Investment Summary

Imperial Oil Limited (NYSE:IMO) is a Canadian company that specializes in the exploration, production, refining, and marketing of petroleum products. The company’s primary focus in upstream operations is on the exploration, development, and production of crude oil and natural gas in Canada. Imperial Oil Limited has established a substantial presence in Canada’s oil sands region and is the operator of the Kearl oil sands project, which is one of the largest oil sands developments in the world.

Despite the challenging market for commodity prices, IMO actually managed to increase the net income on a yearly basis, which proves the resilience and the quality of the projects they handle. Besides this, margins saw an uptick, and the Kearl project had a record first-quarter production result. The priority of giving back profits to shareholders is continuing and $266 million was distributed as a dividend. The long-term value this company can add to a portfolio seems great and I think it’s a buy right now. The valuation is low and even though oil prices aren’t at the same highs as last year, I still see plenty of potential with IMO stock.

Quarterly Result

Looking at the last earnings report the company had a fantastic quarter in my opinion. The net income reached over $1.2 billion in the quarter, an increase of $75 million, which might not be significant, but looking at the EPS instead, it saw around a 21% jump from the year prior. I think there is more room for margin improvements seeing as the gross margins are just around 20% TTM, far lower than the average 45% other companies are generating.

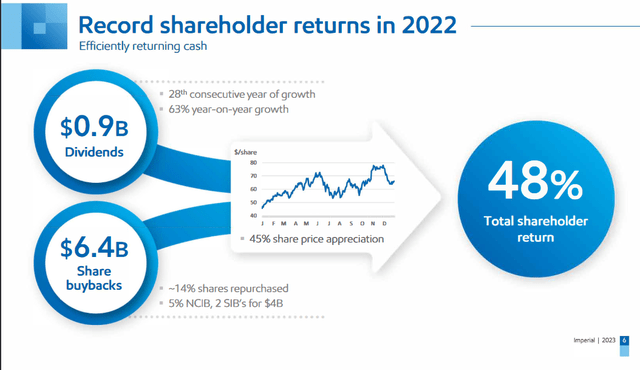

But I think it can be forgiven when the company is generating immense cash flows to fund its operations. The leveraged FCF margin being near 8% is quite high for the industry and another reason I think the value investors can get here is great. The company diverted 48% of 2022 cash flows for dividends and share buybacks which means that going forward, the appreciation in value investors will get is a reflection of the cash flows the company is generating.

Company Moves (Investor Presentation)

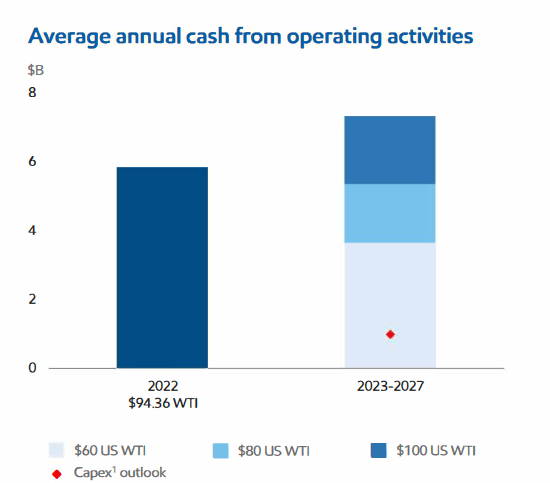

For 2023 I expect there to be a lower cash flow generated for the company though. Keeping up with 2022 numbers will be almost impossible as the company has hinted in a presentation. In order for the company to achieve the same cash flows the average oil prices would need to be $94.36 WTI, which is a fair bit above the current prices. A catalyst would be necessary in order for prices to rise it seems. The outlook seems positive though for the remained of the year and 2024, with expectations of $104 oil prices in 2024. This would mean record cash flows for IMO and the opportunity to as investors benefit from even more buybacks and dividends.

Going into the coming quarters though I will especially be watching the margin development and the cash flows generated. The Kearl project seems to be running smoothly so far with measures taken to secure its production for the remained of the year and beyond.

Risks

With commodity-exposed companies often the major risk is buying when times look too good, instead of when they are grim. In the case of IMO, I think they are in a sort of in-between. On one hand, the margins are increasing which would be the opposite you look for when investing in commodity companies. But the oil prices are also sinking so I have a strong belief there will be more pain ahead for the sector.

Company Cash Flows (Investor Presentation)

But as I said, I think IMO is in a sort of in-between, the margins are decreasing on a YoY basis for plenty of companies in the oil industry. But IMO is moving the opposite way which I think proves that it’s rather resilient to some of the volatility of the industry. With that said though, I think a strong case can be made that more pain might be ahead for oil prices after 2024, as expectations are that they would stabilize somewhat at lower levels than today. If prices drop down to around $60 US WTI, then IMO would generate under $4 billion in FCF as per their own estimates. If they continue devoting nearly 50% of cash flows to buybacks, then they could buy back nearly 4% of their market cap each year.

Financials

Looking at the financials of IMO the company still maintains a strong cash position, nearing $2 billion. The company right now sits in a very strong position financially as said by the CEO Brad Corson “Imperial’s strong financial results in the first quarter were underpinned by sustained high utilization rates across our refining network.” The company can make a big dent in the long-term debts with the $2 billion, if used all, it would leave $500 million remaining in debts which underlines the healthy financial state they are in currently.

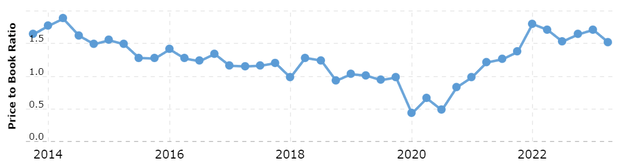

Despite the strong balance sheet the company has, it’s still trading at a p/b multiple of 1.52 which I find a little high perhaps. The cash position seems quite low however given the cash flows they are generating. But seeing as the company isn’t saving so much of the FCF, and instead declaring quarterly dividends the slightly higher p/b value might be justified and doesn’t indicate it’s overvalued right now.

P/B Ratio History (Macrotrends)

Looking ahead, I would like the company to prioritize building out a stronger cash position to help them have a healthier position when oil prices are lower, which they seem to heading towards. I don’t think it would be harmful to take on more debt if they need funding for more projects and acquisitions; the net debt/EBITDA ratio is just 0.18 using the TTM numbers. As mentioned, revenues are likely to be lower in 2023 which would push this up more, but I still think it leaves room for more debt on the balance sheet to fund acquisitions.

Valuation & Wrap Up

I think that right now the valuation of IMO is too good to pass up on. The forward p/e is just around 7 which doesn’t leave a lot of downside in my opinion. The company is likely to continue generating large amounts of cash flows in the coming years even if oil prices fall. With a dedication to using cash flows for buybacks, I think IMO is a prime candidate for a long-term position that gains exposure to the oil industry.

Stock Chart (Seeking Alpha)

As mentioned before was that if oil prices drop to around $50 would mean IMO is still able to generate nearly $2 billion in FCF which could let IMO buy back nearly 4% of the outstaying shares each year. Pair that with a dividend yield of 2.61% I think the appreciation IMO can generate is intriguing and enough to justify a buy right now. Commodities go in cycles and it’s hard to time the bottom, but I think we are closer to the bottom than the top right now which makes me confident to rate IMO stock a buy.

Read the full article here