Investment Thesis

I last covered Simpson Manufacturing Co., Inc. (NYSE:SSD) in October 2023 and while the company has faced headwinds from challenging market conditions since then, especially in the housing sectors in the U.S. and Europe, the stock is up a reasonable ~20%. I believe we are close to the bottom in terms of business fundamentals, and the company’s revenue growth should improve once the interest rate cycle turns in the next few quarters. Moreover, the company has a strong track record of outperforming its end markets, driven by its good execution in terms of building long-standing relationships, focusing on product innovation, enhancing customer service, and capacity expansions. I expect this solid execution to continue and drive end-market outperformance in the coming quarters. Additionally, the supply-demand conditions in the housing market remain tight, which bodes well for long-term revenue growth. Besides organic growth, the company has a healthy balance sheet and is well-placed to do M&A.

On the margin front, the company’s margins are expected to face pressure from increased costs related to ETANCO integration and investments in growth initiatives in the near term. In the medium to long term, as the company realizes cost synergies from the integration and benefits from these growth investments, its margins should improve. Coming to the valuation, the company’s FY25 forward P/E valuation looks attractive when compared to historical averages. This, coupled with good growth prospects, makes SSD’s stock a good buy.

Revenue Analysis and Outlook

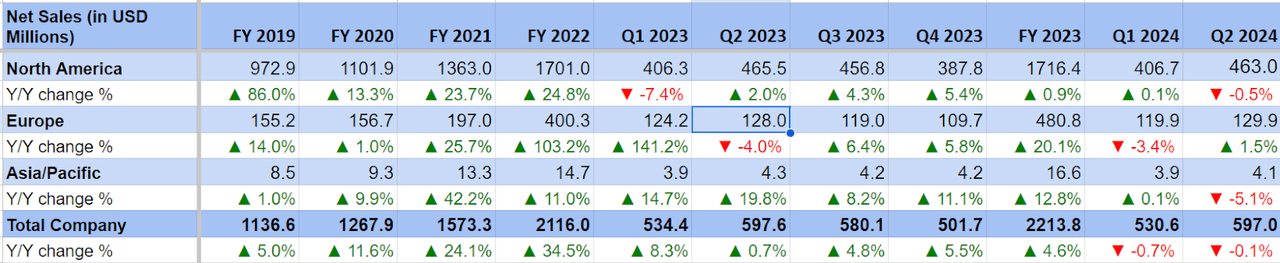

Post-pandemic, the company saw double-digit sales growth driven by robust demand across its end markets and pricing increases. In 2023, the company’s sales benefitted from contributions from the ETANCO acquisition. However, sales growth has turned negative in recent quarters due to challenging market conditions, especially in the housing sectors in both the U.S. and Europe.

In the second quarter of 2024, the company’s sales declined by 0.1% Y/Y to $597 million. In the North America segment, sales decreased by 0.5% Y/Y on relatively flat sales volume and pricing. End-market-wise, the mid-single-digit Y/Y growth in the OEM and component manufacturer, and modest volume improvement in the commercial end market was offset by a low single-digit decline in the national retail sector. The residential market remained relatively flat Y/Y as improvements in the single-family housing market were offset by a double-digit Y/Y decline in the multifamily housing market.

In Europe, sales grew by 1.5% Y/Y attributed to higher sales volume. The Y/Y volume growth was attributed to the company’s solutions-based selling approach, which continues to generate new customer wins and expand product applications. However, this volume increase was partly offset by price decreases in some regions, as well as the negative effect of approximately $0.7 million in foreign currency translation.

SSD’s Historical Revenue Growth (Company Data, GS Analytics Research)

While the company dialed down its expectations for the current year’s end-market growth in its recent earnings release, it is mostly macro related, and I am not too worried about it. The high interest rates are impacting the company’s sales like most other building product companies. However, recent data points around inflation have been encouraging, and I am optimistic that we should see an interest rate cycle reversal in the next few quarters.

Meanwhile, the company is executing well and gaining share. On its Q2 earnings call, management noted that the good execution against the company’s growth strategy continued to drive new customer wins, helping it outperform a declining housing market which is down mid-single digits on a year-to-date basis.

I like the companies that outperform end markets during the downturn and gain share as once the macroeconomic cycle turns, these companies emerge much stronger on the other side of the cycle. SSD is one such quality company.

The company is also expanding its capacity, which makes it well-placed to capture upside opportunities once the interest rate cycle starts reversing. It is currently expanding its Columbus, Ohio facility and constructing a new fastener facility in Gallatin, Tennessee. The facilities are expected to become fully operational in 2025, and position SSD to benefit from increased demand as the interest rate cycle reverses and the housing market recovers.

The company has a strong track record of outperforming the broader market, with historical average performance in North America 250 bps above the housing market. In the past two years, it has outperformed the housing market by 800 bps. I expect the company to continue surpassing its end markets by at least 250 bps in 2024 and beyond, driven by its solid execution in building strong relationships, enhancing customer service levels, and focusing on product innovation, capacity expansion, and M&A.

Additionally, the long-term fundamentals of the U.S. housing market are also favorable, with a shortage of new as well as existing homes after more than a decade of under-building compared with population growth. I believe this structural supply-demand gap positions the housing market well and, once the interest rate cycle reverses in the coming years, there can be a swift recovery.

While the company’s European business remains under pressure due to macroeconomic challenges and lower overall construction activity, there are secular drivers in this business as well. The company should benefit from the New European Bauhaus initiative, which aims to promote sustainable and innovative building practices, with a focus on using wood as a primary construction material in Europe. Wood Connectors & Trusses account for approximately two-thirds of the company’s sales, and the company has a 54% market share in this $2.5 billion market.

Further, the ETANCO acquisition (completed in April 2022) expands the company’s operations into new geographies, sales channels, and commercial building markets. There is a good potential for revenue synergies as the company sells its products through ETANCO’s established distribution channel, grows its direct sales business, and expands into commercial building markets.

Further, the company is also evaluating smaller tuck-in M&A opportunities to expand its product line or solution set and accelerate the traction of its key growth initiatives. The company has a healthy balance sheet with net debt to EBITDA of ~1.2x at the end of Q2, 2024, which should enable it to pursue M&A and complement organic growth.

So, overall, I remain optimistic about the company’s long-term growth prospects and believe investors should not worry about the Q2 earnings miss caused by transient macroeconomic factors.

Margin Analysis and Outlook

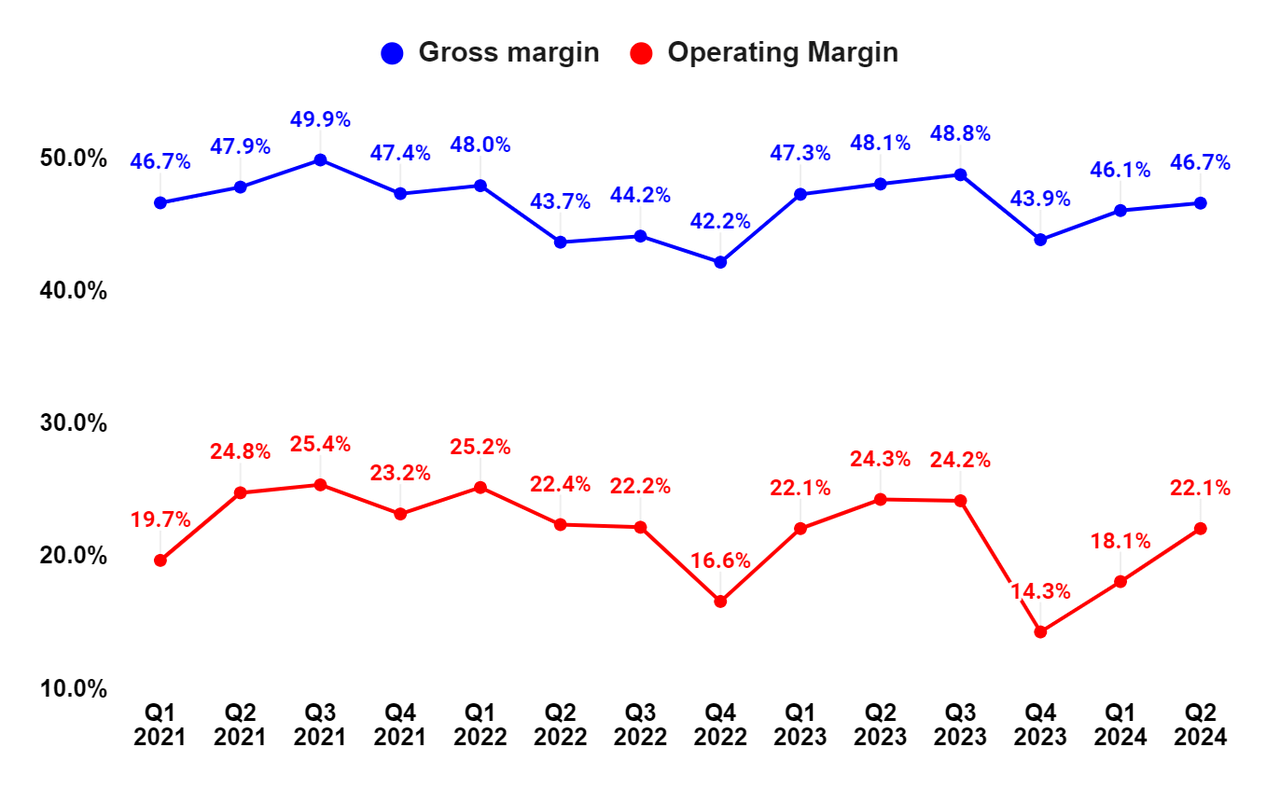

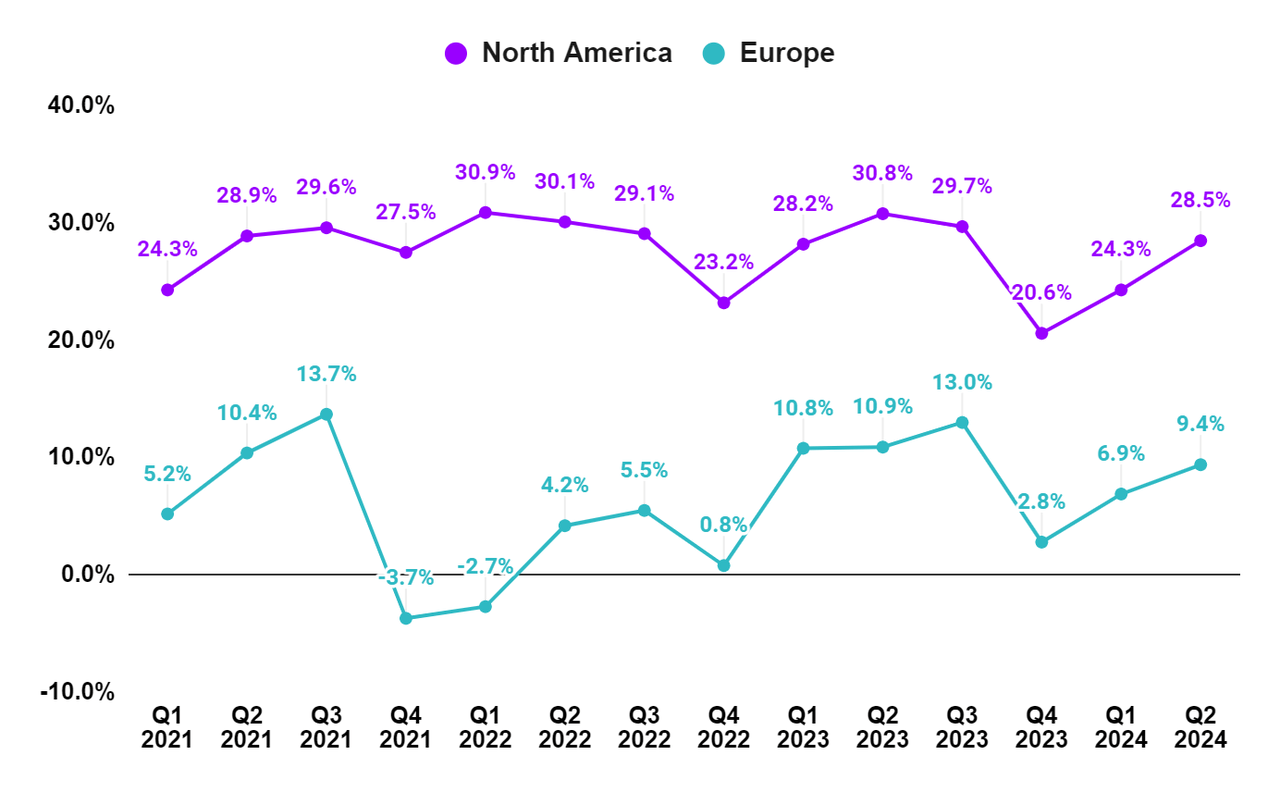

In Q2 2024, SSD’s gross margin contracted by 140 bps Y/Y to 46.7% due to an unfavorable product mix, growth investments, and higher factory overhead costs, partially offset by productivity improvements. The operating expenses increased by 3% Y/Y due to increased personnel costs and professional fees. The lower gross margin and higher operating expenses resulted in a 220 bps Y/Y decline in operating margin to 22.1%.

On a segment basis, the North America operating margin declined by 230 bps Y/Y due to lower gross margin and an increase in personnel costs and professional fees. In the Europe segment, the operating margin declined by 150 bps Y/Y due to a decrease in gross margin and higher personnel costs, which more than offset lower integration expenses.

SSD’s Gross Margin and Operating Margin (Company Data, GS Analytics Research)

SSD’s Segment-Wise Operating Margin (Company Data, GS Analytics Research)

Looking ahead, the company’s margins are expected to be impacted in the near term by increased costs related to the addition of new warehouses, facility expansions, and investments in growth initiatives such as engineering, marketing, sales personnel, and testing capabilities, as well as integration costs associated with ETANCO. However, in the medium to long term, as revenue growth accelerates with the recovery in the housing market and the company sees the benefits of these growth investments, its margins should improve.

Additionally, margins should benefit from cost synergies realized through the ETANCO integration, including procurement optimization, footprint rationalization, and manufacturing and operating expense efficiencies in the coming quarters.

Valuation

SSD stock has seen some correction after the lower than expected Q2 2024 results and is trading around ~$170 in premarket trading at the time of writing this article. If we look at the FY25 consensus EPS estimate of $8.96, the stock is trading at ~19x P/E which is lower than its historical 5-year average P/E of 20.99x.

I expect the company to see improving trends in the coming quarters as the interest rate cycle reverses. In fact, the company has already started seeing a strong trend after the correction in mortgage rates over the last couple of months, and management noted a low double-digit percentage increase in North America revenues in the first few weeks of July. I believe the company is close to the bottom and should see improving trends in the coming quarters. The good growth prospects coupled with lower than historical forward P/E on FY25 consensus estimates make SSD stock a good buy.

Risks

- My thesis anticipates a recovery in the housing market from an interest rate cycle reversal over the next few quarters. If this doesn’t happen, it may negatively impact the end market demand as well as the company’s revenue growth.

- The company is evaluating smaller tuck-in M&A opportunities to expand its product line or solution set and accelerate the traction of its key growth initiatives. However, inorganic growth is relatively riskier compared to organic growth and there are always risks related to integration missteps, overpaying for an acquisition, and the leverage a company takes to make an acquisition. In case any future acquisition goes wrong or the management fails to realize the intended synergies of ETANCO integration, it may negatively impact the stock price.

Takeaway

While the company faces near-term challenges due to the current macroeconomic environment, I believe we are close to the bottom and the company should see improving trends once the interest rate cycle reverses over the next few quarters. Moreover, the company has a good track record of outperforming its end market driven by longstanding relationships, focus on product innovation, best-in-class field support, and a diverse portfolio of products. The company’s long-term outlook is also favorable with the significant underbuilding of new homes in the US in the decade following the great housing recession of 2008 which has resulted in a tight demand-supply situation in the U.S. housing market. The emerging trend towards wood construction in Europe should also help the company. The margins should also expand in the medium to long term as the company realizes cost synergies from the ETANCO integration and benefits from its growth investments. Given the good growth prospects and discounted valuation on a forward basis, I have a buy rating on SSD stock.

Read the full article here