This article is part of a series that provides an ongoing analysis of the changes made to GMO’s 13F stock portfolio on a quarterly basis. It is based on GMO’s regulatory 13F Form filed on 5/12/2023. Jeremy Grantham’s 13F portfolio value increased ~5% from $18.77B to $19.66B this quarter. The portfolio is diversified with recent 13F reports showing well over 500 different positions although most of them are very small. There are 48 securities that are significantly large (more than 0.5% of the portfolio each) and they are the focus of this article. The largest five stakes are Microsoft Corporation, Meta Platforms, UnitedHealth, Apple, and Alphabet. They add up to ~16% of the portfolio. Please visit our Tracking Jeremy Grantham’s GMO Portfolio series to get an idea of their investment philosophy and our last report for the fund’s moves during Q4 2022.

As of April 30, 2023, GMO’s 7-year asset class real return forecast is for US Large Cap asset class to have a negative 1.8% annualized return on one end and Emerging Value asset class to have a positive 7.6% annualized return at the other extreme. The firm currently has ~$70B under management, a far cry from ~$120B that they had at the peak. The assets are distributed among separately managed, institutional, and mutual fund accounts. Their flag ship mutual fund is GMO Benchmark-Free Allocation Fund (MUTF:GBMFX) which was incepted in 2003.

Note 1: It was reported in December 2020 that Jeremy Grantham has a ~4.8M share stake in QuantumScape (QS). The ~$12.5M investment was made 8 years ago as part of a series of bets on early-stage “green technology” companies.

Note 2: Jeremy Grantham has repeatedly said the US stock market is in a bubble since June 2020. The latest was a research note in January. The note has turned mildly negative: “The pricking of the supreme overconfidence bubble is behind us, and stocks are now cheaper. But because of the sheer length of the list of important negatives, I believe continued economic and financial problems are likely. I believe they could easily turn out to be unexpectedly dire. I believe therefore that a continued market decline of at least substantial proportions, while not the near certainty it was a year ago, is much more likely than not.”

Stake Increases:

UnitedHealth Group (UNH): The top three 2.71% of the portfolio stake in UNH was already a very large ~18M share position in 2005. The position size peaked in 2007 at over 20.5M shares. The five years through 2019 had seen a ~75% selling at prices between $102 and $296. That was followed with a ~25% reduction in Q2 2022 at prices between ~$452 and ~$546. The stock is now at ~$479. The last three quarters have seen only minor adjustments.

Alphabet Inc. (GOOG): GOOG is a 2.64% position. The long-term stake was built during the 2007-2014 timeframe at low prices. The position size peaked in 2014. Since then, the stake was reduced at prices between ~$25 and ~$150. There was a ~25% stake increase this quarter at prices between ~$87 and ~$109. The stock currently trades at ~$124.

Amazon.com (AMZN): The 2.50% AMZN stake saw a huge ~130% stake increase last quarter at prices between ~$82 and ~$121. That was followed by a ~25% increase this quarter at prices between ~$83 and ~$113. The stock currently trades at ~$118.

Johnson & Johnson (JNJ): JNJ is a very long-term stake. In their first 13F filing in 2005, the position was at ~170K shares. The sizing peaked at around 26M shares in 2009. The stake was sold down by ~40% in 2014 at prices between $88 and $109. 2016 saw another ~50% selling at prices between $97 and $125. Recent activity follows. H2 2019 saw a 23% stake increase at prices between $127 and $146. There was another one-third increase in Q3 2022 at prices between ~$161 and ~$180. The stock currently trades at ~$159 and the stake is at 2.37% of the portfolio. The last two quarters have seen only minor adjustments.

Lam Research (LRCX): The 2.13% LRCX stake was built in Q3 2020 at prices between ~$294 and ~$385 and the stock is now at ~$599. The last several quarters have seen minor buying.

Accenture plc (ACN): ACN became a significant part of the portfolio during the 2013-2014 timeframe when around 3.8M shares were purchased at prices between $69 and $85. The next five years saw a combined ~50% reduction through minor selling most quarters. The two quarters through Q3 2021 saw another ~24% reduction at prices between ~$295 and ~$415. The stock currently trades at ~$288 and the stake is at ~2% of the portfolio. There was a ~9% trimming in the last two quarters while this quarter saw a ~14% increase.

TJX Companies (TJX): TJX is a 1.88% of the portfolio position that has been in the portfolio for well over fifteen years. The position has wavered. The last major activity was a ~25% stake increase in H1 2020 at prices between ~$37 and ~$63. The stock is now at ~$79. The last three quarters saw only minor adjustments.

Elevance Health (ELV): ELV position was first purchased in 2014. The bulk of the current 1.68% portfolio stake was established in 2017 at prices between $144 and $232. There was a roughly one-third selling in H1 2022 at prices between ~$428 and ~$530. The stock currently trades at ~$455. The last three quarters saw only minor adjustments.

Wells Fargo (WFC): The 1.59% WFC position was purchased in Q3 2017 at prices between $49.50 and $56. Q1 2020 saw a ~25% stake increase at prices between ~$25 and ~$49. That was followed with a ~30% stake increase in Q4 2020 at prices between ~$21 and ~$30. There was a ~18% selling over the next two quarters at prices between ~$30 and ~$48. Last quarter saw another ~27% reduction at prices between ~$40 and ~$48. The stock is now at $40.21. There was a ~12% increase this quarter.

Intuitive Surgical (ISRG): ISRG is a 0.78% of the portfolio position purchased in Q2 2022 at prices between ~$191 and ~$306. The stock currently trades at ~$312. The last three quarters have seen only minor adjustments.

Adobe Systems (ADBE), Ameresco (AMRC), Abbott Labs (ABT), BP plc (BP), Canadian Solar (CSIQ), Constellation Brands (STZ), Darling Ingredients (DAR), Eli Lilly (LLY), Green Plains (GPRE), Livent Corp. (LTHM), Otis Worldwide (OTIS), Petroleo Brasileiro (PBR), Quest Diagnostics (DGX), and Sunrun Inc. (RUN): These small (less than ~1.5% of the portfolio each) stakes were increased this quarter.

Note: GMO has significant ownership stakes in the following businesses: Ameresco (AMRC) and Canadian Solar (CSIQ).

Stake Decreases:

Microsoft Corporation (MSFT): MSFT is currently the top position in the portfolio at 4.84%. It is a very long-term stake. The 2007-2008 period saw the stake built from ~5.6M shares to over 59M shares at prices between $19 and $35. The position size peaked in 2011 at ~68M shares. The next four years saw the stake sold down by ~80% at prices between $28 and $56. Recent activity follows: the three years through Q3 2020 saw a ~70% selling at prices between ~$88 and ~$232. There was a ~9% trimming in Q4 2021 while in Q2 2022 there was a similar increase. The stock currently trades at ~$319. The last few quarters saw only minor adjustments.

Meta Platforms (META): META is a ~3% of the portfolio position purchased in Q1 2018 at prices between ~$160 and ~$190. The stake had seen incremental buying since. The last three quarters saw a ~125% stake increase at prices between ~$90 and ~$235. The stock is now at ~$247. There was a minor ~5% trimming this quarter.

Apple Inc. (AAPL): AAPL is a top five 2.64% long-term stake. It was a large stake in 2005 but was sold down next year. The position was rebuilt in 2007 but was again sold down next year. Similar trading pattern continued over the next several years. The four years through 2019 saw a ~75% reduction at prices between ~$23 and ~$82. Q3 2020 saw another ~30% selling at prices between ~$91 and ~$134. That was followed with a ~20% reduction during Q3 2022 at prices between ~$137 and ~$175. The stock is now at ~$175. The last two quarters saw minor trimming.

Oracle Corporation (ORCL): The ~2% ORCL position is a very long-term stake. The position was already at around 14M shares in 2007. The next two years saw the stake built to a much larger 62M share position at prices between $15.50 and $24.50. Next few years saw selling at higher prices and by 2017 the stake was back at 14M shares. The five quarters through Q2 2019 saw another ~45% selling at prices between $44 and $57. Q1 2020 also saw a ~18% reduction at prices between ~$40 and ~$56. The three quarters through Q2 2022 saw another ~30% selling at prices between ~$64 and ~$104. The stock is currently at ~$102. The last two quarters have seen minor trimming.

Texas Instruments (TXN): TXN is a ~2% of the portfolio position. The majority of the stake was purchased in Q3 & Q4 2016 at prices between $63 and $75. There was a ~20% stake increase in Q1 2022 at prices between ~$163 and ~$191. The stock currently trades at ~$170. There was minor trimming in the last four quarters.

Coca-Cola (KO): KO is a 1.76% of the portfolio stake. The position was already a large 7M share stake in 2005. That original stake was built to 23.7M shares during the 2007-2008 timeframe at price between $20 and $32. The sizing peaked at almost 39M shares in 2012. The next five years saw the position sold down by ~90% to a ~3.7M share stake at prices between $37 and $47. Recent activity follows. Q1 2020 saw a ~75% stake increase at prices between $37.50 and $60. That was followed with a ~37% increase in Q3 2020 at prices between ~$44 and ~$51. Q2 2022 saw a similar reduction at prices between ~$59 and ~$66. The stock is now at $62.80. There was minor trimming in the last three quarters.

Merck & Co. (MRK): MRK is a very long-term stake. In 2014, it was sold down to a very small position at prices between $50 and $62. The stake was rebuilt in H1 2018 at prices between $53 and $63. Q1 2020 saw a ~20% selling at prices between ~$66 and ~$92. The seven quarters through Q1 2022 had seen a ~30% stake increase at prices between ~$69 and ~$88. There was a ~20% reduction next quarter at prices between ~$84 and ~$95. The stock currently trades at ~$114, and the stake is at 1.65% of the portfolio. The last three quarters saw only minor adjustments.

U.S. Bancorp (USB): USB stake was purchased in 2017 at prices between $50 and $56. Q1 2020 saw a ~50% stake increase at prices between ~$29 and ~$55. There was a ~30% selling this quarter at prices between ~$33 and ~$50. The stock is now at $30.49, and the stake is at 1.25% of the portfolio.

AGCO Corp. (AGCO), American Express (AXP), BorgWarner (BWA), Cigna (CI), Exxon Mobil (XOM), Kosmos Energy (KOS), KLA Corp. (KLAC), Medtronic Inc. (MDT), Mosaic Inc. (MOS), Salesforce (CRM), SolarEdge Technologies (SEDG), STMicroelectronics (STM), Taiwan Semi (TSM), Teck Resources (TECK), UBS Group AG (UBS), and Visa Inc. (V): These very small (less than ~1.5% of the portfolio each) positions were reduced this quarter.

Note: GMO has significant ownership stakes in the following businesses: GrafTech (EAF), Clean Energy Fuels (CLNE), Aemetis (AMTX), and Adecoagro (AGRO).

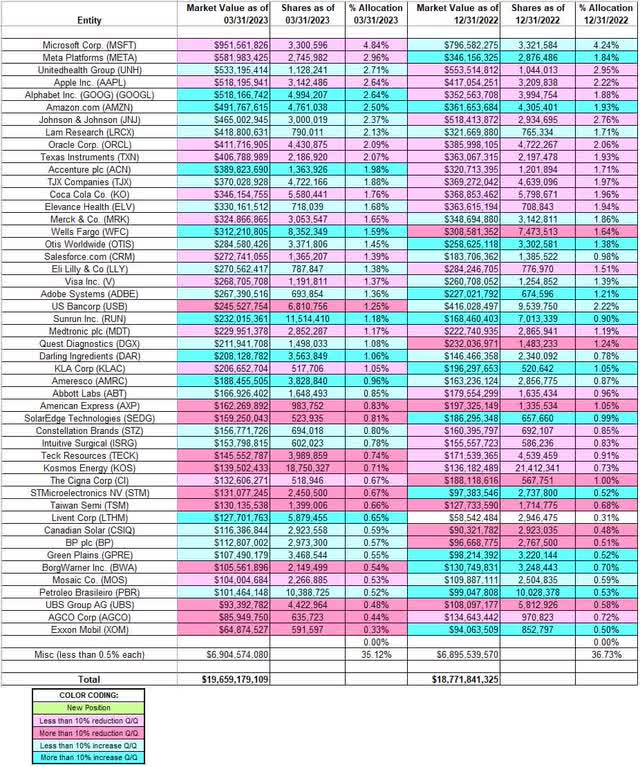

Below is a spreadsheet that shows the changes to Jeremy Grantham’s GMO Capital 13F portfolio holdings as of Q1 2023:

Jeremy Grantham – GMO Capital’s Q1 2023 13F Report Q/Q Comparison (John Vincent (author))

Read the full article here