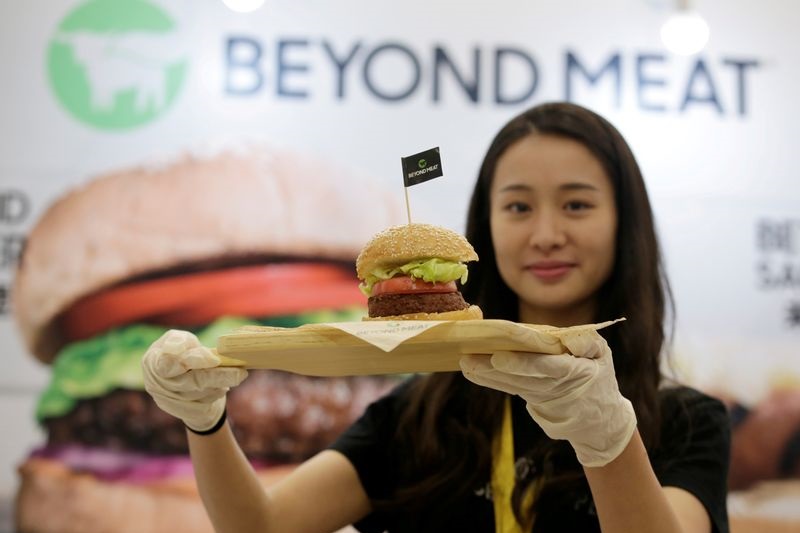

© Reuters

Investing.com — Beyond Meat (NASDAQ:) reported better-than-expected quarterly results as cost cuts helped boost margins. Shares initially gained 8% before rotating lower.

At 06:25 ET (10:25 GMT), Beyond Meat shares trade 3% lower in pre-open Thursday.

The company a loss of 92 cents per share on revenue of $92.2 million, topping analyst estimates for a loss of $1.02 a share on revenue of $91.7M.

The better-than-expected results were driven by a jump in gross margin to 6.7% from 0.2% in the year-ago period, underpinned by lower costs.

Looking ahead, the company reaffirmed its forecast for revenues to be in the range of approximately $375M to $415M, representing a decrease of approximately 10% to 1% compared to 2022.

Gross margin, however, was now expected to be 1% to 2% points above prior guidance of the low double-digit range for the full year, following an accounting change.

Bank of America analysts reiterated an Underperform rating and a $5 per share price target.

“We view BYND’s likelihood of disruption in its respective category as lower vs others.”

Bernstein analysts are more positive on BYND shares, although they also note that the company is “not out of the woods yet.”

“While the stated goal is still to reach FCF positive in at least one quarter of 2H:23, it’s likely that this will be at least partly achieved through inventory reductions and so FCF is likely to be volatile into 2024.”

(Additional reporting by Senad Karaahmetovic)

Read the full article here