Introduction

Three things are certain in life:

- Death.

- Taxes.

- European oil stocks underperform their American peers.

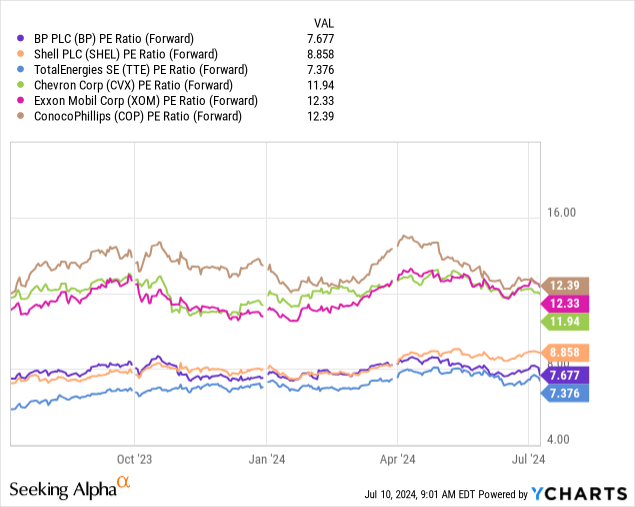

While I’m obviously joking a bit, it is widely known that European energy majors don’t have the valuation multiples their American peers enjoy.

Using the forward P/E ratio metric, we see the three Americans, Exxon Mobil (XOM), Chevron (CVX), and ConocoPhillips (COP), are trading all at 12x NTM earnings.

The European giants, BP (NYSE:BP), Shell (SHEL), and TotalEnergies (TTE), all trade at 9x or less.

In this article, I’ll zoom in on BP.

I covered the company in an article on November 24, titled; “Despite Its Valuation, BP Remains A Hard Pass For Me.”

Since then, shares have gone nowhere, pressured by new negative headlines that I will discuss in this article.

So, as we have a lot to discuss, let’s get right to it!

BP Isn’t Offering What The Market Wants

The biggest reason American and European oil stocks are trading at two very different valuations can be summarized in one sentence: European companies are more prone to ESG-related diversification.

Or, to put it differently, the European oil majors have a much bigger focus on non-oil operations, which most have done in response to political/social pressures to make their businesses more sustainable.

This is what it says on the Wikipedia page of BP:

In 2001, in response to negative press on British Petroleum’s poor safety standards, the company adopted a green sunburst logo and rebranded itself as BP (“Beyond Petroleum”) plc. – Wikipedia

The problem – for BP – is that market participants do not want to go “beyond petroleum.” They are buying big oil for a reason.

Especially after the pandemic, it became slowly obvious that the energy transition was not going to put an end to oil and gas demand growth.

Even the sustainability-focused International Energy Agency, which I consider to be often too pessimistic, does not expect peak demand in oil until at least 2030.

Despite the slowdown in growth, global oil demand is still forecast to be 3.2 million barrels per day higher in 2030 than in 2023 unless stronger policy measures are implemented or changes in behaviour take hold. – IEA

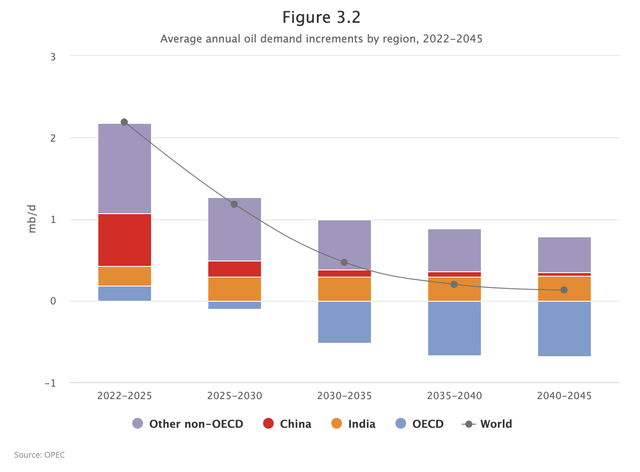

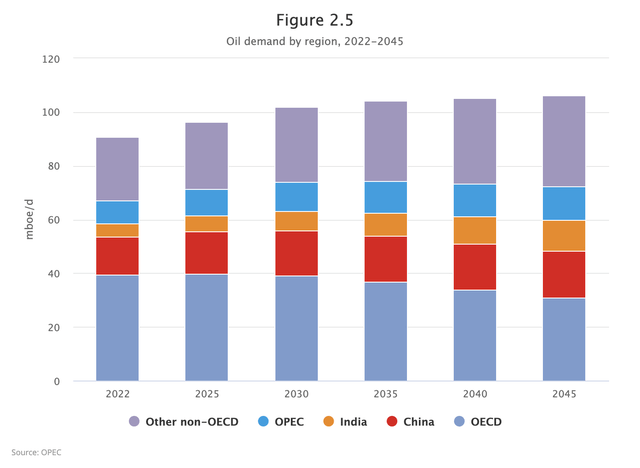

OPEC is even more bullish, expecting oil demand growth to last beyond 2040, fueled by emerging market demand offsetting declines in OECD nations.

OPEC

Especially if we add that supply growth is slowing, we get a strong long-term thesis for oil and gas.

In light of these developments, investors want a few things from an oil company:

- Deep reserves and growth potential.

- Healthy balance sheets.

- A focus on shareholders through (special) dividends and/or buybacks.

BP has all of this.

However, it also bet on non-oil operations. Last year, it had to admit it made a mistake when it promised to cut oil and gas output.

At BP, Mr. Looney this week scaled back a high-profile goal he had championed in 2020 as a hallmark of his strategy. Instead of cutting oil-and-gas output this decade by 40% from 2019 levels, he said BP will now aim for a cut of around 25%.

Mr. Looney emphasized BP’s intention to increase spending in both oil-and-gas production and renewables such as biogas, hydrogen and electric-vehicle charging networks. The world needs all of it, in parallel—but at the right speed, and that hasn’t been happening, Mr. Looney said. – The Wall Street Journal

With all of this in mind, new headlines are now causing BP’s underperformance to worsen.

More Bad News

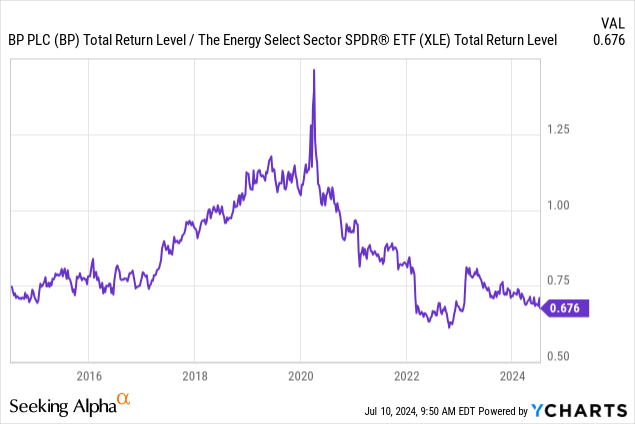

The chart below shows the ratio between BP and the energy ETF (XLE).

Including dividends, BP has consistently outperformed the XLE ETF since mid-2019.

Last year, it briefly outperformed when it admitted betting on the end of oil was a mistake. Unfortunately, since then, it has almost nonstop underperformed XLE again.

Now, new headlines are popping up. This time less bullish.

According to Bloomberg, the company is seeing headwinds from lower refining margins and writing down half of the initial value of its refinery in Gelsenkirchen, Germany.

Lower profits from making fuels such as diesel and higher levels of maintenance will have an adverse impact on BP’s second-quarter earnings from oil products of $500 million to $700 million, the company said in a statement on Tuesday. Results from oil trading are expected to be weak, it said. – Bloomberg

The company is scaling back refining operations in Germany as a result of high costs and lower demand.

In general, Germany is struggling with elevated costs and a poor business climate. It also does not help that the Middle East and Asia are producing refined products much cheaper, allowing them to export to Europe.

The good news is that the company expects upstream (oil and gas production) volumes to be flat in the second quarter. Initially, it expected these volumes to be down a bit.

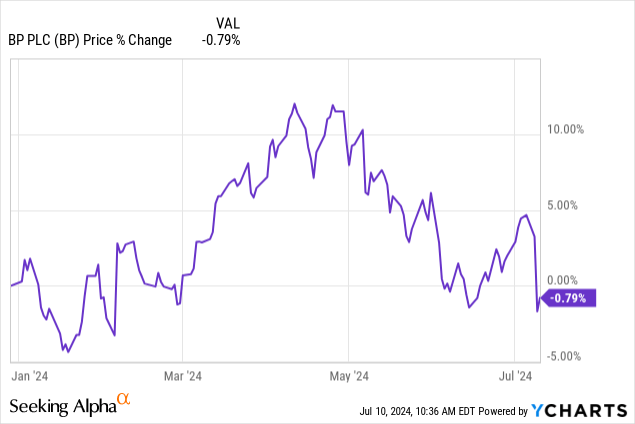

Nonetheless, headwinds are stronger than tailwinds, resulting in a year-to-date stock price performance of roughly -1%. That’s down from a gain of more than 10% in April.

With that in mind, I am also not a fan of other headlines that involved the company, including the one below:

Bloomberg

Essentially, the British company is making the case the world isn’t transitioning away from fossil fuels fast enough.

Fossil fuel consumption broke records last year, led by climbing oil demand, the company said in its annual Energy Outlook on Wednesday. Countries remain in an “energy addition” phase — increasing their consumption of both low-carbon energy and fossil fuels — and need to pivot to a “substitution” phase, it said.

If this trend continues to the early 2040s, the world may have exhausted the so-called “carbon budget” that would limit temperature increases to 2C above pre-industrial levels, BP cautioned. – Bloomberg

Although the company knows the surge in renewable energy output is not enough to cover rising energy demand, it keeps making the case to shift away from oil much quicker, which is something I just don’t get.

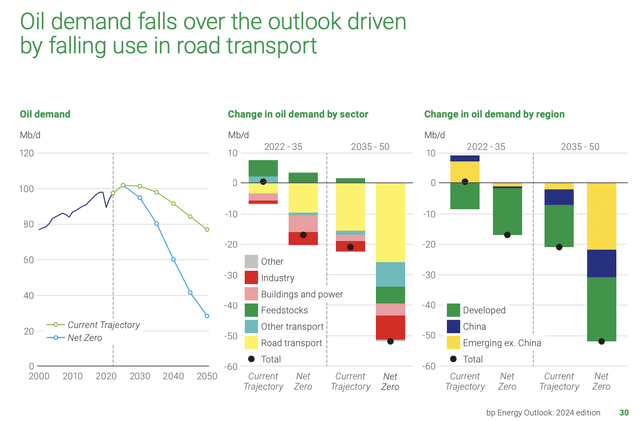

I took a closer look at the full document, which included the outlook of less than 80 million barrels of oil demand by 2050, which would be a mile below OPEC’s estimate of more than 106 million barrels of oil per day.

BP

The report even expects peak growth in (non-China) emerging markets in 2030.

In the other emerging economies, increasing levels of prosperity and rising living standards support more resilient oil demand. In Current Trajectory, emerging economies’ demand increases until the mid-2030s after which it broadly plateaus. The increased electrification of road transport in Net Zero leads to more pronounced falls in oil consumption across emerging economies in the second half of the outlook. – BP

According to OPEC, “other non-OECD” nations could see a demand increase of more than 10 million barrels per day through 2045.

OPEC

The good news is that while I absolutely disagree with the company’s numbers and the fact that they even try to predict long-term demand, they continue to focus on upstream production.

BP

One of its goals is to improve its returns on employed capital to at least 18% next year.

This includes boosting high-margin projects like oil, gas, and liquified natural gas.

[…] we expect the start-up of a further five new major oil and gas projects. In addition, we expect bpx 2025 production to grow by 30-40% compared to 2022 levels. And in LNG, our target of 25 million tonnes per annum by 2025, up from 23 million tonnes per annum in 2023, is well underpinned. – BP

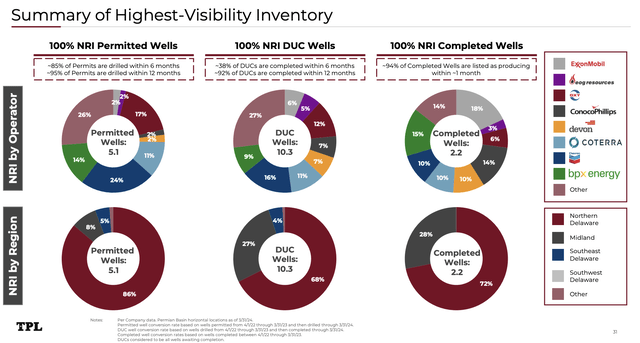

BPX is the company’s U.S. onshore business, where it produces in the Permian and Eagle Ford Basins. This includes production on Texas Pacific Land (TPL) ground. In May, TPL reported that BPX accounted for a large share of new and current wells. This makes sense, given the company’s plans.

Texas Pacific Land Corporation

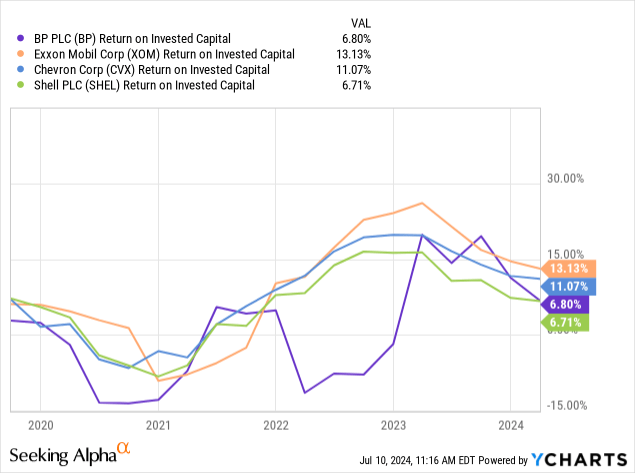

Efforts to boost upstream output are important, as the company isn’t even close to being as profitable as its American peers.

Both BP and Shell have a return on invested capital of 7%. Exxon and Chevron, who have both prioritized high-margin oil over renewables, have ROICs of 13% and 11%, respectively.

What does this mean for shareholders?

Dividend & Valuation

One bright spot is the company’s dividend. It wants to pay a more consistent dividend, allowing investors to benefit from potential upside in energy prices.

In the first quarter, it announced a 7.270 cents dividend (in British pound), which fits its strategy to keep a sustainable dividend in an environment of $40 Brent and $3 Henry Hub natural gas.

Currently, BP yields 5.0%, which is higher than Exxon’s 3.4% yield.

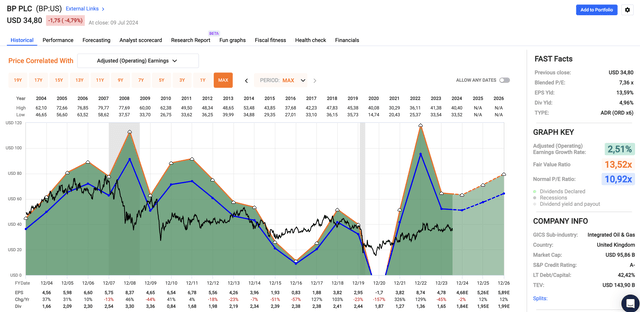

With regard to its valuation, as I already briefly discussed, we are seeing a few interesting developments.

- The company trades at a blended P/E ratio of just 7.4x. Exxon has a blended P/E ratio of 12.1x.

- The normalized P/E ratio over the past two decades for BP is 10.9x. Exxon has a 14.5x normalized P/E ratio.

Moreover, using the FactSet data in the chart below, analysts expect 12% EPS growth in both 2025 and 2026.

FAST Graphs

If the company moves back to a 10.9x multiple in this scenario, it could get a fair price target of $64, roughly twice its current price.

The problem is that the market isn’t willing to apply a higher multiple.

There’s just too much uncertainty in the oil and gas market and people seem to be unsure if European majors will change their outlook again.

After all, if BP believes we are close to peak oil, it is unlikely it will boost its upstream output on a long-term basis.

Even worse, in some areas, it may not even be up to BP, as the new government of the U.K. is looking to end North Sea drilling licenses and hike taxes on oil and gas companies.

North Sea oil and gas producers urged Britain’s incoming Prime Minister Keir Starmer to provide clarity on his election promise to increase tax on the sector, warning it could lead to a rapid decline in output and revenue.

Starmer’s Labour Party swept to power in a parliamentary election on Thursday, ending 14 years of Conservative government.

The party’s manifesto promised to rapidly build up Britain’s renewable power, partly by increasing taxes on its oil and gas sector. It also vowed to end issuing new licences in the North Sea basin. – Reuters

All things considered, BP may be yielding 5%, but that’s where the good news ends. While it’s not a bad business, it just isn’t good enough to compete for shareholder capital. Especially not given the stronger business models of its American peers.

As such, I will stick to a Hold rating, as I cannot make the case that BP can outperform the energy sector on a prolonged basis.

Takeaway

BP continues to struggle with its strategy and market positioning. Despite having solid reserves, a healthy balance sheet, and a high dividend yield, its focus on non-oil operations due to ESG pressures does not align with investor expectations.

I believe the company’s underperformance compared to American oil giants like Exxon and Chevron highlights the market’s preference for traditional oil and gas investments over renewable ventures.

Furthermore, with headwinds from refining margins and geopolitical challenges, BP’s outlook remains challenging.

Although its valuation is attractive, the uncertainty surrounding its long-term strategy keeps me cautious. It’s also the reason why I stick to a Hold rating for the time being and continue to invest in U.S. and Canadian oil companies.

Read the full article here