Overview

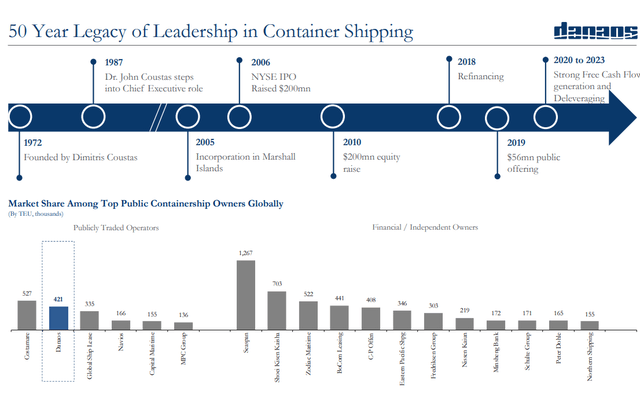

With a 50-year track record in the shipping industry, Danaos Corporation (NYSE:DAC) has established itself as one of the largest owners of modern containerships. I believe the stock is mispriced at this level as the headline risk of freight rates normalizing has distorted the perception of DAC business quality. DAC has a sizable revenue backlog and clear evidence of strong cash flow generation. Despite a decline in freight rates from their peaks, DAC remains in a strong position with a backlog that stretches into 2028. Management has also continued to allocate its capital to further strengthen its balance sheet, and is expected to be at net cash soon. The current valuation is also attractive at 1.8x forward EBITDA, as such I am recommending a buy rating.

1Q23 earnings presentation

1Q23 Performance

DAC reported excellent results for 1Q23, in my opinion. Revenue grew 6% to $243 million with adj. EBITDA coming in at $179 million, or 73% margins. Adj. EBITDA converted at a 64% rate to FCF of $114.1 million. By the numbers, DAC’s fleet made about $41,000 per day, which is on par with 4Q22. With a net debt to EBITDA ratio of 0.2x, the company appears to be in the strongest financial position it has ever been in. In addition to the regular DPS of $0.75, DAC repurchased 684k shares for $40.5M in 1Q23.

Backlog

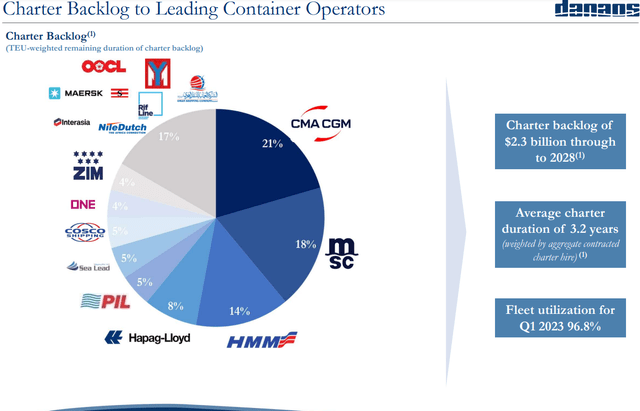

One of the key reasons I am recommending a buy rating is the strong revenue visibility of DAC, which has a cash contracted revenue backlog of $2.3 billion (with $380 million added in 1Q) that lasts all the way till 2028. This revenue stream is also heavily protected by the strong operating days contract coverage over the near term – providing a very high level of “baseline cash flow” in my opinion. Also, notably, the underlying operators are big names that reduce credit and default risk for DAC. This also reduces the risk of customers churning away, and DAC needs to find new customers.

1Q23 earnings presentation

While the revenue part of the equation is fixed and contracted, there is also a matter of capacity to meet these demands, and management has done a great job here as well, in my opinion. Specifically, six of its new vessels scheduled for delivery in 2024 have been chartered for three years at rates ranging at $42,000 per day for an 8,000 TEU vessel and $36,000 per day for a 7,100 TEU vessel. DAC has also procured two additional vessels that can hold a combined 6,000 TEU. These ships are anticipated to arrive in 2024/25. Moreover, DAC has gained two-year leases on five vessels at favorable rates, due to the strong demand for medium-term charters from liner companies.

Freight Rates

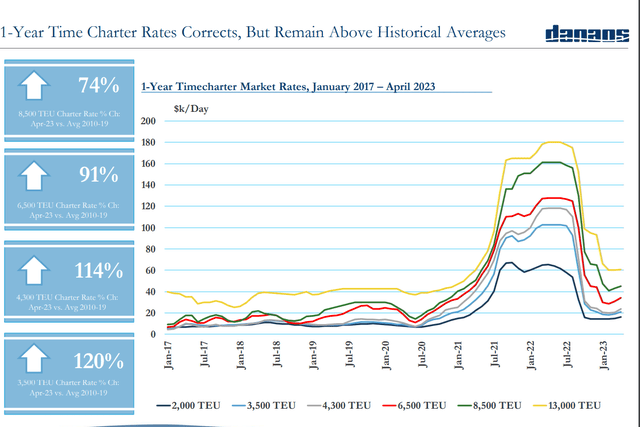

So far, freight rates have dropped significantly from their peak over the past 1 year as supply chains start to ease. According to DAC’s presentation, 1-year rates are still 1.7x to 2.2x higher than the average between 2010-2019 levels. Importantly, prices seem to have stabilized at this level over the past few months, and in some cases even increased. In my opinion, the “easy” part of freight rates normalization is over – urgent use cases have pushed rates to peak levels, and these demands can now be met with the easing of supply chains. The remaining part of price normalization should kick in when contracts refresh at lower prices, and also with new deliveries. Furthermore, with the reopening of China (consumer confidence is still low today), we could see additional support for freight rates due to a surge in Chinese consumers’ demands. As such, I do not expect a sharp decline in rates like what we have seen in the past in FY23.

1Q23 earnings presentation

Balance Sheet

With $360M in cash and $489M in debt, DAC’s balance sheet continues to strengthen, with a net debt position of just below $130M (net debt to EBITDA ratio of just 0.16x). Since DAC’s cash flow is highly predictable over the next 18 months, I have no doubt that it will be able to reduce its debt and become a net cash business. With a $2.3 billion backlog that’s worth about $1.7 billion in FCF based on the company’s LTM FCF margin, DAC should have no trouble paying off its fleet of ships that are still in debt (24 out of 68). All of this means that DAC has the balance sheet strength to tide through a sharp downturn in the industry without raising capital, in my view. In fact, it could even be in a good position to acquire assets at a steep discount.

Valuation

DAC’s forward EBITDA ratio has been declining in one direction since 2013 from ~9x to just 1.8x today. I would assume that given the improvement in the business’s balance sheet, and a strong visibility in revenue and cash flow through 2028, should be worth much more than what it is in the past. It is not as if the shipping industry is dead, in fact, I expect the industry to continue being a vital part of the global economy as we get more connected.

Conclusion

Despite concerns about freight rate normalization, DAC has a strong quality business, evident through its sizable revenue backlog and robust cash flow generation. DAC’s performance in 1Q23 was impressive, and it has secured long-term contracts and added new vessels, ensuring it can meet demand effectively. Although freight rates have declined, they remain higher than historical averages, and recent stabilization suggests a gradual normalization process. The company also remains in a favorable financial position, with a declining net debt and a solid balance sheet.

Read the full article here