Written by Nick Ackerman, co-produced by Stanford Chemist.

ArrowMark Financial Corp (NASDAQ:BANX) is one of the more interesting closed-end funds out there that are available to investors. The fund benefited significantly from the higher rate environment. While the next move is expected to be a rate cut and not a rate hike, even a few rate cuts won’t leave this fund in a terrible position. Distribution coverage will remain strong unless we go back to a zero-rate environment, which is not expected to happen. Given the fund falling back to a wide discount, it once again becomes an enticing investment choice for investors looking in the high-yield space.

ArrowMark Financial Corp Basics

- 1-Year Z-score: 1.08

- Discount: -13.4% (based on 05/31/2024 estimated NAV)

- Distribution Yield: 9.79%

- Expense Ratio: 4.31%

- Leverage: 22.74%

- Managed Assets: $197.9 million

- Structure: Perpetual

BANX’s investment objective is “to provide shareholders with current income.” To achieve these investment objectives, they will invest primarily in “regulatory capital securities of financial institutions.”

If you aren’t too familiar with regulatory capital relief securities, that’s okay. They aren’t a normal investment that the public often can get exposure to unless you are investing in BANX. We previously discussed these more in-depth in a prior article. Here is the general idea:

The general concept of these securities is they help provide support to banks and other financial institutions to meet their regulatory requirements, essentially providing “capital relief” to these institutions as their name would imply. For BANX they are investing in mostly credit-linked notes.

The fund’s expense ratio is quite high, but that isn’t unusual when we start getting into the more eccentric pools of investment choices that investors have at their disposal. Lower expenses would lead to higher total returns for investors, but BANX has been able to deliver respectable returns anyway. Working against the fund is a rather small size, which can add liquidity issues for larger investors; they may find it difficult to build or exit sizeable positions in a timely manner, with the average volume coming in at about 15.5k shares daily.

Discount Widens Back Out

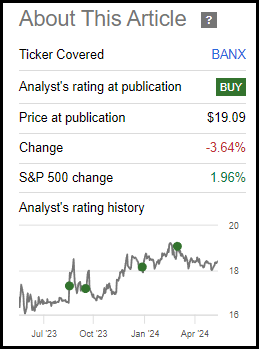

We last covered BANX earlier this year, and since that time, the fund has been under some pressure in terms of share price.

BANX Performance Since Prior Update (Seeking Alpha)

However, that was largely because the closed-end funds discount widened back out. In our prior update, while I thought the fund was still worthwhile and attractive, the discount had narrowed on us quite materially from where it had been.

That’s simply one of the factors one has to consider when investing in CEFs since that added discount/premium mechanic where the fund can swing wildly away from its actual NAV per share. While that adds volatility and risks to this specific structure of pooled investment, it is also what can be easiest to exploit for our benefit as well.

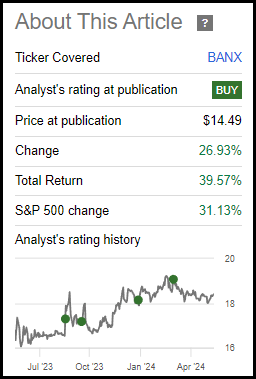

Going back further to one of our prior updates posted on May 4, 2023, that was a great example of where the fund plunged to a nearly 30% discount. Since then, it has rallied hard — even outpacing the S&P 500 Index, which I wouldn’t compare directly but helps to provide some context.

BANX Performance Since May 4, 2023 Update (Seeking Alpha)

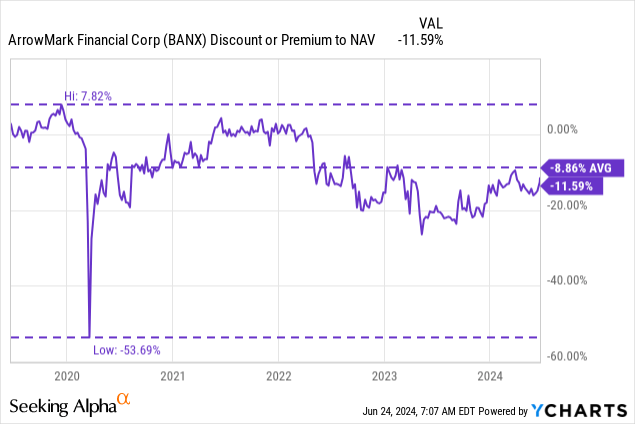

That is why BANX is once again a more tempting offer than it had been previously. We might not be at the 30% discount level, but the discount certainly has widened out since our most recent update. At that time, the fund’s discount stood at around 9%. Now, the latest reported estimated NAV on May 31, 2024 is at $21.76.

That would put the latest discount for BANX at around 13.4%. Today is the ex-dividend date, so that will see the NAV adjusted lower by $0.45, but the price should also be adjusted, making the discount similar. This NAV was also up from the previous monthly report for April 30, 2024, which came in at $21.49.

Our ‘Buy’ target is anything wider than a 10% discount is what we feel provides a good entry price. The current discount is also below its longer-term average.

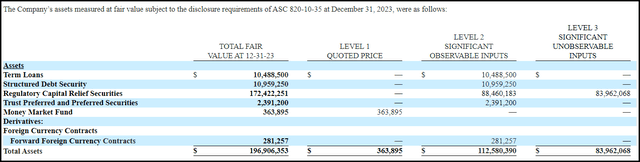

With an estimated NAV, we are sometimes in the dark about the actual value, but it is due to the type of security that the fund invests in. They aren’t traded daily, with nearly half of the fund’s capital invested in level 3 securities, so putting together the NAV takes a bit of extra work.

BANX Security Level Breakdown (ArrowMark)

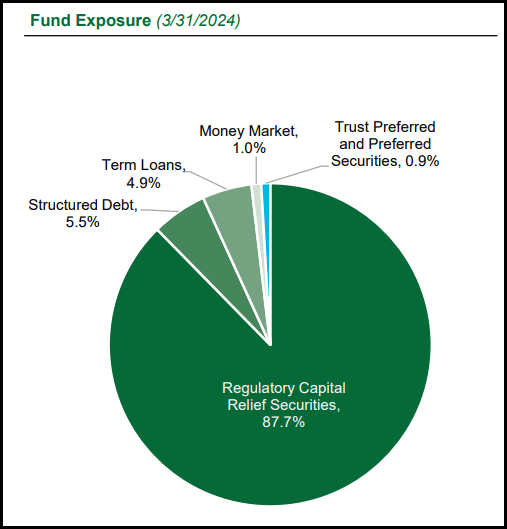

Nearly 90% of the fund is invested in regulatory capital relief securities, which is what provides the fund with its floating rate exposure. Floating rate assets were approximately 88% of the fund’s assets.

BANX Fund Exposure (ArrowMark)

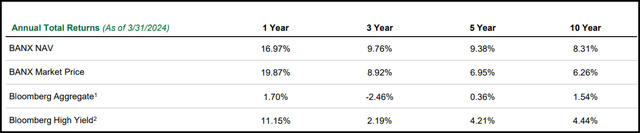

As mentioned above, when discussing the fund’s higher expense ratio, the fund was able to deliver attractive total returns nonetheless. The fund provides this table in their quarterly presentation showing they’ve been able to outperform on all timeframes against the Bloomberg Aggregate and Bloomberg High Yield Indexes. The data is as of the period ended March 31, 2024.

BANX Annualized Performance (ArrowMark)

Distribution Remains Healthy

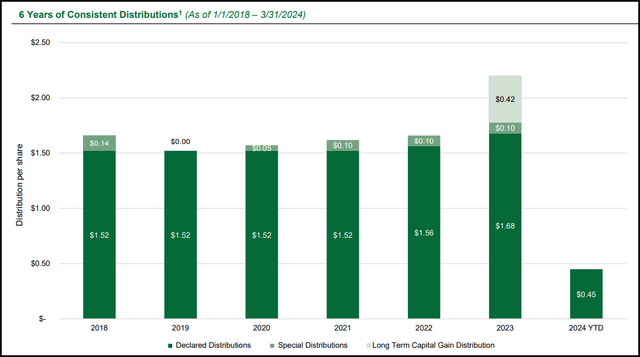

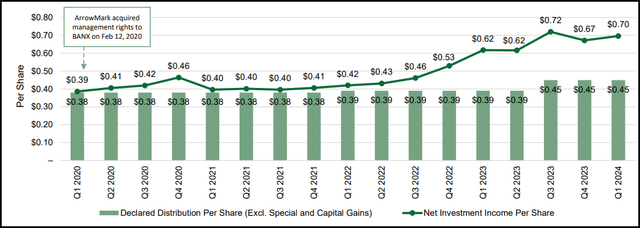

What those floating rates were able to do during this higher rate environment was able to deliver a growing net investment income for BANX and that resulted in investors being rewarded through a distribution hike and an extra special.

BANX Regular And Special Distribution History (ArrowMark)

The fund utilizes leverage, which adds volatility and more risk to the fund. The fund’s total expense ratio climbs to 6.72% when including the fund’s leverage expenses. However, utilizing leverage also has provided better results for the fund and that includes higher net investment income.

Given the floating rate nature of the underlying securities, the cash flow was also increased as the fund’s higher borrowing costs were more than offset. The NII ratio to net assets climbed to 12.43% by the end of 2023, up meaningfully from 8.72% at the end of 2022. That itself was up from the 7.46% NII yield to end 2021. In 2020, the fund was taken over by ArrowMark, as it was formerly StoneCastle. They also transitioned the fund to what it is today after taking over as the management, so looking at historical information prior to 2021/2020 isn’t too relevant.

The fund does pay quarterly instead of monthly, which some investors aren’t a fan of. However, when asked previously, they said they pay quarterly to match the cash inflows of the underlying securities, which also come in quarterly.

Will Rate Cuts Lead To Distribution Cuts?

Today, the distribution rate works out to 9.79% based on the regular quarterly distribution. With strong coverage remaining in place while rates remain elevated, there is a strong likelihood the special distributions can continue. Further, this helps highlight why even a few rate cuts from the Fed won’t be enough to completely crush coverage. It would require going back to a zero-rate environment for the fund’s coverage to fall below 100%.

BANX Distribution And Coverage (ArrowMark)

As the underlying cash flows would take a hit, just as it was a headwind of higher borrowing costs when the Fed was raising rates, it would become a tailwind as the Fed cuts rates. The fund pays based on SOFR plus 2.61%.

Conclusion

BANX looks set to continue to deliver a strong yield for investors. Even if the Fed starts cutting rates in the next year or two, the fund’s coverage should remain strong. If we return to a zero-rate environment, that is when there could be some pressure on the distribution coverage. That isn’t anticipated to happen, but black swan events are unpredictable, and if the economy starts to slow too much, we definitely could get back there. At the same time, the distribution yield would likely continue to still deliver an attractive payout nonetheless. Given the fund moving back to a sizeable discount, it once again presents a more compelling opportunity to potentially add or initiate a position in this fund for investors.

Read the full article here