Unlock the White House Watch newsletter for free

Your guide to what Trump’s second term means for Washington, business and the world

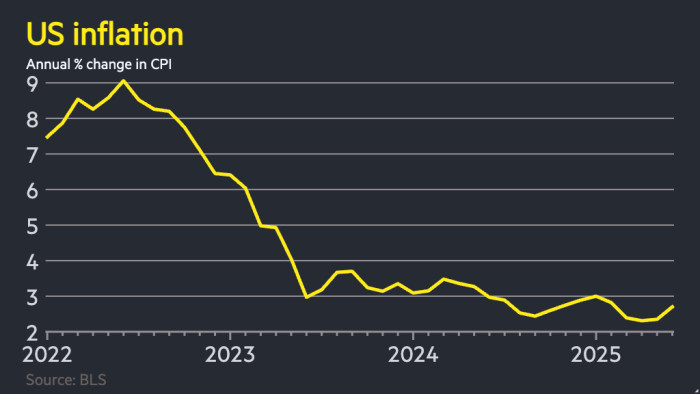

US inflation climbed to 2.7 per cent in June, surpassing expectations and signalling that Donald Trump’s tariffs are hitting prices.

Tuesday’s annual consumer price index figure was up from 2.4 per cent in May and above expectations of 2.6 per cent among analysts surveyed by Bloomberg.

The data from the Bureau of Labor Statistics comes as the US president ratchets up his tariff war with Washington’s trading partners, threatening to impose large levies on importers from next month if they do not reach trade deals.

“Today’s report showed that tariffs are beginning to bite,” said Omair Sharif at Inflation Insights.

Trump has announced a host of tariffs since returning to office, setting a baseline rate of 10 per cent and introducing an array of sector-specific levies. He has delayed the introduction of steeper reciprocal duties, previously due to take effect last week, until August 1.

“The effects of tariffs are finally showing through in inflation, although still in a modest way, suggesting that businesses have so far absorbed a significant share of the impact,” said Eswar Prasad, economics professor at Cornell University.

He added: “This is unlikely to be tenable, especially if Trump follows through with his recent tariff threats.”

June’s inflation rise was fuelled in part by higher food prices, but offset by weaker commodity prices. Annual core inflation, which strips out more volatile food and energy prices, rose 2.9 per cent, in line with expectations.

Traders in the futures market modestly increased their bets on interest rate cuts after the data publication, but still expect two reductions by year-end.

The dollar fell slightly against a basket of other currencies, while Treasury yields and stock futures were largely unmoved.

“The market is relieved that the number wasn’t worse,” said Andy Brenner, head of international fixed income, NatAlliance Securities.

He added that there had been “a fear . . . of a worse number” after US Treasury secretary Scott Bessent argued in a Bloomberg interview on Tuesday against giving too much weight to one month’s figure.

Lou Brien, market strategist at DRW Trading, noted the “muted” market reaction to Tuesday’s figures but added: “We still have the possibility that inflation is lurking around the corner.”

Trump has piled pressure on US Federal Reserve chair Jay Powell to reduce interest rates by as much as 3 points to lower the country’s debt payments.

But most members of the Fed’s rate-setting committee have indicated they want to hold off on any reduction until the inflationary impact of tariffs becomes clear.

Two members had indicated they would be open to a cut as soon as this month.

Read the full article here