Introduction

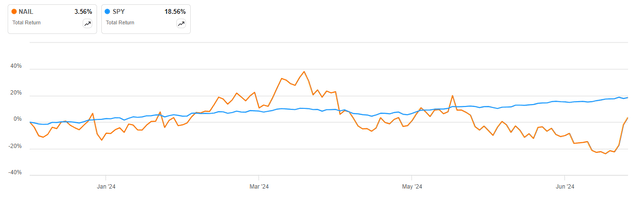

The Direxion Daily Homebuilders & Supplies Bull 3X Shares ETF (NYSEARCA:NAIL) has substantially underperformed the SPDR S&P 500 ETF (SPY) so far in 2024, delivering a 3.5% total return against the 18.5% gain in the benchmark ETF:

NAIL vs SPY in 2024 (Seeking Alpha)

While some of the underperformance is due to the quite high expense ratio of 0.97%, I still think the ETF makes sense for investors with a short-term horizon who want to benefit from the expected pivot in FED monetary policy over the next few years. With an undemanding valuation of underlying holdings and the substantial leverage employed by the ETF, investors willing to take the risk may achieve a return in the low-to-mid double digits.

ETF Overview

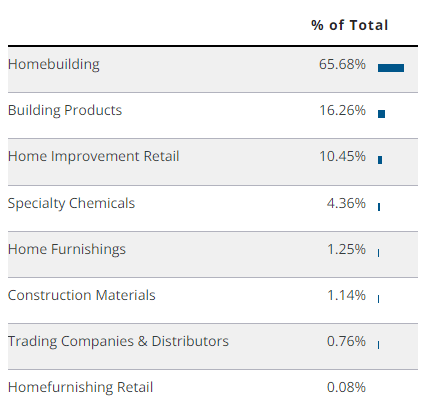

You can access all relevant NAIL information on the Direxion website here. The ETF seeks to deliver 300% of the daily performance of the Dow Jones U.S. Select Home Construction index. The portfolio is heavily invested in homebuilding stocks which account for 65.68% of net assets, followed by building products at 16.26% and home improvement retail at 10.45%:

Portfolio allocation across sectors (Direxion website (Accessed July 2024))

Large Holdings and Concentration

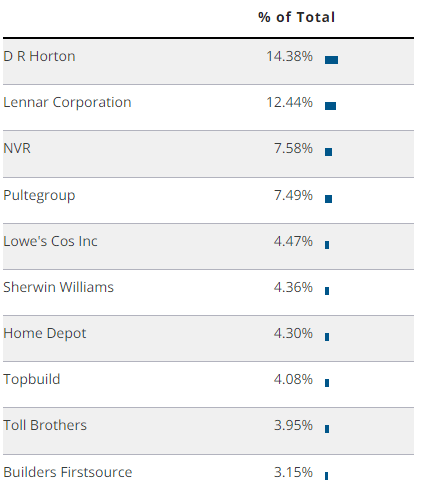

You can access all NAIL holdings here. The portfolio consists of 44 separate stocks but remains highly concentrated nevertheless, with the top ten positions accounting for 66.2% of net assets:

Top ten NAIL positions (Direxion website (Accessed July 2024))

Portfolio fundamentals

While the expense ratio of 0.97% is quite high for such poor diversification, the concentrated portfolio allows for a better grasp of underlying holding dynamics and valuation, as shown below:

| Company | Seeking Alpha Quant Rating | Forward P/E |

| D.R. Horton | Buy (3.89) | 10.83 |

| Lennar Corporation | Hold (3.04) | 11.30 |

| NVR | Hold (3.06) | 16.34 |

| PulteGroup | Strong Buy (4.76) | 9.08 |

| Lowe’s Companies | Hold (3.27) | 19.13 |

| Sherwin-Williams | Hold (3.05) | 28 |

| Home Depot | Hold (3.25) | 23.57 |

| TopBuild | Buy (4.44) | 19.82 |

| Toll Brothers | Hold (3.40) | 8.74 |

| Builders FirstSource | Hold (2.70) | 12.04 |

|

Weighted Average (Position weight * indicator) |

3.54 | 14.36 |

Source: Seeking Alpha & Author calculations

We observe that the top ten holdings have a weighted average forward P/E of 14.36 (earnings yield of 6.96%) and a weighted average Seeking Alpha quant rating of 3.54. You can learn more about Seeking Alpha quant ratings here.

Future Federal Reserve Policy

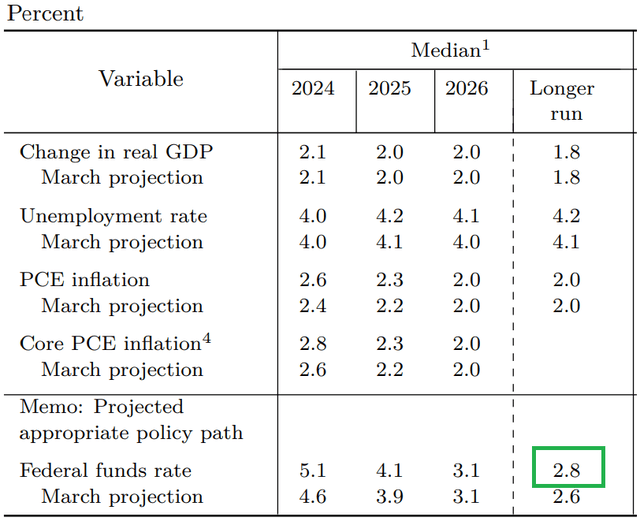

The homebuilding sector will be one of the key beneficiaries of lower interest rates as interest on mortgages closely follows the FED funds rate. Lower mortgage payments will in turn increase the demand for housing. Futures pricing indicates the FED is likely to bring rates to 3.75-4.00% in July 2025, 1.5% lower than current levels. Furthermore, in its June 2024 summary of economic projections, FED officials signaled they expect further cuts post 2025, to a level of about 2.8% in the long term:

Outlook for macroeconomic indicators ((Federal Reserve June 2024 Summary of economic projections))

The earnings yield outlined in the previous section stands at a weighted average of 6.96%. Combining it with the long-term GDP nominal growth rate of about 3.8% we see that investors are looking at a potential low double-digit return, even before we factor in the one-off boost from lower interest rates. Since home building is rather capital intensive, you can be on the cautious side and only add inflation of 2% rather than a boost from national GDP growth of 1.8%. Still, you are looking at a high single-digit return, which is quite good.

We should note the above return expectation is more of a medium-term outlook and does not factor in leverage (which at 300% for NAIL is game-changing). Therefore the actual return investors may achieve could be in the low-to-mid double digits if homebuilding stocks jump as I expect.

Risks

The main risk facing investors in NAIL is an unexpected pickup in inflation, which would freeze the Federal Reserve’s plans to gradually reduce interest rates over the next few years. Furthermore, homebuilding is a cyclical industry, hence a potential recession sometime in the future may dampen demand for homes. Recession risk is arguably more manageable since the FED is likely to cut rates, lowering mortgage costs, and to an extent mitigating the recession’s impact on housing in particular.

The other fact to note is that the expense ratio of 0.97% is quite high for such a concentrated ETF. Over the long term, you are likely to pay 1/10 of your potential return as fees to the ETF manager. As such, I view NAIL as more of a speculative/trading ETF over the next few years as the FED cuts rates and homebuilding stocks appreciate. After that one-off boost, however, I think you are better off replicating the ETF’s portfolio to save on fees.

Finally, we should note that since NAIL is tracking the underlying index’s performance threefold, it will be quite a volatile ETF as homebuilding stocks will move strongly on each inflation/jobs report or Federal Reserve policy meeting.

Distributions

NAIL pays a quarterly dividend but with a yield of 0.25% clearly the main appeal of the ETF is not in its income potential. We should note that a number of components, such as D.R. Horton (DHI) conduct sizable share buyback programs. As such, you should not jump to the conclusion that NAIL holdings are by default not shareholder-friendly.

Conclusion

The Direxion Daily Homebuilders & Supplies Bull 3X Shares ETF has substantially lagged the broad U.S. market so far in 2024. Against the backdrop of expectations for FED rate cuts that will materially boost the housing market and an undemanding valuation of top ten holdings, I think NAIL will be a worthwhile investment over the next few years. I would note however that the high expense ratio coupled with high concentration in a few names reduce the long-term appeal of NAIL as a buy-and-hold investment. Nevertheless, the ETF may present the ideal opportunity for investors with a short-term horizon, and as such I rate it a buy.

Thank you for reading.

Read the full article here