Unlock the White House Watch newsletter for free

Your guide to what Trump’s second term means for Washington, business and the world

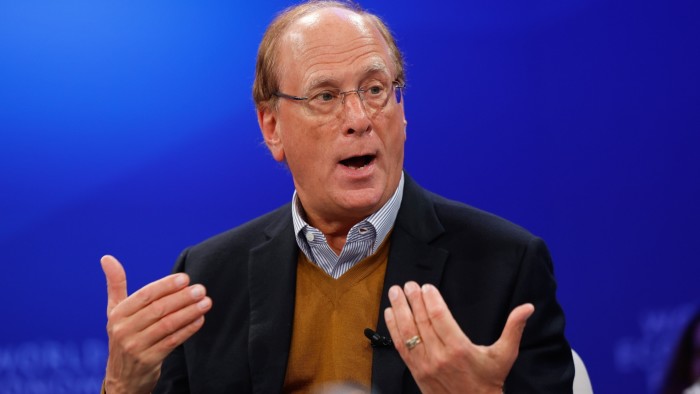

BlackRock chief executive Larry Fink said the US was “going to hit the wall” unless the economy grows quickly enough to manage higher deficits from government spending, as a growing chorus of financiers warn about the country’s mounting debt.

Fink, who leads the world’s largest asset manager, characterised the deficit as one of the “two most consequential issues” US politicians are ignoring, as President Donald Trump looks to pass tax cuts that will add $2.4tn to the national debt over the next decade.

“We have a pending tax bill that’s going to add $2.3tn, $2.4tn on the back of that,” Fink said, pointing to the $36tn in existing US debt. “If we don’t find a way to grow at 3 per cent a year . . . we’re going to hit the wall.”

“If we cannot unlock the growth and if we’re going to continue to stumble along at a 2 per cent economy, the deficits are going to overwhelm this country,” Fink said, speaking at a Forbes conference in New York.

Speaking at the same conference, Citadel founder Ken Griffin said the US’s “fiscal house is not in order”.

“You cannot run deficits of 6 or 7 per cent, at full employment, after years of growth,” he said. “That’s just fiscally irresponsible.”

US deficit spending has soared in recent years, and now stands at 120 per cent of GDP, according to the Federal Reserve Bank of St Louis. The yield on the 30-year US sovereign bond has risen to its highest level since late 2023 in recent weeks amid expectations of a flood of new Treasuries on the market.

Wall Street titans, including JPMorgan CEO Jamie Dimon, have sounded the alarm in recent weeks about the prospects of higher deficit spending. Investors have raised concerns that the growing interest expenses related to the nation’s debt will overwhelm federal spending, which in turn will weigh on growth.

The worries have mounted since the Republican House of Representatives passed Trump’s “big beautiful bill”, which would add $2.4tn to the deficit, according to the independent Congressional Budget Office. The Senate is now deliberating the spending plan.

While the Trump administration has promised to cut federal spending, those reductions are more than offset by the extension of the president’s 2017 tax cuts.

The US has been on a unsustainable fiscal path for years, economists have argued. Large federal spending programmes have been passed — notably after the Covid-19 crisis — while the government has cut taxes. Even before the vote on Trump’s “big beautiful bill”, the CBO projected that US debt as a share of GDP would rise above the high previously set during the second world war.

The more the US borrows, the more government debt the US has to sell to investors: the Treasury market has ballooned in size from about $5tn in 2008 to $29tn today. Fink noted a glut of Treasury supply would be particularly hard for the market to digest at the moment, as Washington has alienated foreign investors with its tariff policies.

“Importantly, 25 per cent of the US Treasury market is owned by foreigners,” Fink said. “That’s not a good situation when we are now battling many countries related to tariffs. And so you’re starting to begin to see a weakening in the dollar.”

Read the full article here