Summit Midstream Corporation (NYSE:SMC) is an almost $400 million company, a small cap that took a massive impact with COVID-19 and the resulting impact on prices. The company’s non-premium assets have put it in a difficult position, but the company has worked hard to clean up its balance sheet, and is focused on generating long-term shareholder returns.

Summit Midstream Corporation Results

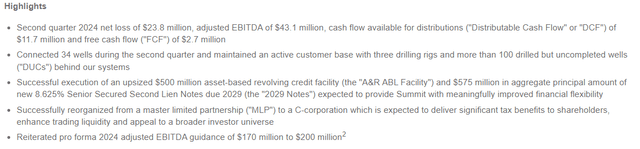

The company had a net loss of almost $24 million for the quarter, and discounted cash flow (“DCF”) was almost $12 million.

Summit Midstream Corporation Investor Presentation

Annualized, that’s almost $50 million DCF, which is a 13% DCF yield. That doesn’t count the massive drop from EBITDA to DCF caused by the company’s debt, which it has continued to pay down. The company did manage to connect 34 wells during the quarter and has more than 100 DUCs and 3 rigs. This is on the upper end of the company’s midpoint guidance of 135 wells for the year.

However, it’s still below pre-COVID well connection. Still, the company is now a C-Corp and the chance of bankruptcy has decreased substantially with the company rolling over its debt to 2029. That frees it from the risk of debt expiration and high rates, with debt originally coming due in the 2025-2026 period.

Summit Midstream Segment Performance

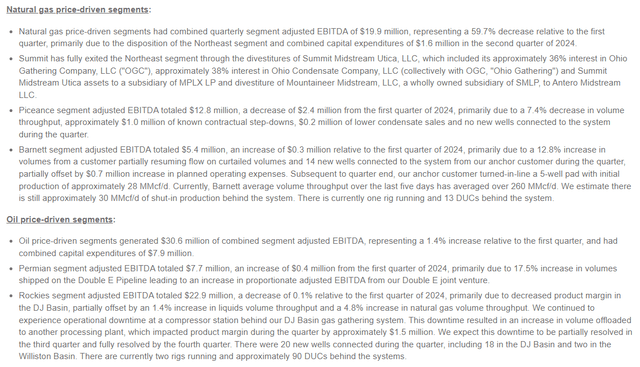

From a segment perspective, the company has continued to suffer from weak natural gas prices.

Summit Midstream Corporation Investor Presentation

The company fully exited the Northeast segment of its business. The company’s Piceance segment has suffered from no new wells connected to the segment. The company’s Barnett segment has seen continued support from its anchor customer, but again natural gas production and support remain low. Natural gas prices need to recover to help the company for the long term.

With oil, the company’s Permian segment has continued to be strong, supported by the Double E pipeline. The company continues to ramp up this segment and the potential demand. The company was impacted by processor downtime, but that’s expected to recover. The key thing for the company is to see recovery in its Piceance and Rockies segments.

That depends upon natural gas prices.

Summit Midstream Financial Performance

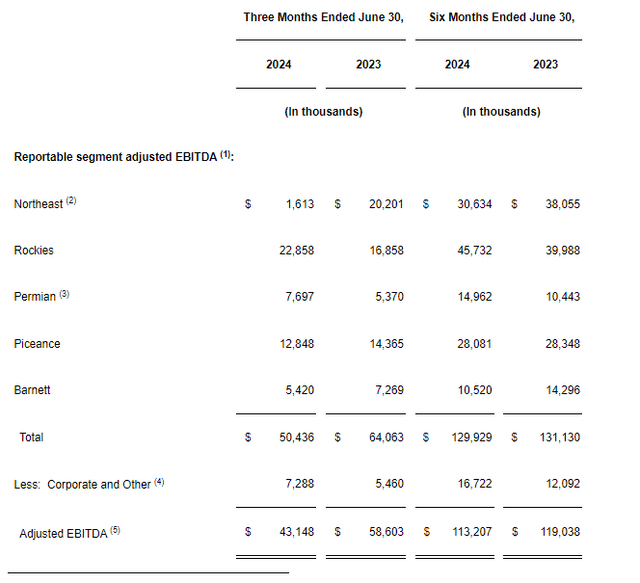

Financially, partially supported by MVCs, the company continues to generate strong EBITDA.

Summit Midstream Corporation Investor Presentation

The company’s adjusted EBITDA is primarily down due to its northeast segment divestiture, at a great price, while the company’s other segments remain relatively strong. The company continues to face substantial interest expenditures, to the tune of $50 million annually, which substantially impacts its DCF, although its ability to lower debt has been remarkable.

The company needs reasonably strong prices to reliably generate EBITDA and pay-down debt to drive future shareholder returns.

Summit Midstream Shareholder Returns

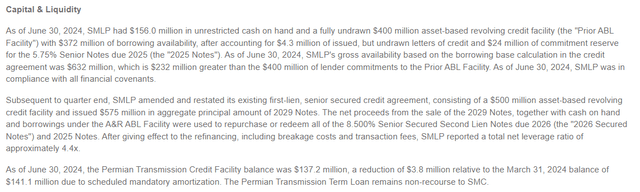

At the end of the day, Summit Midstream’s ability to drive long-term shareholder returns depends on the continued clean-up of its capital stack along with continued demand for its assets.

Summit Midstream Corporation Investor Presentation

The company is past the point where it’s facing a year-to-year slip on a potential bankruptcy, which is exciting to see for those of us who’ve followed it for a while and had to wait for this moment. The company managed to add 3 years to its debt period in a high-interest rate environment with only a 0.125% increase in rates.

The company has a net leverage ratio of approximately 4.4x, with a target of 3.5x, implying roughly $100 million more in debt that needs to be paid off. That’s roughly 2 years at its current DCF, assuming nothing else happens in terms of the company cleaning up its capital stack. Realistically, investors need to remain patient for the company to continue to clean up its debt.

However, the company’s capital stack is now at a point where it can explore bolt-on acquisitions or expansions of the Double E pipeline it runs with ExxonMobil. Both could help EBITDA increase with minimal debt increase. Continuing to pay-off debt meanwhile could help shareholder returns.

Thesis Risk

The largest risk to our thesis is the company’s cash flow and ability to continue that cash flow in a low price environment. Natural gas prices (NG1:COM) remain incredibly weak. If the completed wells behind the company remain weak, that could hurt the company’s ability to drive future shareholder returns and cash flow.

Conclusion

Summit Midstream Corporation has done a lot to continue cleaning up its capital stack and improve the company. Patient investors from the last few years have already been well rewarded, and the company is handling the current downturn in natural gas prices much better than it managed to handle prior ones.

The company going forward needs to increase utilization of its assets, partially dependent on natural gas prices, while seeing wells continued to be drilled and cash flow remain strong. Additionally, the company needs to continue paying down its high-interest debt, which will enable it to improve its DCF and eventual shareholder returns. This could result in strong returns versus its market capitalization.

Please let us know your thoughts in the comments below!

Read the full article here