Unlock the White House Watch newsletter for free

Your guide to what Trump’s second term means for Washington, business and the world

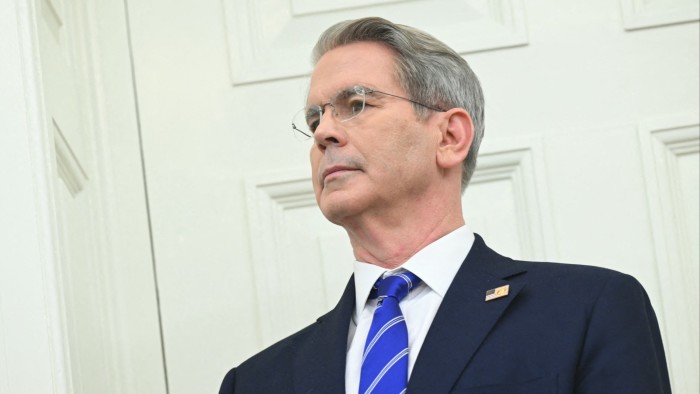

US Treasury secretary Scott Bessent on Tuesday warned that the US-China trade war was “not sustainable” and that the countries would have to de-escalate their dispute, in comments that buoyed financial markets hoping for a trade deal.

Bessent told investors at a private conference hosted by JPMorgan in Washington that he expected Washington and Beijing would reach a deal in the “very near future”, according to several people familiar with his comments.

But several people familiar with the remarks said the markets had reacted too optimistically, noting that the Treasury secretary had made clear that there were no trade talks under way between Washington and Beijing. Bessent also admitted that any negotiations with China would “be a slog”.

The US and China are in the middle of a deepening trade war after President Donald Trump imposed a total tariff of 145 per cent on goods from China and Beijing retaliated by slapping a 125 per cent levy on imports from America.

“No one thinks the current status quo is sustainable at 145 and 125 [per cent],” Bessent told the conference, according to one person in the room.

“So, I would posit that over the very near future, there will be a de-escalation. And I think that should give the world, the markets, a sigh of relief . . . We have an embargo now, on both sides.”

Pointing out that shipping container bookings had fallen by a lot, Bessent added, “The goal isn’t to decouple.”

Following his remarks, the S&P 500 closed 2.5 per cent higher, while the Nasdaq Composite rose by 2.7 per cent.

But while a number of countries have contacted the Trump administration since the president imposed “reciprocal” tariffs this month, China and the US have not held any substantive trade talks. Beijing has made clear to the White House that it views Trump’s approach as bullying and that it will not capitulate.

Asked about Bessent’s comments, White House press secretary Karoline Leavitt said the president believed his administration was “doing very well in respect to a potential trade deal with China”.

Later on Tuesday, Trump said he would strike a deal with China — something he has said repeatedly — and that tariffs would “come down substantially”.

“I think it’s going to work out very well,” he told reporters in the Oval Office.

There are no signs, however, that the US and China are about to start negotiations. Trump wants to deal directly with President Xi Jinping, but Beijing is unwilling to risk a phone call or a meeting until the two sides have hammered out the contours of a possible trade agreement.

Read the full article here