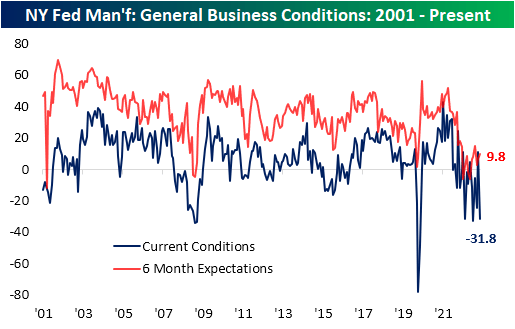

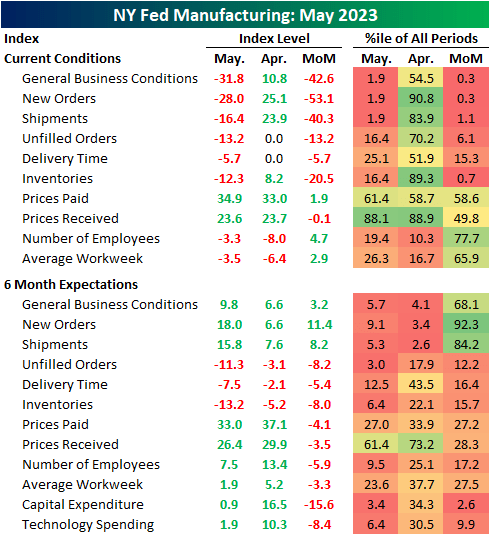

The economic calendar was light this morning, with the Empire Fed Manufacturing survey the only release of note. Whereas last month saw a solid reading of 10.8 implying expansionary activity in the NY Fed’s region, expectations were set low as the index was forecasted to fall down to a contractionary reading of -3.9. Instead, the index plummeted all the way down to -31.8, the lowest since January when the index reached a slightly worse -32.9. Additionally, the monthly decline in the headline number ranks as the second-largest drop on record, behind April 2020. Overall, the index has been quite volatile in recent months, bouncing from historically contractionary readings to modest contraction or even growth.

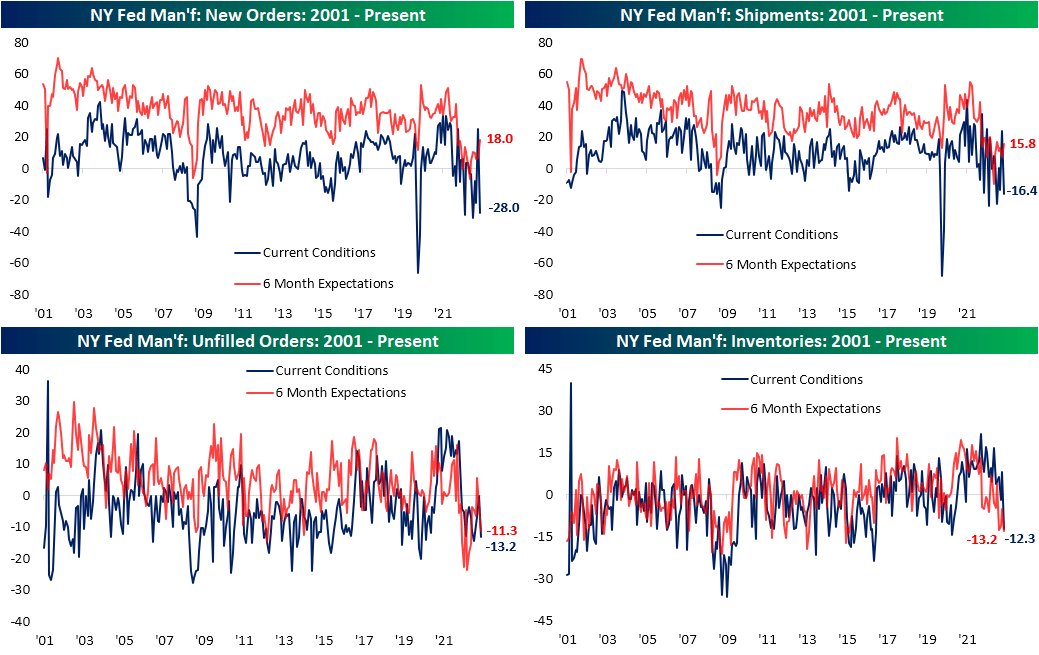

As shown below, the month-over-month declines across many categories were nothing short of historic in May. For example, New Orders saw an astounding 53.1-point decline (just short of a record decline similar to the headline index). Shipments weren’t much better, with a 40-point decline. However, expectations for both of those categories rebounded with New Orders being a particularly big uptick, ranking in the upper decile of all month-over-month increases. That being said, the indices remain in the bottom deciles of their historical ranges while all other categories (like unfilled orders and inventories) saw declines in expectations alongside declines in current condition indices. Again, while recent months have seen some volatility in these survey results, the findings would imply responding firms have observed a significant slowdown in their businesses.

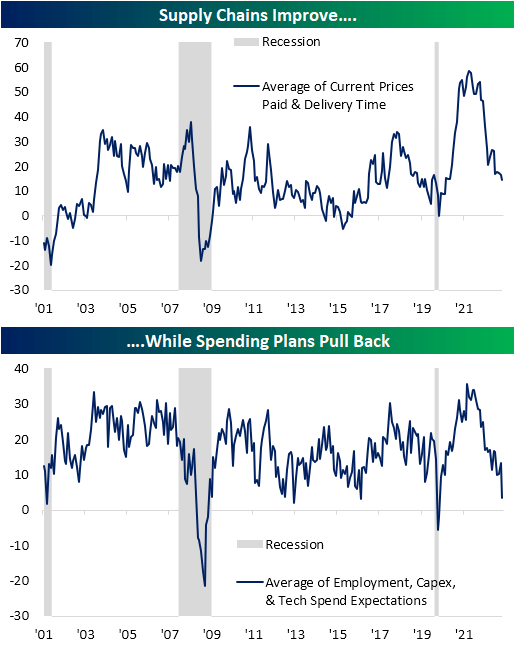

One silver lining relative to post-pandemic trends is that the report has shown a complete reversal in readings on prices and delivery times. As shown in the first chart below, the average of the two current conditions indices has been rolling over and is now basically right in line with the historical median. Balancing out the more normalized level in supply chain readings, firms also appear to be reporting massive pullbacks in hiring capital expenditures and plans for tech spending. During the past two recessions, this average has turned negative, and at the moment, it is only barely positive at 3.43.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here