Introduction

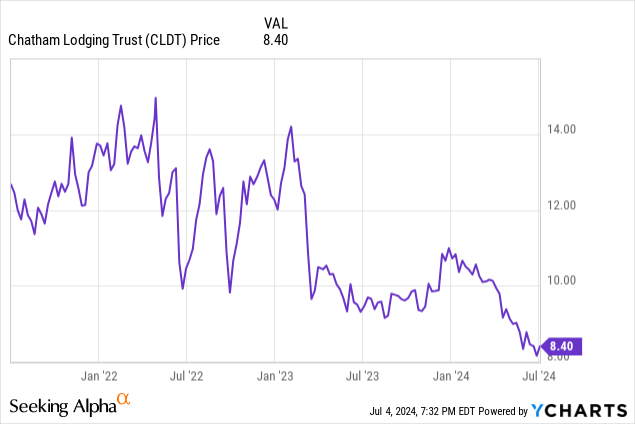

In the past few months I have been taking advantage of the relatively low price of the preferred shares of Chatham Lodging Trust (NYSE:CLDT) as I think the risk/reward ratio looks pretty good right now. As it has been a while since I last discussed (NYSE:CLDT.PR.A), I wanted to double check on the recent financial results to make sure there are no unexpected surprises. For a more detailed overview of the hotel REIT’s assets and business focus, I’d like to refer you to this older article.

Chatham’s financial performance remains robust – from the perspective of a preferred shareholder

I’m mainly interested in Chatham’s preferred shares, which means I focus on two specific elements: How well is the preferred dividend covered, and is there a balance sheet risk that could jeopardize the value of the preferred shares?

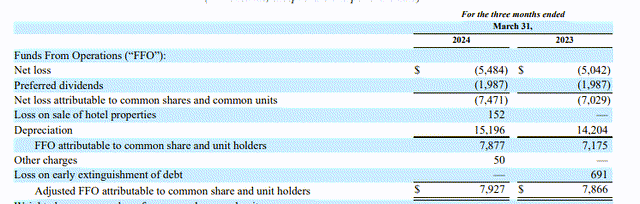

To answer the first question, I always want to have a look at the FFO and AFFO generated by the hotel REIT as that ultimately decides how much cash flow is coming in and what it has to be spent on.

As the image below shows, Chatham generated $7.9M in FFO and $7.9M in AFFO. This already includes the $2M in preferred dividends.

CLDT Investor Relations

This means the Q1 AFFO before taking preferred dividends into account was almost $10M, which means the REIT only needed just over 20% of its Q1 AFFO to cover the preferred dividends.

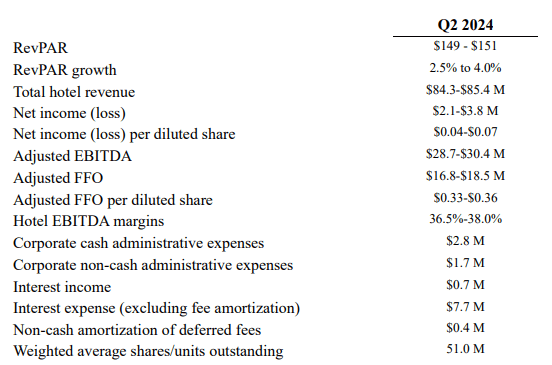

I’m fine with that preferred dividend coverage ratio as the first quarter traditionally is a weak quarter for Chatham. That also becomes clear when you look at the Q2 AFFO guidance. As you can see below, Chatham is guiding for an adjusted FFO of $16.8-18.5M for the quarter, which means the $2M in preferred dividends (which once again is already included in the AFFO guidance mentioned above) results in a payout ratio of just over 10%.

CLDT Investor Relations

There’s one caveat though: The REIT plans to spend $37M in capex this year, and that still has to be deducted from the AFFO. That’s a relatively high capex, but it will allow Chatham to complete renovations at five hotels. And just to provide some context: In both 2022 and 2023, Chatham reported an AFFO of $59.6M and $59.7M, respectively. This means the AFFO before taking the preferred dividends into account was almost $68M so even if there would be no growth this year, the preferred dividends and the capital expenditures should be fully covered this year.

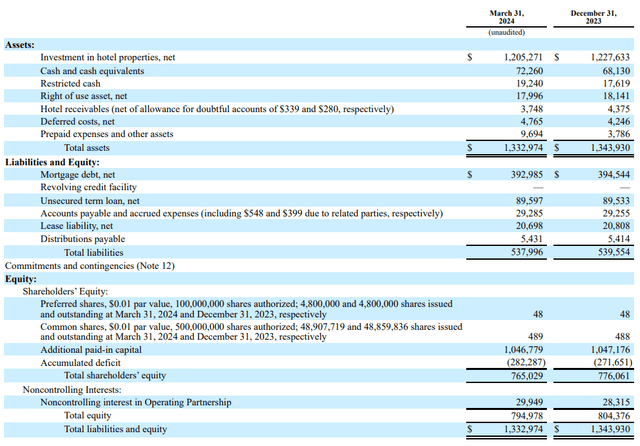

Looking at the balance sheet, the REIT has in excess of $90M in cash and restricted cash resulting in a net debt of just under $400M. Also important: 25 hotels are currently unencumbered.

CLDT Investor Relations

Not only is that pretty low vs. the $1.2B in real estate assets, keep in mind that $1.2B in book value for the hotel assets already includes an accumulated depreciation of in excess of $450M. Even if you’d exclude the furniture and fixtures, the acquisition cost of the land and buildings exceeded $1.5B.

And as the liabilities side of the balance sheet shows, the total equity value on the balance sheet is $765M, of which $120M is represented by the preferred equity. This means there’s almost $650M in common equity which ranks junior to the preferred equity to absorb the first potential losses. And that’s based on the $1.2B book value of the assets – if the fair value is higher than the book value, the “cushion” is even bigger.

The details on the Series A preferred shares

As explained in a previous article, Chatham Lodging Trust only has one series of preferred shares outstanding, the Series A cumulative preferred shares (CLDT.PR.A). The cumulative nature of the preferred shares is an important element as although Chatham suspended the dividend on its common shares from Q2 2020 until early 2023, it continued to pay the preferred dividend. That’s why I’m relatively confident that the REIT will continue to make the preferred dividend times, even during tough times. The preferred shares were issued in 2021, when the distribution on the common units was suspended.

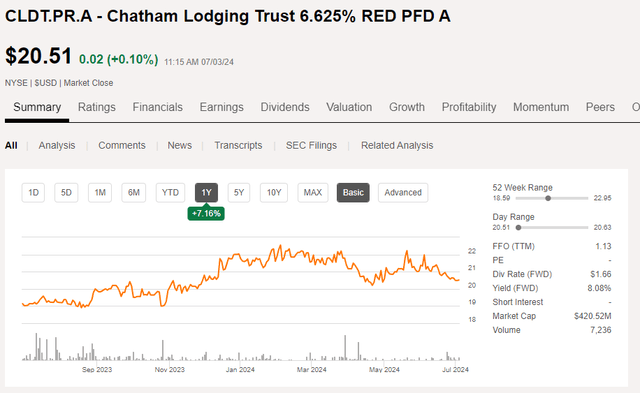

The Series A preferred shares have a fixed annual preferred dividend of $1.65625 per share, which is payable in four equal quarterly installments of $0.414 per share resulting in a pro forma yield of 6.625% based on the $25 principal value per preferred share. But as the preferreds are currently trading at just over $20.5/share, the current yield is approximately 8.1%.

Seeking Alpha

With the five-year US Treasury yield at 4.33%, the markup of almost 380 bp is sufficiently interesting for me to continue to build my position in Chatham Lodging Trust’s preferred shares.

Investment thesis

I have no position in Chatham’s common shares and I’m also not very interested in them as I prefer the income-focused preferred securities. I think the 8.1% preferred dividend yield remains interesting in the current interest rate climate, and as 6.625% is a pretty cheap cost of equity for Chatham, I don’t think the REIT will retire the preferred shares anytime soon (Chatham can call the preferred shares from mid-2026 on).

Given the excellent coverage ratio of the preferred dividends and the robust balance sheet, I like the risk/reward ratio offered by the preferred shares of Chatham Lodging Trust, and I continue to build my position in the preferred shares.

Read the full article here