Global index provider MSCI has dropped two Adani Group stocks from its India equities benchmark, in a move analysts said could spur investor outflows of almost $400mn and complicate plans for share sales by the sprawling Indian conglomerate.

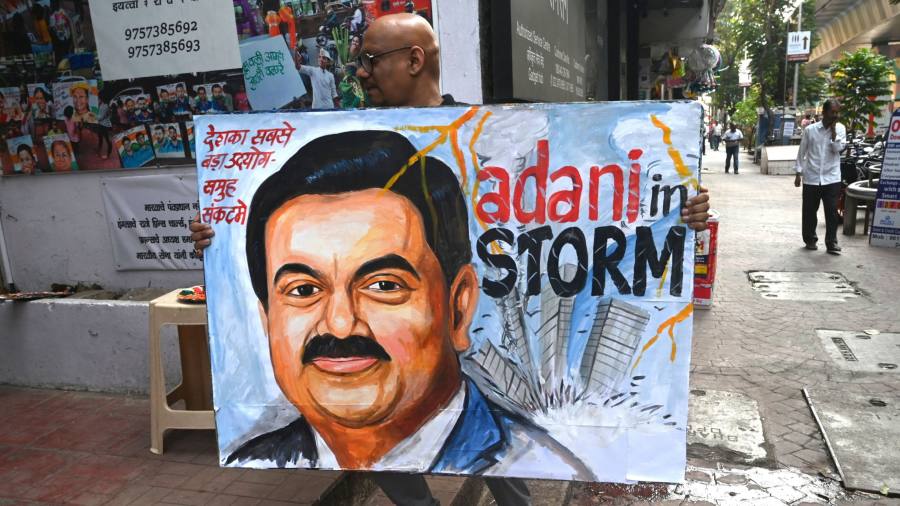

The latest setback for the industrial group owned by Indian billionaire Gautam Adani follows months of grappling with accusations of fraud and stock price manipulation made by short seller Hindenburg Research, which at one point lopped off more than $150bn from the market value of Adani’s listed companies.

The allegations, which Adani denies, also spurred greater scrutiny from index providers over how much of the companies were freely traded. MSCI said in a statement on Friday that it would drop Adani Total Gas and Adani Transmission from its India Domestic index at the end of the month.

The deletion of the two listed companies from the MSCI index adds to the challenges facing Adani Group, which has struggled to shore up investor confidence following the short seller’s report and has been forced to slow the previously breakneck pace of its acquisitions and spending.

“The company has done very little, if anything at all, to provide a different narrative and show things are not how Hindenburg said,” said Brian Freitas, an independent analyst. Adani did publish a 413-page rebuttal to Hindenburg’s allegations in late January.

Freitas said the exclusions, which MSCI blamed on the companies’ failure to meet its minimum free-float requirements, would trigger outflows of almost $400mn, as investors who track the benchmark reduce their shareholdings.

The deletion of the two Adani Group stocks follows a cut to their index weightings, along with those of several other Adani listings, by MSCI in February.

Adani Total Gas and Adani Transmission together account for about 0.6 per cent of MSCI’s India Domestic index, which tracks 115 of the largest and most liquid stocks traded in the country with a combined market capitalisation of $1.08tn. Six other Adani Group stocks will remain in the index, with a total combined weighting of about 1.8 per cent of the stock benchmark after the cuts.

The MSCI announcement also comes after three Adani companies, including Adani Transmission, told stock exchanges that they were considering new share sales, without giving details. Their boards will meet to decide on Saturday.

Last week, Adani Enterprises, which includes the group’s coal trading and airports businesses, reported post-tax profits had more than doubled in the first quarter. It is one of the Adani companies considering fundraising.

“Given that Adani Transmission could also be looking to do a fundraise soon, this makes that more difficult because people are now going to be selling $200mn [of that stock] towards the end of this month,” Freitas said.

Read the full article here