Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

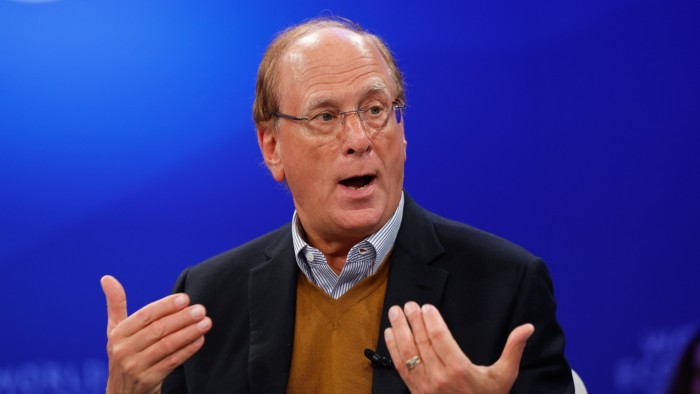

BlackRock chief executive Larry Fink told shareholders in the world’s largest asset manager that “protectionism has returned with force”, days before US President Donald Trump is set to escalate a tariffs war with America’s trading partners.

Fink, whose annual letter is pored over by investors and executives across the corporate world, said his conversations with “nearly every client, nearly every leader” underscored the pervasive unease over the state of the global economy. That anxiety has caused US stock benchmarks to slide since Trump took office.

He said people were “more anxious about the economy than any time in recent memory”. Despite rising participation in the US stock market by everyday investors, “not everyone has shared in this wealth”, he added.

“This extraordinary era of market expansion has coincided with — and was largely fuelled by — globalisation,” he wrote. “And while a flatter world lifted 1bn people out of $1-a-day poverty, it also held back millions in wealthier nations striving for a better life.

“The unspoken assumption is that capitalism didn’t work and it’s time to try something new. But there’s another way to look at it: Capitalism did work — just for too few people.”

His comments follow elections in the US and Germany where voters said the economy was one of the most important issues for them. Both economic powerhouses shifted right in the electorate, and both are grappling with an economic slowdown sparked by Trump’s escalating trade war.

Fink used much of his letter as a pitch to expand access to private investments to everyday investors, which would help “further democratise investing”. He told BlackRock shareholders that the “solution isn’t to abandon markets; it’s to expand them . . . and let more people own a meaningful stake in the growth happening around them”.

He framed the drive into private investments as one way to level a playing field that has given sovereign wealth funds and large investors access to higher yielding products, which everyday savers have largely been locked out of.

The firm has bet heavily on the blurring of lines between public and private markets, as giants such as Blackstone, Apollo Global and KKR have refashioned Wall Street and the investment world.

BlackRock itself has shifted beyond its core business in public markets. Last year it agreed to spend roughly $30bn on two of the biggest private investment firms — infrastructure investor Global Infrastructure Partners and private credit firm HPS Investment Partners — and data provider Preqin.

“We’ve been — first and foremost — a traditional asset manager,” Fink wrote. “That’s who we were at the start of 2024. But it’s not who we are any more.”

The dealmaking put the $11.6tn asset manager squarely in competition with giants in the alternative asset management industry. BlackRock expects to manage more than $600bn in alternative assets when its takeover of HPS is completed later this year.

The fruits of Fink’s dealmaking are already being seen: the company earlier this year led a $22.8bn deal to buy 43 ports around the world, including two politically sensitive operations on both sides of the Panama Canal.

“Assets that will define the future — data centres, ports, power grids, the world’s fastest growing private companies — aren’t available to most investors,” he wrote. “They’re in private markets, locked behind high walls, with gates that open only for the wealthiest or largest market participants.”

Fink conceded that “private markets have been among the most opaque corners of finance”, with fundamental questions over how private investments are valued. It is a point that has concerned regulators, particularly after valuations in several high-profile deals have collapsed unexpectedly, hitting private credit and private equity funds.

The BlackRock chief believes that Preqin, which tracks the private investment sector, is one tool that will enable BlackRock to bring “clearer, more timely data” to the industry, making it “possible to index private markets just like we do now with the S&P 500”.

The buyout and private investment industry has begun lobbying the Trump administration to open up their access to retirement pools, including defined contribution plans such as 401ks, which could give them trillions of dollars to invest.

BlackRock estimated the higher returns on private investments could bolster the average 401k over four decades by 14.5 per cent, enough to fund nine more years of retirement.

“That’s part of the reason I’m writing this letter — to cut through the fog,” Fink wrote.

“We need to make it clear: Private assets are legal in retirement accounts. They’re beneficial. And they’re becoming increasingly transparent.”

Read the full article here