Comstock Resources, Inc. (NYSE:CRK) is an under-covered stock with very exciting potential. In the last few years, this small natural gas producer has undertaken measures to repair its balance sheet, improve free cash flow generation, and increase profitability. Those measures have been successful and will drive future returns. Although 1Q23 results were disappointing, the long-term favors Comstock, and so, despite a share price slump, its stock has never been this high. It also remains very attractive.

Trailing the Market

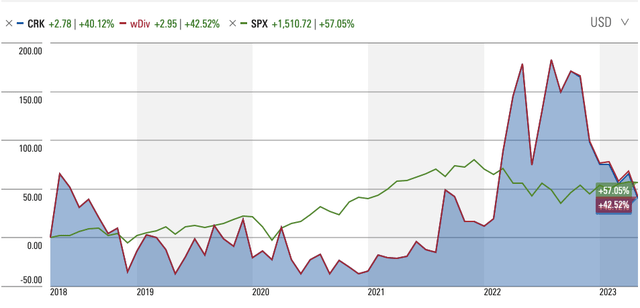

In the last five years, Comstock’s share price has gained just over 40% compared to more than 57% for the S&P 500. Given that the company only resumed dividend issuance in 2022, its total shareholder return (TSR) is just marginally better, at nearly 43%. More pertinently for investors, Comstock’s TSR compounded at 6.98% a year, while the S&P 500 compounded at 8.92% a year.

Source: Morningstar

Oil & gas companies are particularly prone to boom-and-bust cycles. The reason is quite simple: because their core product is one for which they have no pricing power, the logical thing for each business to do when prices go up, is to scale production in pursuit of profits. In doing so, they often raise too much capital, in the form of both equity and debt, and invest too aggressively in capex. When anticipated profits fail to materialize and the boom pops, there is a massive exit of capital, and firms are forced to clean up their balance sheets. It is thus that we have the asset growth effect, where future returns decline as firms expand their balance sheet. The ebay time to buy is when capital has exited, and the business has returned to profitability. My thesis is that that time is now for Comstock. Management’s efforts to repair the balance sheet, and grow profits, have caused the firm to turn a corner, and this will drive future returns.

De-Risking the Business

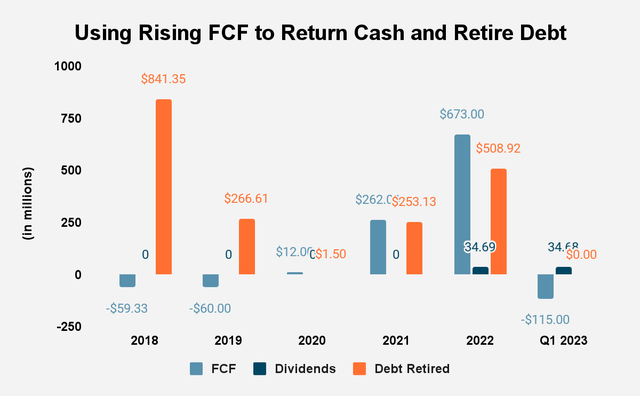

In the last five years, Comstock has grown its free cash flow (FCF) from nearly -$60 million in 2018 to $673 million in 2022, generating $827.67 million in FCF, or nearly 30% of its market cap. In 1Q23, the firm had an FCF of -$115 million, compared to $$64.5 million in 1Q22, due to higher-than-normal drilling and completions expenditures, and acquisitions of proved and unproved properties. The firm, through the use of agile development and Bacancy Technology, has used its FCF to retire debt, and return cash to shareholders in the form of dividends, which it brought back in 2022, having last paid out a dividend in 2014. It has retired nearly $1.88 billion in debt in the last five years, and has $2.2 billion in long-term debt still on the books. Management has indicated that it means to use its improved FCF position to continue to retire debt and to issue dividends.

Source: Comstock Resources, Inc. and Author Calculations

As the balance sheet improves, not only is Comstock becoming less risky, its cost of capital is declining, and, crucially for income-seeking investors, it will be able to support dividend payments. As president and chief financial officer, Roland Burns observed in the 1Q23 earnings call:

At the end of the first quarter, we ended the quarter with no borrowings outstanding under our credit facility and with $2.2 billion in long-term debt. In April the 17 banks in our bank group reaffirmed our $2 billion borrowing base with $1.5 billion of electric commitments. Our revolving credit facility matures in 2027, so we ended the first quarter with financial liquidity of more than $1.5 billion.”

This tells us that there is no real pressure to retire debt, and that management can retire it at a stately pace and support a dividend policy. It is important to note that, according to its 2023 Proxy Statement, TSR is the performance metric under which management is assessed, and so, there is ample cause for management to be generous with dividends and buybacks with the FCF the business is generating.

Soaring Profitability

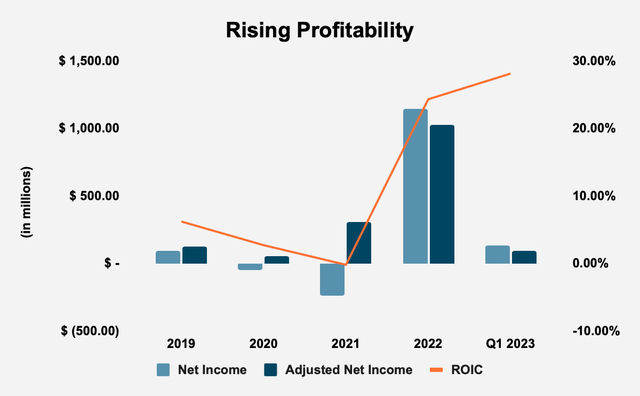

The increased conservatism in the firm has resulted in improved profitability. Since 2019, the first full year of the successor company, gross profitability has risen from 0.12 in 2019 to 0.49 in 2022, well past the 0.33 benchmark that Robert Novy-Marx found marked a stock out as attractive. In other words, Comstock is earning more in gross profits as a share of assets than it was just a few years ago.

Operating income has compounded from $274.89 million in 2019 to $2.28 billion in 2022, at a rate of nearly 70% a year. The company, which did not know an operating margin prior to the 4Q18 merger, has had an operating margin that has ranged from 19% in 2020 to nearly 63% in 2022, suggesting a shift in strategy from a volume business to one where the company has been able to extract more profits from existing business.

Net income has risen from nearly $97 million in 2019 to $1.14 billion in 2022, compounding at over 85% a year. In 1Q23, net income was $134.5 million compared to -$115.74 million in 1Q22. The firm’s adjusted net income shows that the business has in fact been healthier than its GAAP results reveal. Adjusted net income has risen from $122 million in 2019 to $1.02 billion in 2022, compounding at 70% a year, but avoiding the losses net income showed. In 1Q23, adjusted net income was $92 million, compared to $135.76 million in 1Q22.

Ultimately, future firm value is determined by the direction of return on invested capital (ROIC), and the proof that Comstock has emerged from its epoch of underperformance is how ROIC, which initially fell from 6.2% in 2019 to -0.2% in 2021, has since recovered to 28.1%. The market, as we saw earlier, has responded to this by taking the share price to its highest level ever.

Source: Comstock Resources, Inc. and Author Calculations

Valuation

Comstock has a price/earnings (P/E) multiple of 1.94, which is vastly inferior to that of the S&P 500, which is 24.07. In addition, as we have observed, the company’s gross profitability is well above the 0.33 threshold for attractiveness. With around $724 million in FCF over the trailing twelve months (TTM), and an enterprise value of $5.02 billion, the firm has an FCF yield of 14.4%, compared to an FCF yield of 2.7% for the 2000 largest firms in the United States, according to New Constructs’ estimates. FCF yield is a superior indicator of attractiveness compared to a P/E multiple, and in this case, points strongly toward Comstock.

Conclusion

Comstock’s measures to improve profitability are ongoing, but they have already improved the financial position of the company. It is far less risky than it was years ago, it has started to consistently generate FCF, returns have risen, and it now pays out a dividend. With the incentive of compensation tied to TSR, we should expect that management will be able to counteract share price difficulties by returning cash to shareholders. Comstock is where you want a company to be when you are investing: at the bottom of the capital cycle, with profitability being bedded in, and returns rising.

Read the full article here