Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

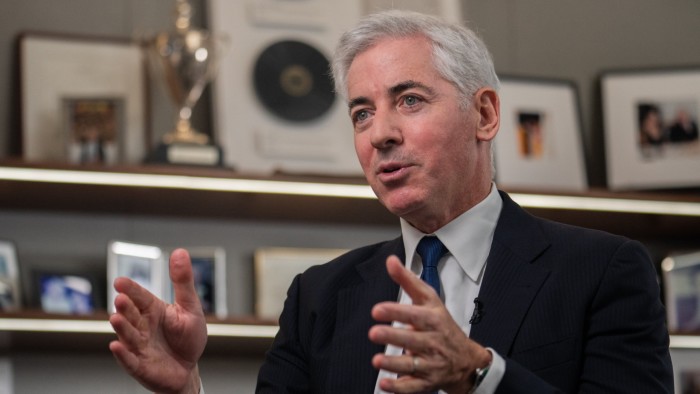

Bill Ackman has created a new acquisition machine, fulfilling his long-standing aspiration to create a conglomerate in the image of Warren Buffett’s Berkshire Hathaway, he announced on Monday.

Ackman is assuming effective control of Howard Hughes, a listed real estate development company he already partially owns, with a further $900mn investment in the Texas-based group. Under the agreement, it will shift its strategy to become a diversified conglomerate, buying controlling stakes in public and private companies under the instruction of Ackman and his investment team.

Ackman has been working on the deal for months but faced backlash from Howard Hughes shareholders over an unusual management fee proposal that could have been worth tens of millions of dollars annually to his asset management firm, Pershing Square. Ackman agreed to softened terms of the fee arrangement, paving the way for Monday’s deal.

Howard Hughes will pay Pershing Square $15mn annually for its investment team, led by Ackman and his chief investment officer Ryan Israel, to hunt for acquisitions. It will also owe Pershing Square a 1.5 per cent fee on any increase in the market capitalisation of Howard Hughes above the inflation rate.

A special committee formed by Howard Hughes’ board addressed complaints about the original terms. The new arrangement was viewed positively by some large Howard Hughes shareholders, who had considered attempting to block a previous effort launched by Ackman in January.

In that first effort, Ackman had proposed that Howard Hughes pay Pershing Square a 1.5 per cent management fee on all of its market cap gains with no hurdle. But the new proposal ties the fee to the current market cap and share count of Howard Hughes, meaning Ackman will not be compensated for simply issuing new Howard Hughes shares to fund acquisitions.

“The management fee change is a pretty big modification from prior proposals,” one large shareholder told the Financial Times. “It is not the perfect deal, but the special committee listened to some feedback,” he said.

However, other shareholders criticised the low hurdle on Ackman’s fee, instead of it being linked to the S&P 500 or a more stringent benchmark. The deal did not require a shareholder vote and closed on Monday.

Ackman created Howard Hughes in 2012 as a way to exit one of his greatest-ever trades, a large bet on bankrupt mall developer General Growth Properties during the 2008 financial crisis. Instead of selling his shares, Ackman took ownership of a piece of General Growth’s non-core properties including large residential developments in Houston, Las Vegas, Maryland and Hawaii.

Ackman has long believed the properties, which public investors have not so far valued highly, can be engineered to fund large corporate takeovers using their cash flows and tax advantages.

Ackman said in a press release that Howard Hughes’s value had “largely gone unrecognized” by public stockholders and that it could now become “a superb platform to build a faster-growing, high-returning holding company”.

Read the full article here