Unlock the White House Watch newsletter for free

Your guide to what Trump’s second term means for Washington, business and the world

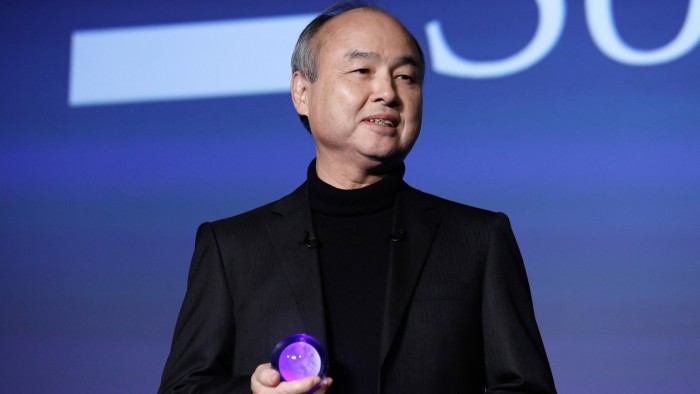

SoftBank founder Masayoshi Son has floated the idea of creating a joint US-Japan sovereign wealth fund to make large-scale investments in tech and infrastructure across the US.

The idea has been raised at the highest political levels in Washington and Tokyo, according to three people close to the situation, and could become a template for other governments to forge closer investment ties with the US.

The plan, which has been discussed directly between Son and US Treasury Secretary Scott Bessent and outlined to other top government figures in both countries, has not yet crystallised into a formal proposal, according to three people close to the situation.

The joint fund idea has been raised several times in recent weeks, however, as Japanese negotiators and the Trump administration edge towards a trade deal. Japan has dug into a position where it will push for zero tariffs, while the US side has made it clear that it will go no lower than its “baseline” tariff of 10 per cent.

But following a call between Donald Trump and Japanese Prime Minister Shigeru Ishiba on Friday, the latter told domestic media he now expected that a planned meeting between the two on the sidelines of the G7 meeting in Canada in mid-June would be a “milestone” in negotiations.

Under the suggested wealth fund structure, the US Treasury and the Japanese ministry of finance would be joint owners and operators of the fund, each with a significant stake. They would then open the vehicle to other limited partner investors, and could potentially offer ordinary Americans and Japanese the chance to own a slice.

One person familiar with the discussions said that to be effective in its investment ambitions the fund would have to be “enormous” — with potentially $300bn in initial capital and then heavily leveraged.

The appeal of the joint fund would stem from its capacity to deliver a revenue stream to both governments, according to people briefed on its details.

“The theory is that Bessent is looking for revenue streams for the Treasury that do not involve raising taxes, and however far out this joint fund may sound, it would in theory provide that,” said one person briefed on the situation who added that the idea had been pitched as marking a clear break with previous strategies.

The person added that they believed Bessent “wants something that can become the blueprint for a new sovereign-to-sovereign financial architecture, while Japan wants a properly governed covenant that protects Japan from the ad hoc decisions of Oval Office politics.”

In the past, the person added, the US government, or individual state, would offer tax incentives for big direct investors to build factories or infrastructure projects. The expectation behind that strategy was that government would indirectly receive tax at some point. But investment made by the envisaged joint fund would directly deliver profits in proportion to the original investment.

Son is close to Trump and was a prominent visitor to the incoming president’s Mar-a-Lago home in December. He has been central to the joint fund proposal, said the two people close to the situation, potentially hoping that he would ultimately play a role in directing the fund’s investment decisions.

The SoftBank boss is used to making high-stakes bets and stood beside Trump in January to unveil his $500bn Stargate plan to build US data centres and artificial intelligence infrastructure with OpenAI and Oracle. It is the kind of project that could attract investment from the proposed wealth fund, said one of the people familiar with Son’s thinking.

A spokesperson for the Treasury declined to comment. SoftBank declined to comment.

Read the full article here