The surprising negative m/o/m CPI reading in the United States on Thursday, July 11 startled investors and economists. Investors, of course, were hoping to see another slowdown in consumer inflation in the hopes that it would finally lead the Federal Open Market Committee (FOMC) to commit to a foreseeable interest rate (Fed Funds Rate) cut. Those who were following FOMC chairman Jerome Powell’s commentaries over recent weeks will know that Powell remained uncommitted to a near-term rate cut until more good inflation data came about.

Then we’ve had a bump in inflation in the first quarter, and now we’ve had one good and one very good inflation reading. We need more good data so that we can be confident that what we’re seeing is really that inflation is going back down toward 2%.

– Jerome Powell, FOMC Chairman (July 10, 2024).

The S&P 500 rose nearly 1% on Wednesday, July 10, with investors confident that a next ‘good’ inflation reading was on its way and would finally cause Powell and co. to take action.

Thursday CPI Reading

Investors got what they hoped for on Thursday, or so they thought. Their cupcake came with an extra layer of icing as monthly CPI dropped for the first time since 2020!

U.S. Bureau of Labor Statistics

Stock Futures rose immediately upon the surprise CPI release – nearly another 1%. The U.S. Dollar tumbled on near-term expectations of lower rates. Cue the victory music?!

Not so fast. Sometimes, it’s possible to get too much of a good thing. Investors following all parts of the story will know that Powell recently admitted that there were two-sided risks present, both risks to persistent inflation and risks to economy.

Economics and many investors (I’m assuming the more experienced variety) paused to reconsider the data. By midday Thursday, U.S. markets were in the red, and relatively substantially. The S&P 500 closed lower by nearly 1%, nearly a 2% reversal from the pre-market highs.

Suddenly, low inflation readings became the enemy.

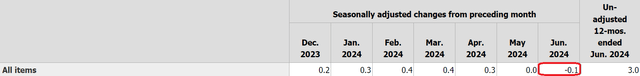

Enter PPI

This morning, the Producer Pricing Index reading delivered another surprise, rising more than expected on both a m/o/m (+0.2% versus +0.1% forecast) and y/o/y (+2.6% versus +2.3% forecast) basis.

Bureau of Labour Statistics

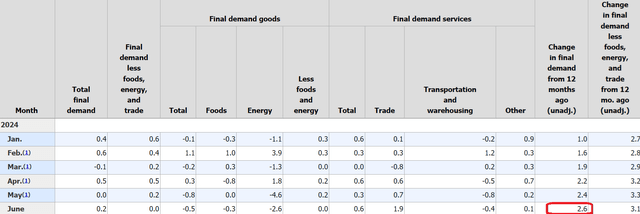

How quickly the world has turned upside down. Everything that used to be bad is now good. Investors, who have been cheering slowing inflation for the past year, were suddenly relieved to see a higher inflation report after the CPI scare. By 11 AM Friday, markets had recovered almost all their losses from Thursday.

Seeking Alpha

Worrying Signs and the Possible Impact on Corporate Profits

With all due respect to investors who are buying back the equity positions they sold yesterday, I think the ‘smart money’ is sitting this one out and seeing where retail investors take this. Friday’s trading volume looks low, and if I’ve learned anything in my years of investing, it’s to pay attention to the direction of trading when volumes spike, as they did on Thursday.

I sense an air of concern in the markets. And let us not forget about the economics, which will ultimately carry the day.

In a time when even the Federal Reserve Chairman is publicly expressing concerns about a possibly slowing economy, rising PPI along with declining CPI gives me the jitters as an investor in company stocks.

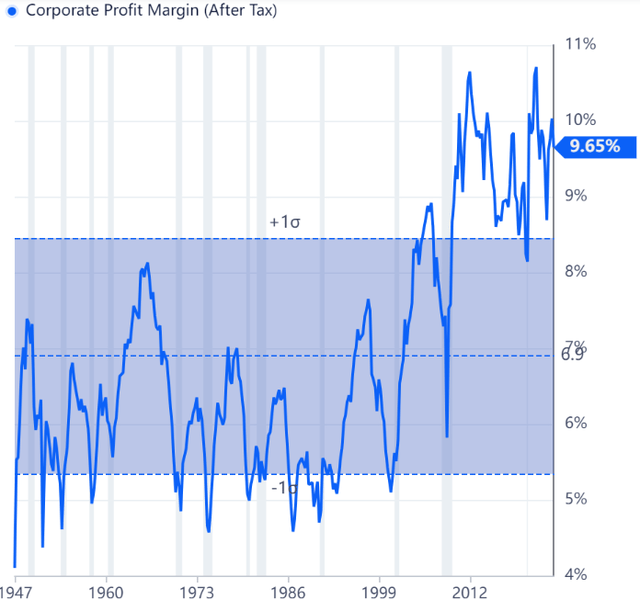

U.S. Corporate Profit Margins remain within 1% of all-time highs, and in the long run of things, it remains to be seen whether the productivity gains companies have seen over the past decade are sustainable.

Gurufocus.com

The United States continues to be a heavily consumer-driven economy, and a slowdown in consumers ability or willingness to pay increasingly higher prices (there are already early signs that the job market has been slowing) is something to take note of, especially in an environment where manufacturers may be continuing to see input cost inflation.

Market Valuation & Outlook

Those who have been following my articles will observe that I’m a bit skittish about the markets, especially as the much-fretted November election (for both camps) seems sure to result in great uncertainty, trepidation, and fear. At low volatility, I’ve been continuing to buy portfolio protection through Put Options.

But this week’s series of economic releases and market reactions have given me a new reason to worry about the downside in U.S. market indices, which most investors are exposed to through index ETFs like the Vanguard S&P 500 ETF (NYSEARCA:VOO).

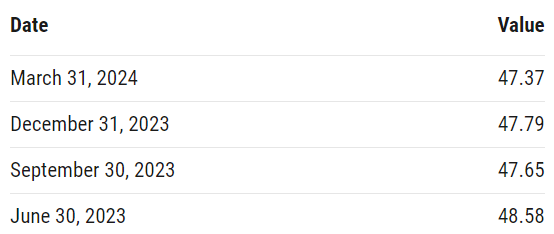

S&P 500 earnings stand at 191.39 over the past four quarters, meaning the index is already trading at a TTM P/E of 29.4x. The Shiller P/E, which I concede doesn’t have the best track record of predicting short/medium-term market movements, stands higher than 36x.

YCharts

Summary and Recommendation

I view the combination of this week’s surprising inflation readings coupled with the market’s seeming reverse reactions to inflation numbers, along with Chairman Powell’s comments, as substantial reasons for investors to question the status quo trend. There’s a lot to absorb here. While markets may be recovering their Thursday, July 11 losses, I’m anticipating much more cautious/negative trading in the weeks to come. Even passive investors in index funds like VOO may wish to consider booking some profits.

Investors should also remember the mantra “buy the rumor and sell the news”. After so much anticipation already, it’s hard to imagine investors driving stock prices higher even when the Fed does cut rates.

Investors looking to remain invested in equities might consider transnational corporations who are based in the United States. Both rate cuts and a potential slowdown in the U.S. Economy would almost certainly drive U.S. Dollar (DXY) (UUP) weakness, making it easier for companies with substantial international operations to maintain profit levels.

Read the full article here