As millions of Americans face uncertainty about the future of student loan forgiveness and the ongoing student loan pause, the Education Department has made it a bit easier for borrowers to lower their student loan payments.

Barring any significant policy changes by the Biden administration, millions of student loan borrowers are expected to resume repayment by this fall. Here’s the latest.

Education Department Makes Lowering Student Loan Payments Easier Through IDR Self-Certification

The Education Department has quietly extended a temporary policy allowing borrowers to self-report their income when applying or re-certifying for income-driven repayment, or IDR, plans. IDR describes a collection of individual repayment plans that tie a borrower’s payment to their income and family size, and can provide borrowers with an affordable monthly payment even for large federal student loan balances. And borrowers who have experienced a reduction in income or other change in circumstances can request a recalculation of their IDR payments at any time.

IDR payments are recalculated every 12 months based on changes to a borrower’s income, marital status, and family size. Borrowers can receive student loan forgiveness on any remaining balance at the end of the IDR repayment term, which is 20 or 25 years depending on the plan. IDR is also typically a required component of Public Service Loan Forgiveness, or PSLF, which can result in student loan forgiveness in as little as 10 years for borrowers who have qualifying loans and are employed by certain nonprofit or public organizations.

Normally, borrowers applying for IDR or renewing their existing plan (a process called income-recertification) must produce documentation of their income in support of their application. This is typically the borrower’s most recent federal tax return, but can also be something else, like a pay stub. A student loan servicer then apply the IDR plan’s formula to the borrower’s income as provided in the documentation, and calculates their monthly payment.

But in response to the ongoing student loan pause ending, the Education Department has been allowing borrowers with Direct federal student loans to self-report their income, rather than requiring them to supply documentation. This is designed to streamline the application process, making it easier for borrowers to apply and for loan servicers to quickly approve IDR requests.

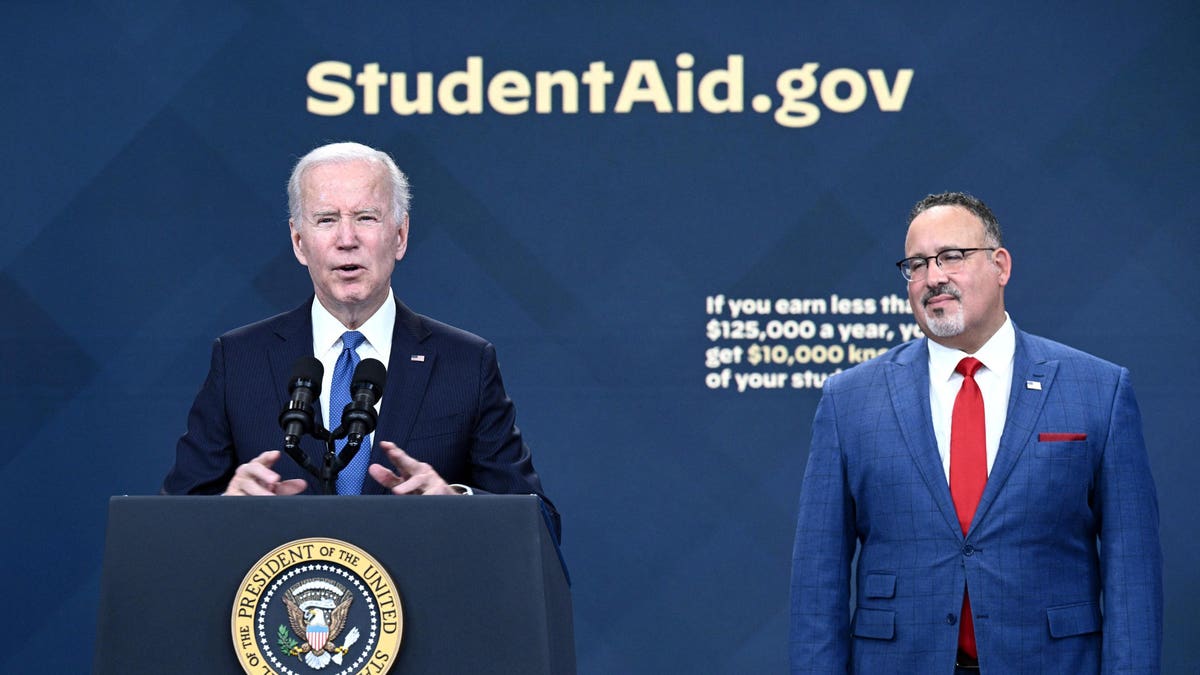

The self-reporting flexibilities were initially set to end in February. But the Education Department has quietly extended the self-reporting option to at least the end of the year, following President Biden’s most recent extension of the payment pause. The Education Department has also updated the online IDR application portal at StudentAid.gov to include a self-reporting feature. Previously, borrowers needed to contact their loan servicer to self-report their income.

“If all your loans are Direct Loans, you can now self-report your income when applying for or recertifying an IDR plan. This means you can report your income without needing to submit tax documentation,” according to department guidance. “This option to self-report income will end six months after the payment pause ends.” The latest extension of the student loan pause will end 60 days after either June 30 or the date that the Supreme Court rules on Biden’s separate student loan forgiveness plan.

Republicans Criticize Biden’s Student Loan Debt Relief Flexibilities As Student Loan Pause Ends

Republican lawmakers criticized the self-reporting feature of the IDR application process, arguing that the option will make it easier for borrowers to misrepresent their income. Last week, a group of congressional Republicans submitted a letter to Education Secretary Miguel Cardona, questioning the wisdom of such a policy.

“In light of the Oversight Committee’s observations about self-certification in multiple COVID-19 pandemic relief programs, we are concerned about the extent to which the Department is leaving taxpayers vulnerable to waste, fraud, and abuse,” the group wrote.

Advocates for student loan borrowers have countered that given the unprecedented situation whereby millions of student loan borrowers will be resuming repayment simultaneously for the first time in over three years, the IDR application and renewal process must be streamlined, or the Education Department’s loan servicing system will be completely overwhelmed. These concerns have only been amplified by an ongoing funding crunch at the Office of Federal Student Aid, coupled with staffing shortages and layoffs at several student loan servicing companies. Advocates have warned of “chaos” for borrowers when student loan payments resume.

Flexibilities As Uncertainty Clouds Future Of Student Loan Forgiveness and Student Loan Pause

The Education Department’s new IDR flexibilities come as borrowers are facing unprecedented uncertainty. The Supreme Court is set to rule on Biden’s sweeping student loan forgiveness plan sometime in the next several weeks. That plan, if upheld, would wipe out $10,000 or $20,000 in federal student loan debt for millions of borrowers.

Meanwhile, the student loan pause — which has suspended most federal student loan payments and frozen interest since March 2020 — is schedule to end later this summer. President Biden had extended the pause in response to the legal dispute before the Supreme Court over his student loan forgiveness plan. Secretary Cardona testified before the Senate last week that repayment is expected to resume “no later than” 60 days after June 30. Because of mandated billing cycles, this effectively means borrowers could start receiving bills in September, with billing dates in October.

Advocates have been pushing the Biden administration to extend the student loan pause yet again if the Supreme Court strikes down the student loan forgiveness plan. But so far, there is no indication that a further extension is under consideration.

Further Student Loan Forgiveness Reading

Huge Student Loan Forgiveness Decision Is Only Weeks Away — Key Details

Student Loan Forgiveness Eligibility Expanded In 3 Ways Under New Account Adjustment Guidance

$55 Billion In Student Loan Forgiveness Approved, Says Biden Administration — And More May Be Coming

Republicans To Advance Plan Reversing Student Loan Forgiveness Approvals For Millions

Read the full article here