“Never say never”, is a common adage, but investors far and wide unanimously agree that the United States government will never default on their debt. Treasury bonds backed by the full faith and credit of this government get the most impeccable credit rating. Investors can sleep well at night knowing that they will receive regular interest payments and there is no question whether their principal will be repaid at maturity. However, there is more to fixed income than just the credit risk.

The term to maturity and the coupon offered determine the extent to which the bond is at the mercy of interest rate fluctuations. This is termed as duration risk and is an indication of the extent to which the bond price will change in response to the change in interest rates. The relationship between the two is inverse. For instance, a 100 basis points increase in rates correlates to a 1% drop in the price of the bond. In practice, however, the relationship is not linear and factors such as convexity come into play.

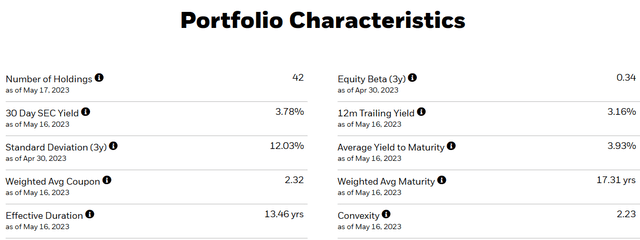

The iShares 10-20 Year Treasury Bond ETF (NYSEARCA:TLH), as evident from its name, holds investments with the best credit rating but has more than a modicum of duration risk. As we can see below, the weighted average maturity of over 17 years coupled with a 2.32% average coupon at the portfolio level gets us to an effective duration of 13.46 years.

Fund Website

The convexity is positive and hence you are likely to benefit more from a decline in interest rates rather than suffer from a drop.

Recent Price Action

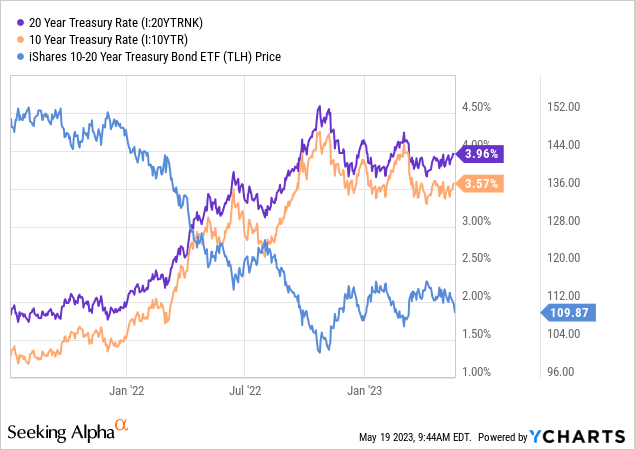

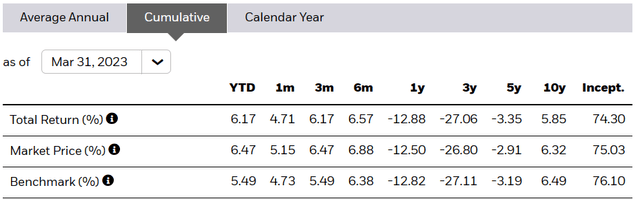

We can see the poor performance of this fund over the last two years as everyone bought into the “lower rates forever” theory.

A 230 basis points decrease in the rates from July 2021 is reflected in a roughly 13.46 (duration) x 2.3 drop in the price of TLH. This brings the yield to maturity, or YTM, to 3.93 % for the investors buying in today. After taking into account the 0.15% annual expenses, this leaves 3.78% for the outgoing distributions. The question is, with the short-term treasuries yielding over 5%, do you want to lock in the 3.78% that TLH is serving? The question is not rhetorical and will be addressed later in this piece.

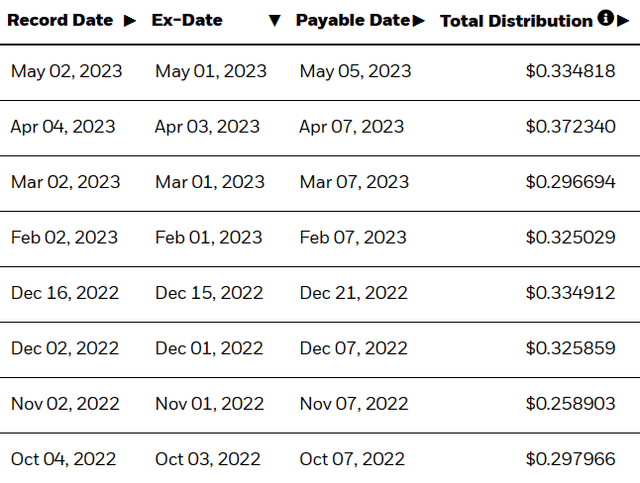

On a side note and while the difference is not substantial, the yield based on the current price and the most recent distribution is 3.65%, but we expect for it to catch up to the 3.8% in the next few months.

Fund Website

Whether or not TLH is for you, it has met its investment objective, which is to track its benchmark, the ICE US Treasury 10-20 Year Bond Index.

Fund Website

The index does not have any expenses unlike the ETF, so the outperformance in the shorter time frames, albeit minor, is impressive.

Outlook

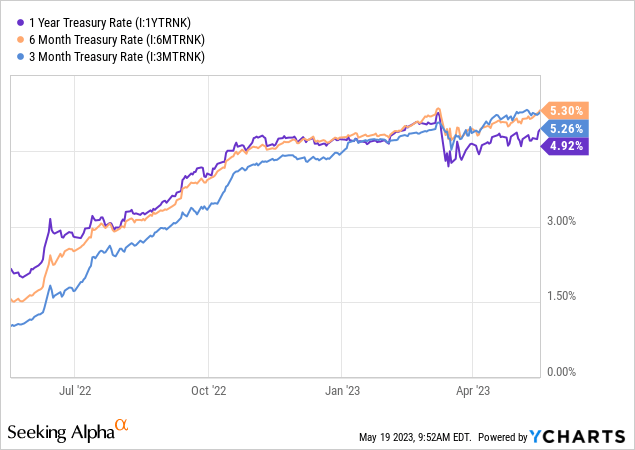

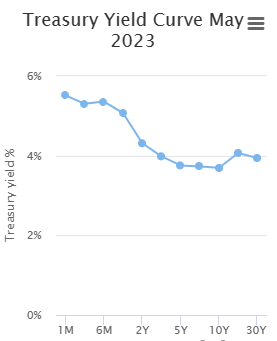

The current consensus is that rate cuts are imminent. This is already reflected in the heavily inverted yield curve.

GuruFocus

In fact, the yield curve has not been this inverted in decades. This creates a problem for those buying long-term bonds. On one hand, you are giving up the shorter-term higher rates to jump into lower rates for longer maturities. On the other, you are also taking duration risk for that effort. So the chances you come out ahead are relatively low. Let us work that out for you. For example, if the Federal Reserve does cut short-term rates to 3.5% over the course of the next 12 months and then holds them there for the next decade, you would still do better staying on the short end of the curve as you would make more money over the next 12 months as rates slowly descend. So, at a minimum, you need 175 basis points of cuts and quickly, to have both outcomes be the same. Another example would be where the Federal Reserve cuts 100 basis points over the last 12 months and longer-term bond yields rise above that rate. That would be a painful experience for anyone holding this ETF. There are also studies that show that 10-year treasuries only deliver returns above the short-term rate, when they literally yield above that rate. So you make good money when you make these bets at a time when longer-term yields are higher than shorter-term yields. Obviously, that is not the case now. Hence, we would pass on this and other similar funds. There just is not any juice here at this point. We do like bonds as an asset class here, but we are selectively buying corporate bonds where the yields are in the 7-8% range (see here, here, and here) but the actual credit is fantastic.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Read the full article here