MasterCraft Boat Holdings, Inc. (NASDAQ:MCFT) continues having a very weak short-term financial outlook as demand for recreational boats remains incredibly low. The company is still positioned to handle the storm with a strong balance sheet, though.

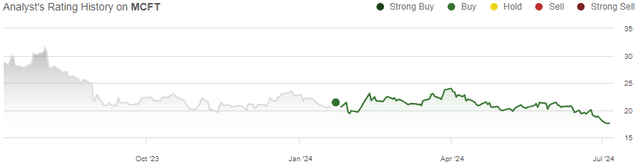

I previously initiated MasterCraft at Buy in an article, titled “MasterCraft: Priced With Too Much Caution”. Since the article was published on the 22nd of January in 2024, the stock has lost -18% of its value compared to an S&P 500 appreciation of 15% in the same period as the industry’s short-term outlook has become even weaker.

My Rating History on MCFT (Seeking Alpha)

MasterCraft’s Earnings Weakness Deepens

As expected, MasterCraft has continued to post weak earnings in the turbulent industry. In Q2/FY2024, the revenues of $99.5 million showed a year-over-year decline of -37.5%, and combined with a significant gross margin deleverage due to lower volumes, inflation, and higher dealer incentives, operating income fell to just $7.0 million – a weaker-than-normal margin of 7.1%.

The third quarter results were even weaker as sales declined by -42.6% into $95.7 million, and the operating income fell further into $4.0 million as negative operating leverage has taken a further toll on MasterCraft’s bottom line.

After Q1, MasterCraft still expected revenues of $390-420 million in FY2024, whereas the guidance has been lowered into $360-365 million in the Q3 report due to persisting industry headwinds. The adjusted EBITDA outlook range has come down by $18 million into $28-30 million. The revenue range’s mid-point reflects an incredibly deep Q4 revenue decline of -62.1%.

The Industry Outlook is Still Cloudy

With remaining high interest rates, a weak consumer sentiment, and marine retailers’ inventory deleveraging continuing, the industry’s outlook especially for manufacturers remains cloudy. The continuing weak outlook was also echoed in MasterCraft’s Q3 earnings call, with the company still reducing planned production to adjust to the industry outlook.

A competitor’s largest dealer is in financial distress, which MasterCraft listed as a reason for the recently piling industry weakness. The situation seems to be related to Malibu Boats’ (MBUU) situation with Tommy’s Boats, which I wrote about in June. The large dealer’s situation was highlighted as a very large factor in the incredibly weak guided Q4, as boat retailers are reassessing stocking risks with increased floorplan interest still weighing on inventory costs.

Competitors have also continued posting weak financials, with Malibu Boats posting a most recent –45.8% decline in the first quarter of calendar year 2024, and Marine Products (MPX) showing a similar -41.7% decline.

With potential rate cuts in the mid-term, and as retailers’ confidence resumes and inventory levels normalizes, an eventual recovery is still likely in the industry. Interest rates likely look to sustain at a higher level compared to pre-pandemic levels, though, potentially swaying some consumers from purchasing boats in coming years.

MasterCraft Should Ride the Wave Well

MasterCraft’s balance sheet still holds $105.7 million in cash and short-term investments combined and a quite moderate amount of debt, positioning MasterCraft well in the headwinds – the company shouldn’t have liquidity issues even with more prolonged macroeconomic pressures. Operative cash flows have still been positive despite the headwinds too, deleveraging risks as well.

The company has even been able to use the weakness into shareholders’ advantage, using the lower stock level to buy back a good number of shares with $56.9 million spent on share buybacks from FY2022 forward.

MCFT’s Valuation Has Become Even More Attractive

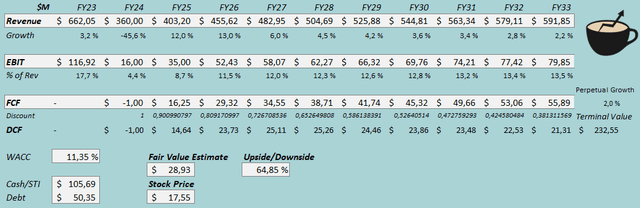

With an eventual earnings recovery, the stock is becoming incredibly cheap. I updated my discounted cash flow [DCF] model to update my fair value estimate and to represent the undervaluation.

I now estimate $360 million in FY2024 revenues, the lower bound of MasterCraft’s guidance. Afterwards, I estimate a recovery in the next couple of years with a 12% and 13% revenue growth in FY2025 and FY2026 respectively. Afterwards, I estimate a gradual growth slowdown into 2% perpetual growth as customers still slowly recover from lower purchasing power, with the perpetual growth estimate being below my prior 2.5% estimate now.

Due to persisting weak consumer sentiment, I estimate the total recovery to be slightly worse as revenues end up at $591.9 million in FY2033 compared to $644.9 million previously.

I now estimate the EBIT margin to recover into a level of 13.5%, down from a previous estimate of 14.0% due to lower sales estimates. The new estimate represents a slightly lower margin than the 13.9% operating margin that MasterCraft achieved in FY2019 prior to the pandemic.

DCF Model (Author’s Calculation)

The updated estimates put MasterCraft’s fair value estimate at $28.93, 65% above the stock price at the time of writing – the stock is incredibly undervalued with an eventual recovery. With the FY2027 EBIT estimate, the stock currently trades at a FY2027 EV/EBIT of just 4.2. The cloudy industry outlook still poses a risk which investors should especially note in the short term, though.

The fair value estimate is down from $31.77 previously, while the undervaluation has widened due to the stock’s price decline.

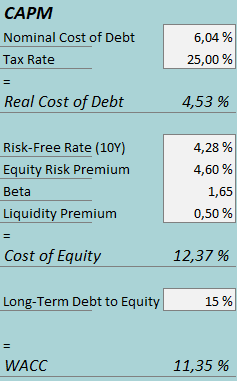

CAPM

A weighted average cost of capital of 11.35% is used in the DCF model, nearly the same as previously. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q3, MasterCraft had $0.8 million in interest expenses, making the company’s interest rate 6.04% with the current amount of interest-bearing debt. I continue estimating a long-term debt-to-equity ratio of 15%.

To estimate the cost of equity, I use the 10-year bond yield of 4.28% as the risk-free rate. The equity risk premium of 4.60% is Professor Aswath Damodaran’s estimate for the US, updated on the 5th of January. I continue estimating a 1.65 beta. With a liquidity premium of 0.5%, the cost of equity stands at 12.37% and the WACC at 11.35%.

Risks

As MasterCraft operates in a highly turbulent industry with persisting uncertainty, the stock’s risk profile is still very elevated. Interest rates and the overall consumer sentiment both play a key part in the industry’s outlook, and further earnings declines beyond my estimates are very possible also likely pressuring the stock price further. The potential persistence of industry troubles is primarily a short- to mid-term issue.

The company has also recently launched the Balise luxury pontoon brand, and the brand’s sales will begin in model year 2025. The Balise brand’s initial demand poses a moderate risk, as a poor sell-through could weaken cash flows and earnings considerably in a scenario where the new brand fails to attract customers.

I believe that investors should note these risks, with the short-term outlook still being incredibly poor and as the stock price’s decline continues for the time being.

Takeaway

The major headwinds in the recreational boat industry have persisted and have even deepened, as high interest rates, a low consumer sentiment, and retailers’ caution pressure sales. MasterCraft has performed in line with peers, posting wide revenue declines and thin but positive earnings due to the pressure. The short-term outlook has even become worse from previously, and investors have seemingly become even more afraid as the stock price continued falling. I believe that MasterCraft’s balance sheet is positioned well to conquer the headwinds, and as the valuation is increasingly attractive, I remain with a Buy rating for MasterCraft despite the cloudy industry outlook.

Read the full article here