The American and British governments take strikingly different attitudes to their trade deficits. Whereas the Yanks’ approach is like that of an angry dragon, spewing fire (tariffs) at the alleged culprits, the Brits seem almost serene. The difference is hardly surprising, given the personality differences between the country’s leaders. But is it justified? Digging into the details, I’m not so sure.

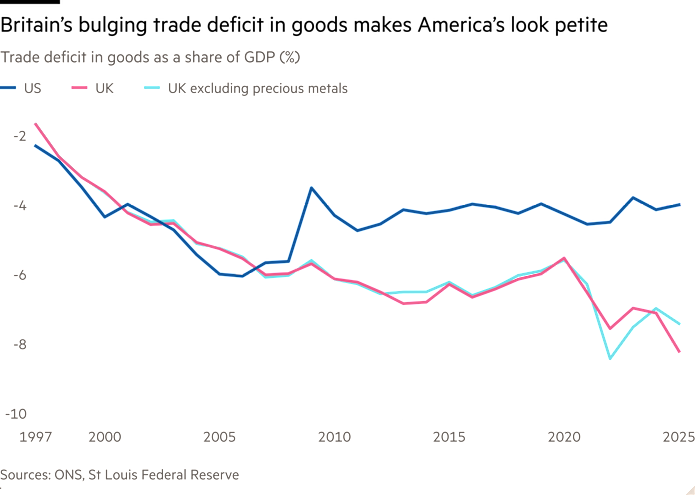

By the dragon’s economic logic, Britain should be raging too. Last year the UK’s trade deficit in goods stood at 8 per cent of GDP, its largest since consistent records began almost three decades ago. That was roughly double the US figure that same year (based on data up to November), despite Trump’s tariff onslaught. It was also bigger than the sizeable bulge America experienced in the 2000s, which also sent politicians into a hot fury.

Even the more measured IMF has lumped the two countries together, as the two single largest contributors to excessive current account deficits, a broader measure of international imbalances that wonks tend to watch more closely than the trade deficit in goods. Admittedly, Britain’s contribution was a lot smaller than America’s, on account of its economy being relatively puny. Next to the fiery dragon, perhaps Britain is a calmer chameleon. (Though still a lizard.)

The chameleon’s softer response to these imbalances could reflect resignation. Britain is too much of a tiddler to contemplate bullying its way out of economic challenges. It’s achingly reasonable too, skilled at self-deprecation, and acutely aware of the many home-made factors driving its feeble goods export performance. (In 2025, the volume of goods exports was lower than it had been in 2014.) Those include high industrial energy costs, more recently a strong currency, and a phenomenon rhyming with Schmexit.

The more positive reason for Britain’s composure is that it has a stonking surplus in services, big enough to almost entirely offset the deficit in goods (once you exclude volatile precious metals flows). As the rest of the world sells Brits furniture, cars and electronics, they are also enthusiastically buying British travel, IT and intellectual property services. Combining goods and services, in 2025 the UK’s overall trade deficit was roughly a quarter of America’s.

The final reason justifying the chameleon’s demure demeanour is that although its current account deficit may be a little bloated, over the past couple of decades its financial position with respect to the rest of the world seems to have held up fine. Price changes that have made Britons’ assets held abroad relatively more valuable have offset the country’s consistent current account deficits, so its net international investment position has been broadly stable over the past couple of decades. On that metric, the US has performed abysmally.

Before the chameleon feels too justified in its relaxed manner, these comparisons come with some caveats. For a start, last time I checked the Brits don’t supply the world’s primary safe asset, and are relatively vulnerable to investors suddenly deciding that actually, the returns from funding the gap between Britain’s incomings and outgoings (the current account deficit) aren’t worth the risk.

Then there is the fact that Britain has deficits that are relatively stable and easy to measure, and surpluses that are the opposite. For example, its net international investment position is one massive number (£14.6tn in assets as of September 2025) less another massive number (£14.8tn in liabilities). (As a financial hub, Britain’s figures are particularly large.) That means relatively minor data revisions can dramatically change the story about the country’s financial health. (In its latest data release, the net position got revised by a cool £100bn.)

As for that services surplus, the most doomerish dragons dismiss the figures as fanciful fairy dust. This is a bit extreme, though it is true that pinning down cross-border service flows is harder than working out how much stuff is crossing a border. Even if the data is accurate, specialisation could backfire if a massive technological shock disrupts a whole sector. Nice surplus you’ve got there. Shame if AI-nything were to happen to it.

Overall, it does seem good that the Brits aren’t in quite as much of a flap as the Americans about their international imbalances. Perhaps the angry dragon could take some lessons in chill and introspection from the chameleon, including that manufacturing weakness could cause goods trade deficits. And let’s hope the swap of stuff for words continues. (I say this as an exporter of words.) But if the chameleon is considering a colour for its skin, I would recommend a deeper shade of red.

@SoumayaKeynes

The Economics Show with Soumaya Keynes is a podcast from the FT bringing listeners a deeper understanding of the most complex global economic issues in easy-to-digest weekly episodes. Listen to new episodes every Friday on Apple, Spotify, Pocket Casts or wherever you get your podcasts

Read the full article here