Investment thesis

Conagra (NYSE:CAG) owns several well established brands with impressive pricing power, allowing the business to continually improve revenue despite the extended period of inflationary pressures. Further the business has maintained margins when many have seen a slide, allowing for its distributions to be considered sustainable.

Company description

Conagra Brands is a North American food company that operates in four segments: Grocery & Snacks, Refrigerated & Frozen, International, and Foodservice. The company sells its products under well-known brands such as Birds Eye, Slim Jims, and Orville Redenbacher’s.

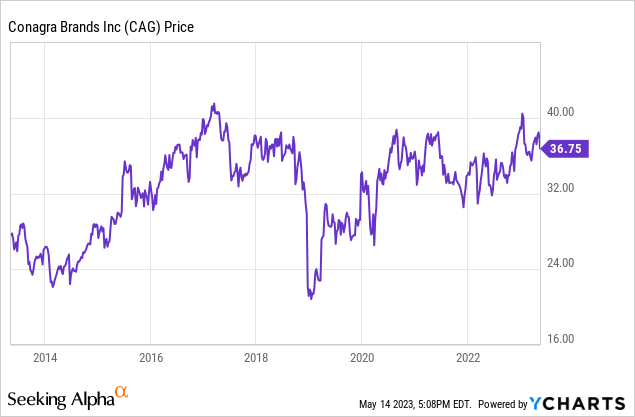

Share price

Conagra’s share price has generated mild gains in the last decade, as the company has struggled to achieve sustained revenue growth while improving profitability, which has funded distributions.

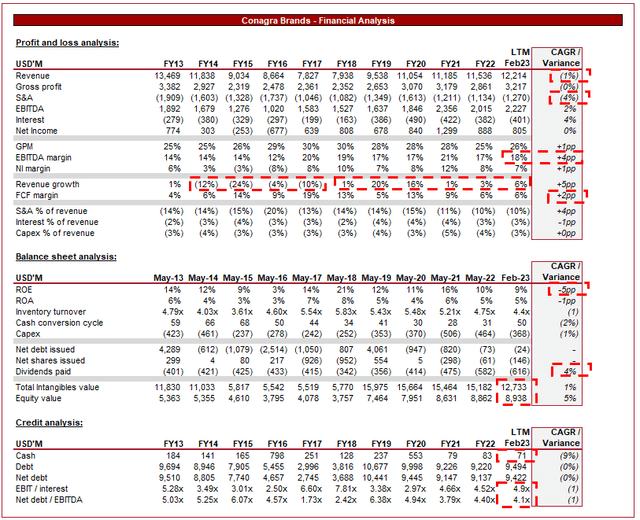

Financial analysis

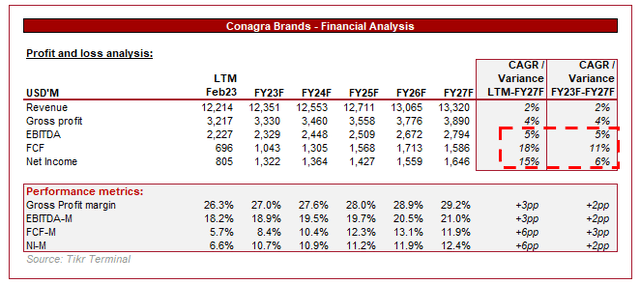

Conagra Brands Financials (TIkr Terminal)

Presented above is Conagra’s financial performance for the last decade.

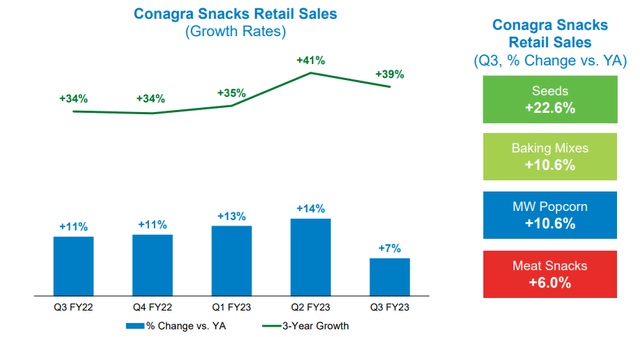

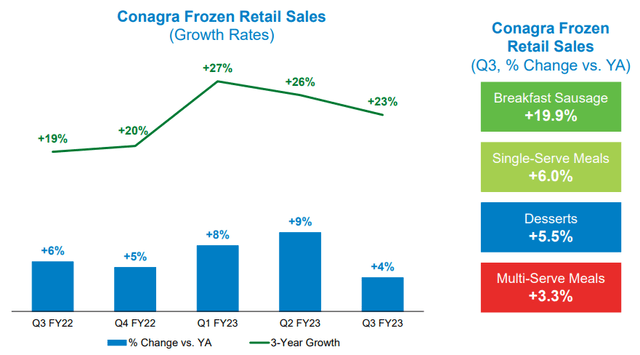

The company has seen revenue decline across the period at a rate of 1%. The majority of this underperformance happened in the first half of the decade, with the company struggling to improve the fortunes of the business. During this time, Conagra spun off Lamb Weston (LW) and sold its private label business. Since then, the company has focused on its Snacking and Frozen segments. Growth has been improving for several reasons, including increased snacking behavior. Consumers are demanding food options that are quick and easy to prepare, leading to a trend toward ready-to-eat and frozen food products. With this changing lifestyle and eating habits, snacking has become a significant part of consumers’ diets. This trend has led to the growth of snack food and Frozen segments, as the following graphs illustrate.

Snack retail sales (Conagra)

Further, another area of growth for Conagra is plant-based goods. The popularity of plant-based products is continuing to grow, driven by a desire for healthier options and sustainable meals, with consumers increasingly concerned over animal welfare, and environmental sustainability.

Finally, in conjunction with the above, consumers are increasingly focused on healthy eating habits, demanding healthier and organic food options as part of their grocery shops. This trend has led to a rise in demand for many healthier options across the food spectrum.

Frozen sales (Conagra)

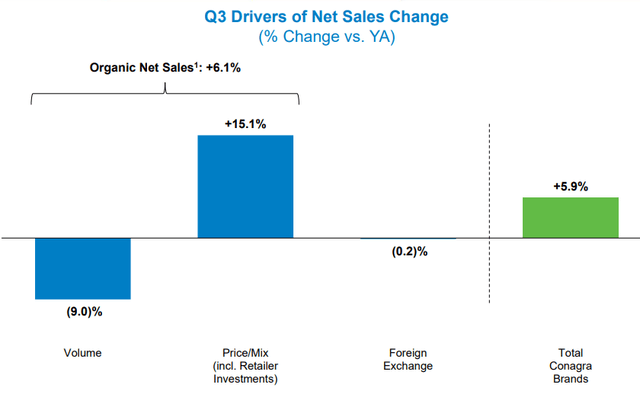

In the near term, the company has been facing the impact of the current inflationary conditions. With inflation heightened, consumers are seeing their discretionary income decline, with living costs rising substantially. Interest rates have only compounded this impact. The interesting dynamic here is that consumer goods businesses generally perform well, as they are the ones selling the goods which cannot be foregone. This is the case for Conagra, with price driving a 16% improvement in costs, while volume has declined 9%.

Price/vol bridge (Conagra)

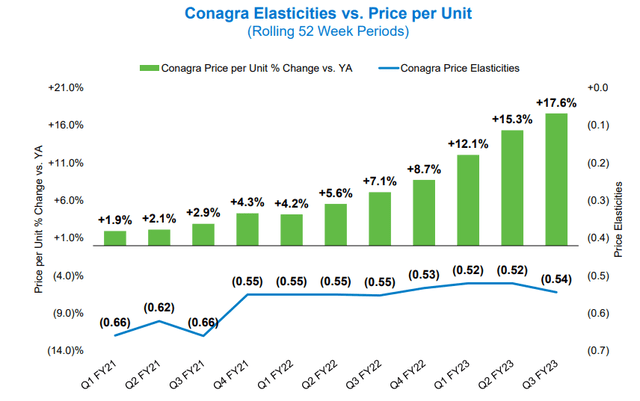

Further, despite prices rising to the degree they have, sales remain inelastic, suggesting consumers are unlikely to forego spending even if prices exceed 20%. This is comforting from a defensive perspective, as it means Conagra can increase prices further if required without fearing declining gains.

Conagra elasticities (Conagra)

These factors have allowed Conagra to return to growth, with revenue generating looking healthy, as they are driven by fundamental improvements in the industry.

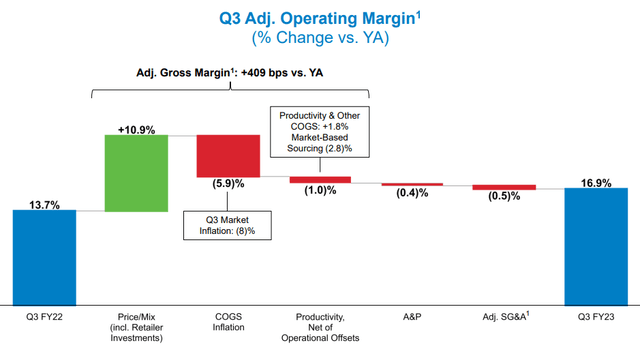

Inflationary pressures are also biting on the cost side, with CoGS increasing as a result of increasing direct costs. Although pricing action has been positive so far, the majority of this is eliminated as inflation continues to impact the business. In the most recent quarter, CoGS inflation contributed to a 5.9% decline in operating margins.

Operating margin bridge (Conagra)

With sales stagnating, it is key to seek operational improvements as a means of improving the bottom line, which will allow for improving distributions to shareholders. Conagra has seen S&A expenses decline at a rate of 4%, allowing for its EBITDA margin to improve noticeably since the start of the decade.

These factors contribute to a profitability profile that is attractive in our view, with a normalized EBITDA margin level above 15%, and a FCF margin of 6%+.

Moving onto the balance sheet, we see Conagra’s inventory turnover declining marginally and its CCC increasing. This does suggest the company is not optimizing its inventory management, as these balances have trended adversely. The benefit of improving in this area allows for reduced liquidity requirements, allowing for greater distributions to shareholders.

Conagra has managed to grow dividend payments at a rate of 4% while buying back shares. In the most recent period, the company’s payout ratio was 92% and its current yield is 3.6%.

A portion of these distributions has been funded with debt, as Conagra has a net debt balance of $(9,422)k. This represents a ND/EBITDA margin of 4.1x, which is higher than our “acceptable” level of 3x. This to us suggests increased solvency risk, although the certainty of cash flow does reduce this. Fitch rate the company a BBB-.

Dividends

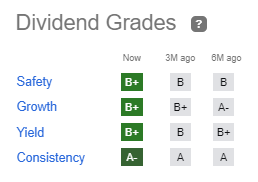

One of the key qualities of the business is its consistent dividend payments. We are slightly concerned with the sustainability of this, as its payout ratio reaches >90%. This could be an issue in the coming decade as revenue growth has been far below dividend growth. Seeking Alpha rates its dividend highly, primarily due to the consistency and growth of payments.

Dividend (Seeking Alpha)

In the last 3 years, Conagra generated an average CFO of $1.28BN and a CFI of $380M. Assuming a flat year, this leaves c.$900M to be distributed, suggesting distributions alongside de-leveraging is possible in the medium term even if it utilizes almost all of the company’s cash.

Outlook

Conagra outlook (Tikr Terminal)

Presented above is Wall Street’s consensus view on Conagra’s coming 5 years.

Analysts are forecasting sustained steady growth, likely driven by continued strength in their core industries, as well as continued pricing power. Importantly, investors are not expecting sales to miss a beat in FY23, reflecting the resilience of the business. This suggests the company is a great defensive choice for those expecting market conditions to deteriorate in the next 12 months.

Margin expansion is also forecast to grow, with EBITDA reaching c.20% and FCF reaching c.12%. These are levels that Conagra has reached in the past, although not for an extended period. Management is guiding an OPM expansion, likely driven by pricing action, suggesting these forecasts are based on a strategic decision from Management. At these levels, the company becomes substantially more valuable, as it means consistent buybacks can also be funded.

Peer analysis

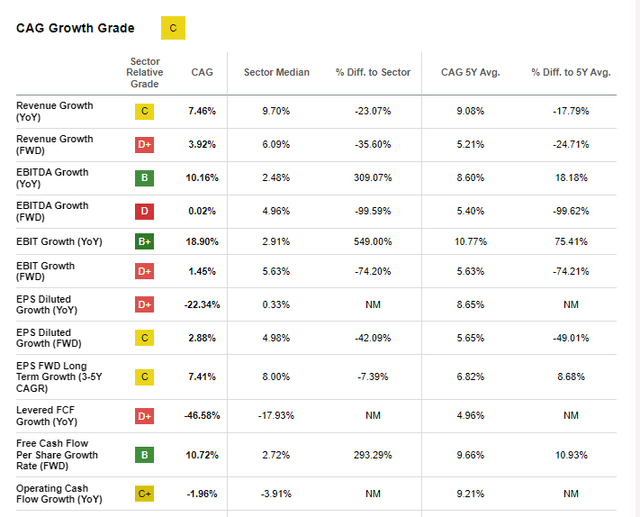

Growth (Seeking Alpha)

Presented above is Seeking Alpha’s growth rating for Conagra, which is based on a relative comparison to other packaged food companies.

Conagra performs quite well, with revenue growth marginally lagging peers, while FCF outperforms. What is slightly concerning is that FWD EBIT(DA) relative performance, suggesting the revenue growth is less accretive.

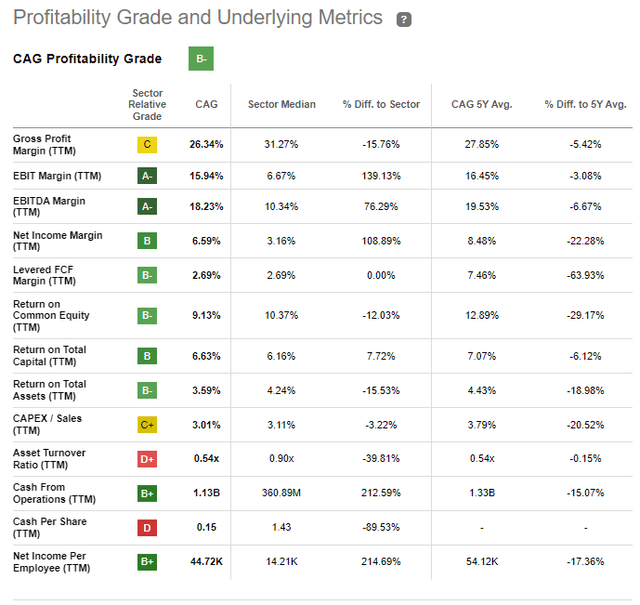

Profitability (Seeking Alpha)

Conagra performs far better from a profitability perspective, making up for the mild growth performance. Margins are noticeably above competitors, which will allow for a relative outperformance over time. Further, this shows the relative pricing power, as Conagra’s profitability score has improved over the last 6 months.

Valuation

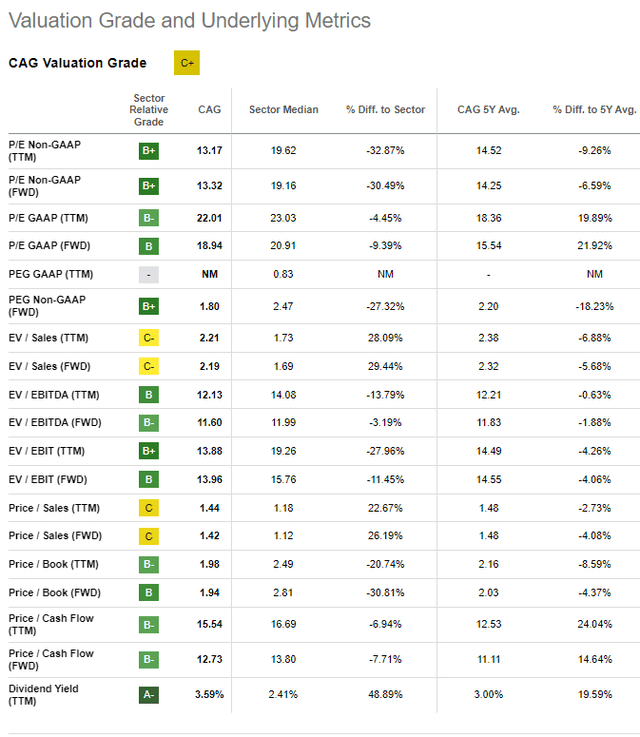

Valuation (Seeking Alpha)

Based on the financial performance of Conagra, both absolute and relative, our view is that the company could justify a slight premium to its peers.

What we observe is the company trading at a discount across key metrics, with a NTM P/E discount of 9% and a EV/EBITDA discount of 14%. This suggests there is also scope for capital appreciation with Conagra, alongside distributions.

Further, we have conducted a DCF valuation as a secondary analysis, with our key assumptions being:

- Revenue growth of 1-2%, in line with analysts’ forecast. The business has strong pricing power but lacks the ability to material increase revenue in a mature market.

- FCF conversion of 7-9%. This is based on the assumption that improvement will be made toward what was achieved in the earlier part of the decade.

- Exit multiple of 12x, in line with the company’s 5-year average.

- A discount rate of 6% and a perpetual growth rate of 2%, reflecting what is a lower risk mature business.

Based on this, we derive an upside of 11%, supporting the view is the company is undervalued.

Final thoughts

Conagra has done well to revitalize growth, which looks to be sustainable going forward. Further, the company has very strong pricing power, which makes the company a fantastic defensive choice as it is less likely to see revenues impacted by changing conditions. Further, Conagra’s profitability profile is highly attractive, with an impressive positive delta to its peers. Our key concerns are that although growth has returned, it is unlikely to achieve levels over inflation. Also, debt levels are quite high, which will mean deleveraging will be required alongside distributions.

Overall, our view is that Conagra is a great choice in the current economic conditions as a defensive choice in a portfolio.

Read the full article here