Intro

We wrote about Eastman Kodak Company (NYSE:KODK) back in March of this year when we discussed the ramifications of unlocking the $1+ billion pension fund and how this would affect the share price accordingly. Share-price momentum concerning the potential tapping of the pension fund (announced in late February of this year) accelerated to the upside on that announcement and has been subsequently aided by the company’s first-quarter earnings report announced on the 9th of May this year. Suffice it to say, although we rated KODK a ‘Hold’ back in March of this year, shares have been able to return north of 28% over the past 12+ weeks which is an excellent return considering the S&P has returned just north of 5% over the same timeframe.

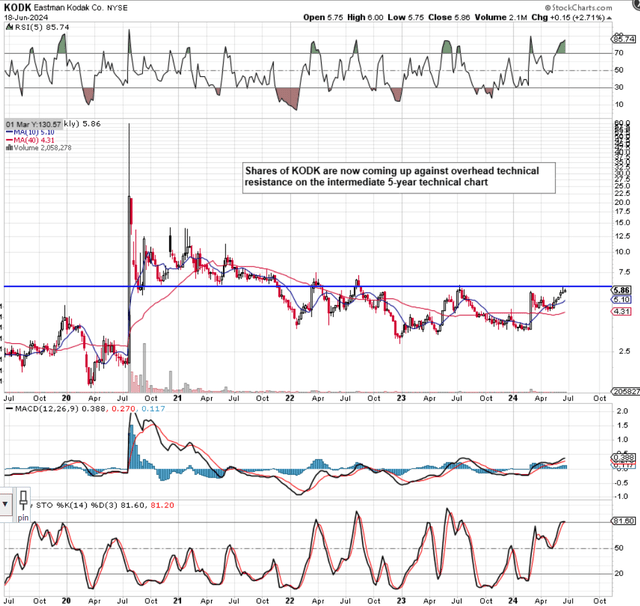

As we see however from the company’s technical chart below, shares of KODK are now coming up against overhead resistance at approximately the $6 area. Furthermore, as we learn from the company’s recent set of first quarter numbers for fiscal 2024, sales growth in KODK remains amiss and is a key reason why we are maintaining our ‘Hold’ rating in the US-based print company. Furthermore, investors should keep in mind that the technicals at all times reflect all known underlying fundamentals taking place within KODK and the markets it serves. To this point, the potential release of capital from the successful pension fund (and how this would affect the share price) has already been accounted for in KODK’s share price action, all things remaining equal.

KODK Intermediate Technical Chart (StockCharts.com)

Negative Sales Growth Continued In Q1

Revenues dropped by $29 million in the first quarter, a 10% drop compared to the same period of 12 months prior. Although gross profit fell by almost $1 million in Q1 ($49 million), gross margin increased to 20% on Advanced Materials and Chemicals growth and enhanced operational efficiency. Reported net income for the quarter came in at $32 million which was only 3% lower than the same period 12 months prior. However, the $32 million bottom-line number was artificially increased by an asset sale worth $17 million so in real GAAP terms, net profit fell by almost 50% in the quarter.

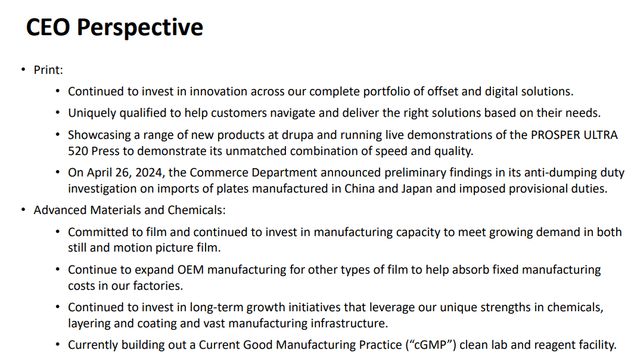

Suffice it to say, the picture management wanted to paint from the Q1 earnings report was that the company’s margin performance & accelerated investment initiatives in recent quarters should demonstrate KODK’s potential when one takes into account the company’s growing portfolio of solutions & innovation in Offset, AMC as well as Digital Solutions respectively.

CEO Perspective – Q1 Earnings Presentation (Investor Website)

However, despite the ‘forward-looking’ encouraging nature of the CEO’s comments above, there is no guarantee that the initiatives listed above will return the company to meaningful sales & earnings growth any time soon. We state this because of how cash has been flowing through the company in recent quarters.

Book Value Has Contracted Meaningfully Over The Past Four Quarters

If we go to the balance sheet for example, we see that shareholder equity has declined over the past 12 months from $1.068 billion to $951 million in Q1 of this year. Long-term debt has increased by $127 million to hit $447 million resulting in quarterly interest expense increasing by $4 million (36%+ increase) on KODK’s income statement over the past 12 months. Suffice it to say, as investors, when a company is undergoing investing initiatives to return to growth, we want those investments to be adding to the company’s book value in the interim period & not subtracting. This has not been happening in KODK which has ramifications for existing investor stakes in the company.

We showcase the 12-month comparables above because shares were more or less trading at the same juncture last year but yet could not break through intermediate overhead resistance. Unless the market is expecting searing growth for the Print company, we do not see how shares can register any type of technical breakout in the not-too-distant future.

| Period | Q1-2023 | Q1-2024 |

| Quarterly Sales | $278 Million | $249 Million |

| Quarterly GAAP Earnings | $26 Million | $15 Million |

| Long-Term Debt | $320 Million | $447 Million |

| Shareholder Equity (Book Value) | $1,068 Million | $951 Million |

Sales Remain Overvalued

The two most popular sales valuation multiples we like to use are the EV/Sales multiple and the traditional price-to-sales multiple. The former calculation takes the company’s debt into account making it especially poignant given how KODK’s leverage has increased in recent times. Although value investors may be eyeing up KODK from both an earnings & asset (book value) standpoint, the company’s sales remained overvalued from a historical perspective, as seen in the table below.

In our previous commentary, we outlined risks in KODK such as under-average trading volume and the sustained decline in the large Print segment (which made up north of 70% of company sales in fiscal 2023). Yes, the AMC segment continues to advance but it is still not large enough to compensate for the loss KODK continues to undergo in its Print business. This explains in part why short interest has remained elevated at above 7%.

| KODK Valuation Multiple | Trailing 12 Month | 5-Year Average |

| EV/Sales | 0.82 | 0.53 |

| Price/Sales | 0.42 | 0.30 |

Conclusion

To sum up, although shares have returned an excellent 3 to 4 months, we are reiterating our ‘Hold’ rating in the stock due to strong overhead technical resistance, declining sales as well as falling bottom-line profits. Furthermore, rising long-term debt on the balance sheet continues to result in rising interest expenses, adversely affecting robust cash-flow generation. Let’s see what Q2 brings.

We look forward to continued coverage.

Read the full article here