Investment Thesis

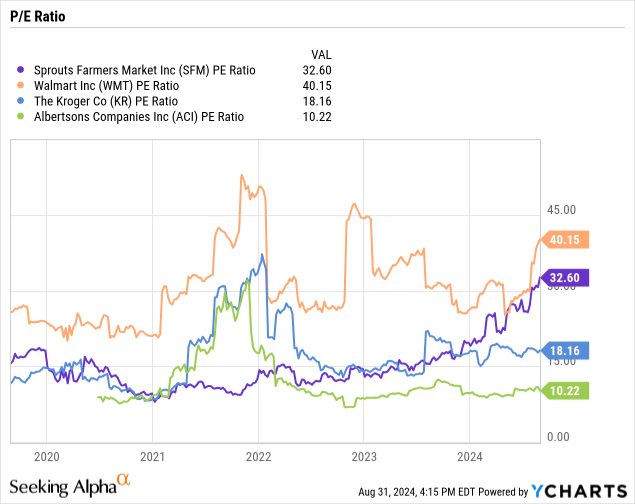

Sprouts Farmers Market (NASDAQ:NASDAQ:SFM) is a supermarket chain in the United States that specializes in fresh foods with a focus on healthy products. At the time it was thought that this would be a fad and during 2021/2022 it was trading at a P/E of 10 times, but it has presented a re-rating as it demonstrates that its concept works and has better margins and growth than its competitors.

However, with a forward P/E of 31 times it seems difficult for me to justify a buy right now, so I think it’s best to wait on the sideline if you’re not yet a shareholder and hold if you fortunately are.

Expansion Opportunity and Relative Quality

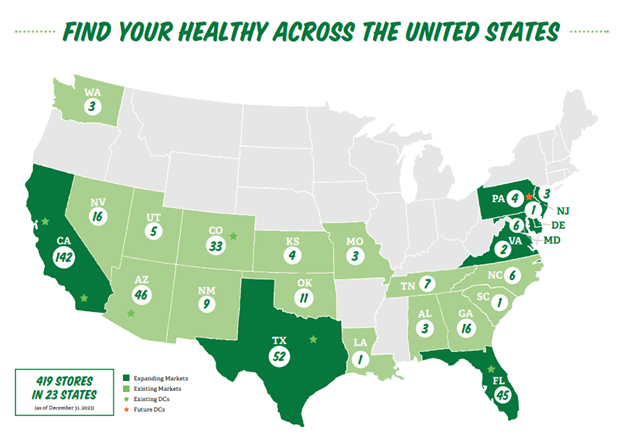

Sprouts has been experiencing rapid geographic expansion and with the 12 stores open YTD they’d be reaching 431 stores, with management’s expectation of reaching 450 this year.

While this is already more than Albertsons’ 378 stores, it still has a way to go for Whole Foods’ 517 and Kroger’s nearly 2,900. Especially considering that people increasingly want to eat healthier and there’s more awareness of their diet, so a concept as differentiated as Sprouts would have a lot of opportunity to grow.

Sprouts investor presentation

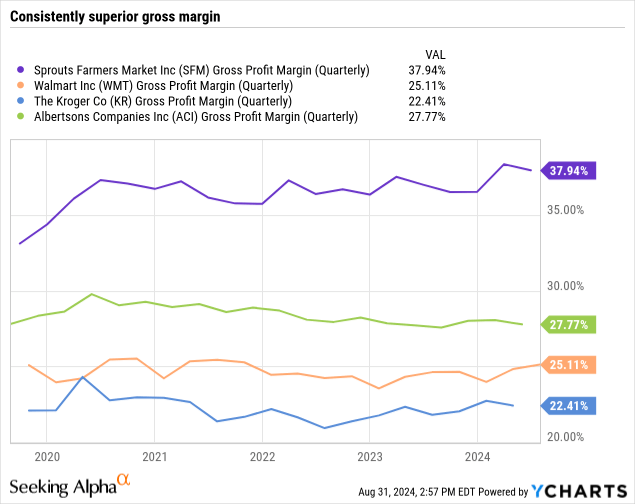

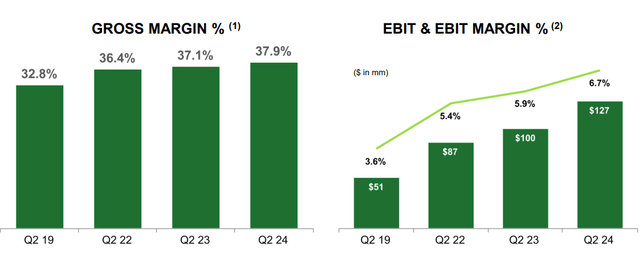

One of the signs that the concept works is the gross margin, which is considerably higher for a supermarket and has remained that way consistently since 2020.

That’s the advantage of offering products for which people are willing to pay a higher price because they consider that it has a benefit that justifies it (a healthier diet). This ends up being reflected also in the net margin which has expanded compared to 2020.

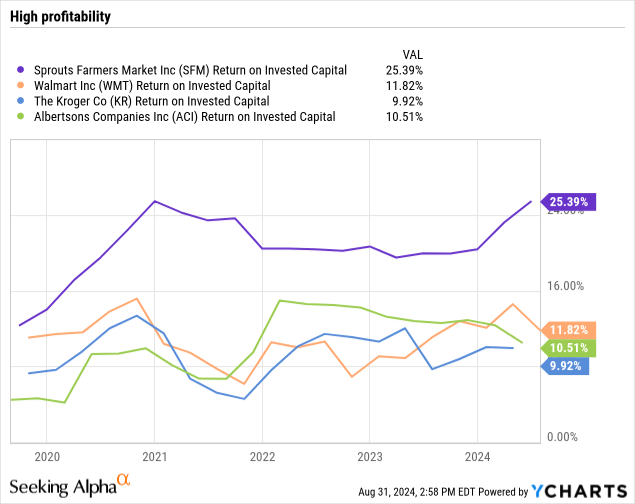

Derived from these higher margins, the company has also shown better returns on its investments than competitors. This ends up confirming the quality of the business and that we could treat it as a higher quality supermarket.

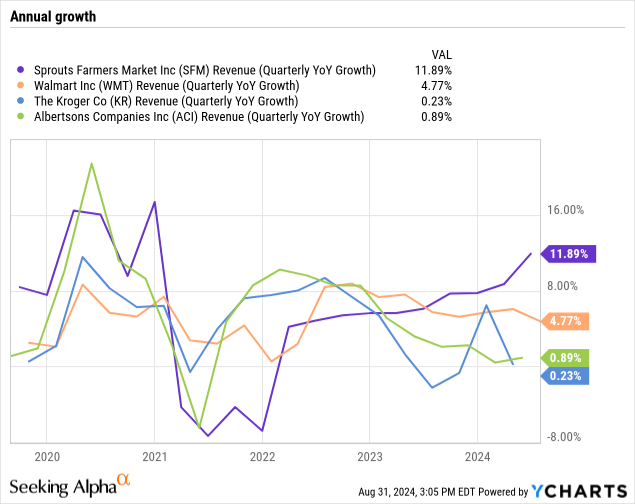

In recent quarters, the company has recovered its low double-digit growth and even during Q2 2024, revenue grew almost 12% annually. We will delve into this later, but this has been one of the factors why the company accumulates an extraordinary 112% YTD return.

Q2 2024: Beat After Beat

During Q2 2024 the company not only grew revenue by 12%, but it did so with 6.7% growth in comparable sales and exceeded analysts’ expectations by 3%, which were already high in themselves. This is extremely positive because it shows that growth doesn’t come only from building new stores, but that each store is increasingly profitable.

Furthermore, the CEO’s words were quite positive about the future of the company and confirmed that the consumer profile concerned about their health has had a lot to do with the success and growth of Sprouts.

Our health enthusiast target customers continue to respond positively to our differentiated product assortment and unique shopping experience. As consumer preferences shift towards healthier living, we anticipate there will be even more health enthusiasts in the future than there are today.

CEO Jack Sinclair on Q2 2024 Earnings Call

A surprising beat was that net profit margin reached 5% compared to a margin of 3.95% a year earlier, this was well above analyst expectations and was one of the reasons that boosted the share price after the report. This improvement in margins seems to come from good inventory management and the sale mix, which has increased the gross margin, as well as optimizations that have led to leverage in the supply chain, according to the words of CFO, Curtis Valentine.

| Estimate | Actual | Beat/Miss | |

| Revenue | $1.84B | $1.89B | +3% |

| EBIT | $108M | $127M | +18% |

| EPS | $0.78 | $0.94 | +20% |

This image makes it clear that this positive trend has been brewing for some time and could give signs of the sustainability of current margins. So, between the growth in sales due to demand, the improvement in margins due to operational efficiencies and the usual share buybacks, there are various levers to believe that EPS will continue to grow in the coming years.

Sprouts Q2 presentation

Valuation

While the business has demonstrated a lot of relative quality against its competitors, with high margins and notable growth, I don’t know if this could justify the current valuation. I mean, I think we’re looking at a stable, quality business valued as such, which doesn’t leave much room for above-average performance.

The company currently trades at a P/E of almost 33 times. In fact, it’s quite notable how during 2021 and 2022 it was trading around 10 times due to the uncertainty of whether this concept would be just a fad (it’s been shown that this isn’t the case).

Walmart has shown us that a stable business of this type can maintain a high multiple for a long time. So, looking at it another way, let’s say in the next few years get 0% from multiple expansion, 8% from sales growth, 1 or 2% from margin improvement and 3 or 4% from share buybacks. It would give a potential return of between 12 and 15%, which wouldn’t be bad.

The problem comes if the company faces some temporary problem that brings a reduction in the multiple, because going down to a P/E of 20 times would represent a 33% drop in the multiple, therefore the risk/reward doesn’t seem so interesting right now. Let’s not forget that the company is still in the process of expansion and doesn’t have a business as stable as Walmart to maintain such a high multiple consistently.

The Bottom Line

I love the business and I personally am a regular consumer. Also, the numbers prove that Sprouts is a quality business (relative to its competitors) and that there’s still room for growth.

However, at the current valuation I find difficult to justify a buy rating. Management gave midpoint guidance of $3.33 EPS for FY2024, with a forward P/E of 20 (my target multiple) the shares would be worth around $65. I realize that it seems difficult to see a 35% drawdown in short-term, but I believe that investing is about putting the odds in your favor.

Another possibility is that the company remains sideways for years but continues to grow its EPS, this way the multiple would adjust without the need for a sharp drop. In any case, the result for investors would be unfavorable, therefore I think it’s best to hold.

Read the full article here