stock price of around $100 and an earnings multiple a little under 12x.

CFR has about 20% upside to its 5-year average valuation of about 14.5x earnings, which combined with mid- to high-single-digit earnings growth and a dividend yield of 3.6% should generate double-digit total returns going forward.

For fellow dividend growth investors, CFR looks particularly appealing, as CFR has increased its dividend for 30 consecutive years, averaging about 7% annually over the past 5 years, and it has a comfortable payout ratio of about 40%. I would expect a relatively minimal dividend hike this year but a return to mid- to high-single-digit growth thereafter.

Frost Bank’s Underappreciated Strengths

Let’s get a snapshot of some of the strengths I think the market is undervaluing in CFR right now:

- The bank boasts strong and growing market share in the largest cities of the strong and growing state of Texas.

- CFR is well-capitalized with capital ratios well in excess of minimum required amounts.

- CFR is a prime example of financial conservatism with very little debt, 17.5% of assets in cash, and a loan-to-deposit ratio of 0.47x.

- Two-thirds of the bank’s investor-owned office loans are Class A and over 90% are backed by properties in Texas, which is enjoying above-average growth in office-using jobs.

- Credit losses remain extremely minimal. Allowance for credit losses stood at 1.29% of total loans in Q1 2024, down from 1.31% in Q4 2023 and 1.32% in Q1 2023. Non-performing loans were 0.37% of total loans in Q1 2024, compared to 0.32% in Q4 2023 and 0.22% in Q1 2023.

- Less than 20% of CFR’s problem loans are tied to investor-owned commercial real estate.

I’d like to highlight three particular points of strength.

The Best Offense Is A Good Defense

On the subject of CFR’s longstanding financial conservatism, note that Frost Bank was the only large bank to make it through the savings & loan crisis of the 1980s without requiring federal assistance or a merger. It was also the first bank in the nation to turn down TARP funds during the Great Financial Crisis of 2008-2009.

The bank’s typical policy is to keep about 20% of total assets in cash, which gives it both a deep cushion and also acts as significant dry powder with which to pounce on attractive investment opportunities when they arise.

The bank has recently been drawing on that cash pile to deploy into high-yielding loans and securities, which should serve the bank well in the long run. Not only is it capturing some nice yield, it is also capturing new borrower customers.

New commercial relationships increased 10% YoY in Q1 2024. At 825 new relationships, it was CFR’s largest number of quarterly borrower relationship gains in its history.

In Q1, the loan book grew 10.4% YoY even while total deposits declined 4.8%. If CFR did not have such a large cash position or such a low loan-to-deposit ratio, it would not be able to capture billions of dollars more of the loan market.

Strong Market Position In Texas

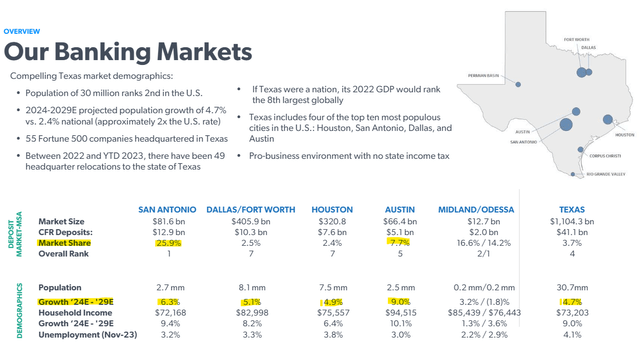

Now, when it comes to CFR’s markets, keep in mind that the bank’s physical branch locations are exclusively in Texas, and the vast majority of its depositors and borrowers are also based in Texas.

The four major metro markets of Texas have been growing well above the national average, in terms of population and jobs, and projections for growth over the next five years show that rapid growth continuing.

CFR February Presentation

Notice from this image that Austin and San Antonio are expected to enjoy the fastest growth in population and households in the coming years, and these two markets are also the ones wherein CFR has captured the greatest market share.

The bank is opening new branch locations in the fast-growing Austin market, which indicates that Frost will likely continue to grow its share in that market.

This is a major and underappreciated strength. Right now, deposits are trickling out of Frost Bank in search of higher yield elsewhere, but within a year or so, the Fed Funds Rate and SOFR are expected to be lower than they are today. If and when that cash flows back into banks, Frost should be a huge beneficiary.

Strong growth in relationships with both borrowers and depositors is an underappreciated strength.

Highly Conservative Loan Underwriting

Finally, I’d like to touch on CFR’s high-quality and conservatively underwritten loan book, particularly the commercial real estate segment.

Note from the above bullet points that despite being about half of CFR’s total loan book, commercial real estate makes up less than 20% of problematic loans. These are non-performing, partially non-performing, or past due loans.

Of the very small amount of non-performance and credit losses in CFR’s loan portfolio, the disproportionate area of weakness is primarily in commercial & industrial (business) loans followed by residential mortgages. But even these areas of weakness are extremely limited.

Non-performing (or non-accruing) loans made up only 0.37% of total loans in Q1 2024.

Now, could CFR’s delinquencies rise from here? It is certainly possible. But keep in mind that any losses from delinquent CRE loans is likely to be quite limited.

Consider, for example, that investor-owned CRE currently has an average loan-to-value of 53%. For investor-owned office, specifically, the average LTV also stands at 53%. However, investor-owned office loans actually have a slightly higher debt service coverage ratio of 1.53x than the CRE segment as a whole’s 1.47x.

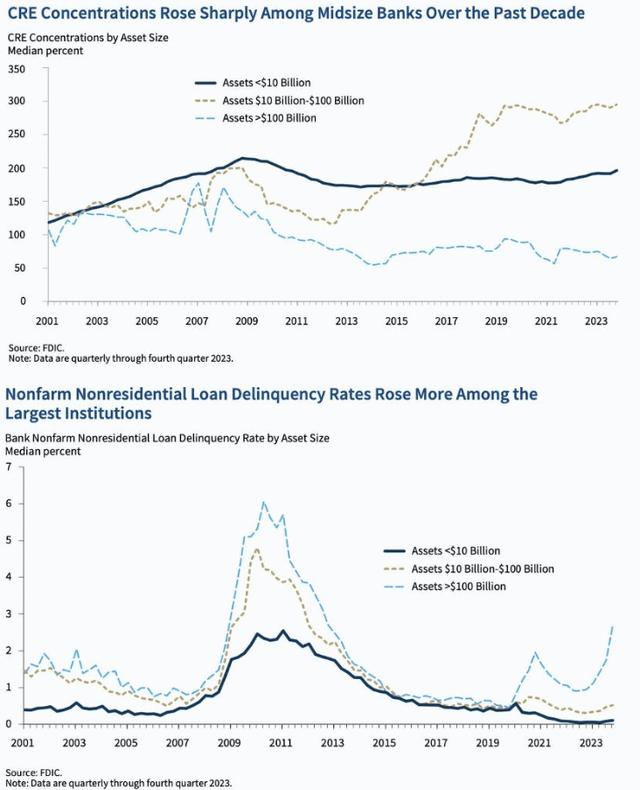

Also keep in mind data recently reported by CoStar that it is actually large banks ($100 billion+ assets) that are experiencing higher delinquency rates from CRE loans right now.

FDIC

As you can see from the charts above, while midsized banks like CFR greatly increased their exposure to CRE loans over the past decade, their CRE delinquency rates have remained quite muted during the current rate-hiking cycle.

Meanwhile, though big banks have reduced their exposure to CRE, those CRE loans they do have are seeing a big surge in delinquencies.

My proposed explanation for this is that small and midsized banks (regional banks) are more familiar with their markets and maintain relationships with the locals. Big banks are often somewhat faceless and committee-driven, trying to make up for their lack of face-to-face relationships with more documentation.

But good old fashioned relationships and smart underwriting trump stricter documentation when the stuff hits the fan.

Even at nearly $50 billion in total assets, CFR does a great job of operating like a small, local bank, exemplified by its host of “best bank” awards.

Bottom Line

It seems as though any bank with substantial commercial real estate exposure is selling off right now, CFR included.

I think this represents a great buying opportunity for long-term investors, especially dividend growth investors such as myself.

While there has been a modest deposit outflow over the last year or so, CFR appears to be in no danger of a “run on the bank” scenario. It is gaining customers, and those customers tend to be quite loyal due to the bank’s top-notch customer service.

But at the same time, no bank, including Frost, can raise their deposit yields enough to keep up with the 5%-yielding money markets and high-yield savings accounts available out there — not to mention 4-5%-yielding Treasuries and CDs. In such a strange environment as this, it should not be surprising to see some cash leave traditional banks in search of yield.

That doesn’t mean depositors are panicking and pulling out. They’re simply acting rationally.

When the yield differential between Frost Bank and other options out there is no longer so wide, it will be the rational decision to consolidate your cash at the same bank that hosts one’s transactional account. And Frost does a good job of capturing and keeping those core transactional accounts.

With great customer service and no legitimate reasons for fear about CFR’s loan portfolio, the risk of a “run on the bank” scenario indeed looks very low.

On the contrary, once the yield curve normalizes, I would expect CFR’s total deposits to grow again, which would return CFR to its normal, virtuous cycle of growth.

Read the full article here