Stay informed with free updates

Simply sign up to the Artificial intelligence myFT Digest — delivered directly to your inbox.

Elon Musk’s artificial intelligence company xAI and chipmaker Nvidia are becoming partners in a multibillion-dollar AI infrastructure fund backed by BlackRock, Microsoft and Abu Dhabi, as companies rush to build data centres and energy projects to power generative AI.

The technology groups said on Wednesday they would join the so-called AI Infrastructure Partnership, with plans to initially raise $30bn from investors and companies, with the goal of securing up to $100bn in total investment including debt financing.

The investment vehicle is aimed at addressing the staggering power and digital infrastructure demands of building AI products that are expected to face severe capacity bottlenecks in the coming years. The computing power of AI requires far more energy than previous technological innovations and has strained existing energy infrastructure.

BlackRock launched the fund in September last year alongside Microsoft and Abu Dhabi AI investment fund MGX. Nvidia, which already provides technical advice to the fund, is becoming a full partner alongside Musk’s xAI, which is emerging as a challenger to AI start-ups such as OpenAI.

Musk’s start-up already has plans to deploy more than 1mn graphics processing units — the chips needed to train cutting edge AI — and operates a cluster of more than 100,000 Nvidia GPUs.

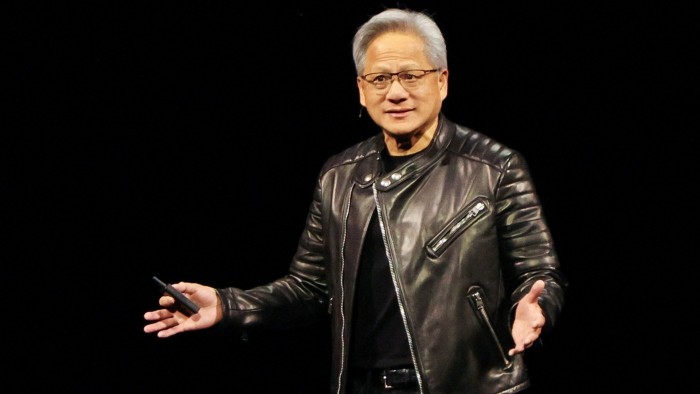

“The global buildout of AI infrastructure will benefit every company and country that wants to achieve economic growth and unlock solutions to the world’s greatest challenges,” said Nvidia chief Jensen Huang.

Part of the financial muscle behind the fund comes from Abu Dhabi, which is leveraging its vast oil wealth to bet heavily on AI. Its efforts are being led by the United Arab Emirates’ powerful national security adviser Sheikh Tahnoon bin Zayed al-Nahyan, who met US President Donald Trump on Tuesday evening during a visit to Washington.

AI “underpins the future”, said Sheikh Tahnoon, MGX chair.

The move comes two months after SoftBank and OpenAI, the company behind ChatGPT, launched their own “Stargate” project to build AI infrastructure, which was endorsed by Trump with plans to spend up to $100bn.

Following the Stargate announcement in January, Microsoft said it would change the structure of its deal with OpenAI to enable the start-up to use rivals’ cloud-computing services.

Tech companies have committed vast sums for capital expenditure dedicated to the buildout of AI. Microsoft has pledged to spend roughly $80bn in the current fiscal year ending June 30 to build data centre infrastructure necessary to train AI models and deploy applications.

This has led to concern over energy use needed to supply data centres. The International Energy Agency estimates that global electricity consumption by data centres could surpass 1,000 terawatt-hours by 2026, more than twice the amount used in 2022.

Read the full article here