Stay informed with free updates

Simply sign up to the Chinese business & finance myFT Digest — delivered directly to your inbox.

A record number of US companies in China are thinking about moving some operations out of the country or are already in the process of doing so, according to a new study, as geopolitical tensions rise with Donald Trump’s return to the White House.

The annual survey by the American Chamber of Commerce in China found 30 per cent of respondents were exploring alternative sources for goods and relocating manufacturing out of the country last year, or had already done so — double the percentage in 2020.

Michael Hart, AmCham China president, said that while the majority of US companies were not moving, the trend towards relocation was unmistakable.

“I don’t see any reason to think that bilateral investment will increase in the next couple of years,” said Hart. “Companies [are] pivoting or bolstering their supply chain by making investments somewhere else.

“Definitely . . . I would be concerned if I was in charge of Chinese investment policy,” he said.

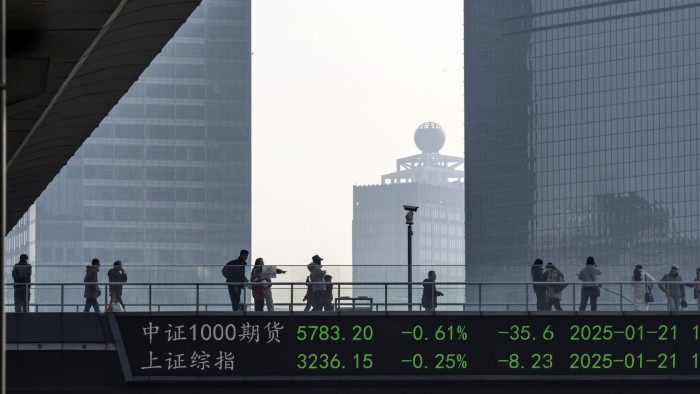

US and Chinese companies are bracing for the fallout of Trump’s protectionist trade plans.

While the new US president held off this week on implementing his most serious threats — which have included a 60 per cent blanket tariff on Chinese goods — he has reiterated that Washington could impose a 10 per cent levy from February 1 if Beijing does not crack down on exports of precursors for fentanyl, the deadly synthetic opioid.

He has also ordered US officials to review trade with China, including supply chains that use other countries to circumvent exposure to tariffs.

The AmCham survey conducted between October and November found that 44 per cent of companies that were considering relocation cited US-China trade tensions for doing so.

Another important reason was “risk management”, with many companies seeking to strengthen supply chains in the wake of the Covid-19 pandemic. “I don’t see that trend slowing down,” said Hart.

The AmCham survey noted developing countries in Asia were companies’ primary destination, with 38 per cent moving there. Developed economies such as the US, EU, Japan and South Korea had also become more attractive.

By industry, technology and research and development groups were among the most likely to move, with 41 per cent relocating or considering doing so.

Both the Biden and first Trump presidencies sought to restrict China’s access to advanced technology such as semiconductors and electric vehicle batteries, while Beijing has retaliated by choking off exports of critical minerals, in a deepening tech war between the world’s two largest economies.

The number of US companies that did not rank China as a high priority for investment has also grown, reaching 21 per cent last year, more than double the level in 2020.

Chinese officials have sought to improve the business climate this year for international companies as foreign direct investment has fallen to record lows.

Foreign business and investor sentiment in China has soured over the past few years after authorities conducted raids on consultancies and auditors and instituted vague regulations covering cross-border data flows.

But a third of the US companies surveyed said despite rising geopolitical tensions, the “quality” of China’s investment environment had improved, an increase of five percentage points from the previous year.

“China continues to be a really important market,” said Hart, adding that it was a message AmCham was trying to communicate to the “folks back in Washington”.

Market access, a long-running complaint among foreign companies in China, remained an important problem, along with increasing competition from local rivals.

Read the full article here