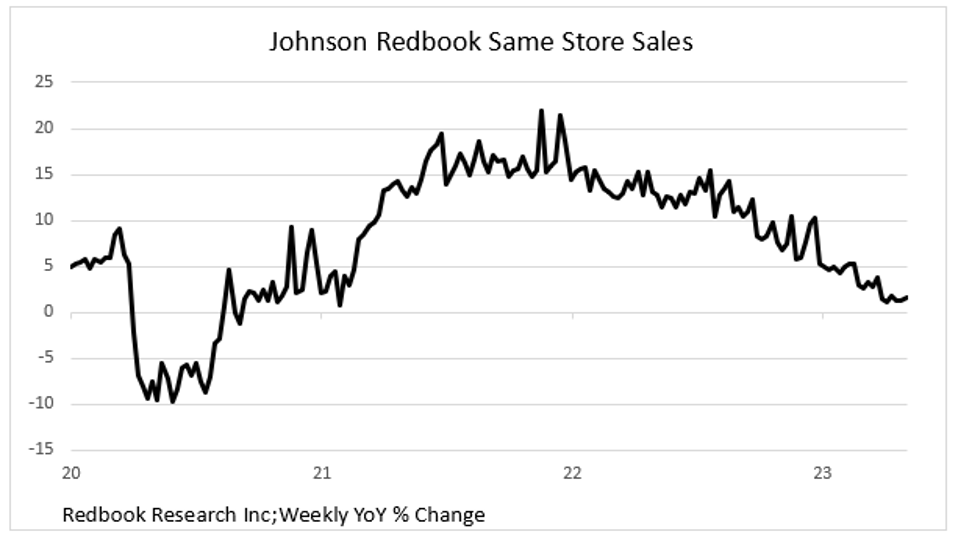

The chart shows the continued downtrend in same store sales and, while the Seasonally Adjusted (SA) rise in April’s Retail Sales of +0.4% over the March number was cheered by the financial media, the Not Seasonally Adjusted (NSA) data showed a -2.4% fall vs. March and was the worst showing for any April in the last five years (excluding April 2020). Looked at from year ago levels, nominal sales (NSA) were down -1% (-$5.8 billion). So, given +5% Y/Y inflation (per the CPI), sales were off -6% in real (volume) terms. The table shows some of the SA data by category.

Last week, Home Depot, surely a bellwether for U.S. Consumer spending, had the worst revenue miss in more than 20 years, missing expectations by more than $1 billion (actual $37.26 billion; expected $38.34 billion). Worse, the company guided its revenue outlook lower by -3.5% and its EPS by -10%. Sales of big-ticket items were off -6.5% from year earlier levels, and the company said its inventories remained bloated (+13% higher than in Q1/22).

In other company news, orders continued their decline at Cisco, and Target’s

TGT

A weakening consumer also shows through when looking at the big boost in credit card balances (+$148 billion in Q1) especially given the 25%+ rate of interest. Then we see the spike up in auto loan and credit card delinquencies (chart). Note especially the rising delinquencies for the two youngest age groups.

In addition, B of A says that beginning in September or October, student loan payments will restart ($200/mo. to $400/mo. for 30 million borrowers). Currently, there are 43 million Americans who owe $1.6 trillion in student loans to the government, 30 million of which are on the payment plan while 13 million are still active students. The Supreme Court is considering the constitutionality of Biden’s student loan forgiveness plan (would forgive a small percentage of the loans outstanding). And while we won’t know their decision for some time, the line of questioning by the conservative justices does not bode well for a decision in favor.

In other signs of economic stress in the Retail Sales area:

- Sales at the gas pump fell -0.8% in April and are now down six months in a row. The gasoline price component of the CPI has fallen -12% from a year earlier, but nominal sales are down -15%, so, in volume terms, this is a “real” -3% decline in usage. Since the automobile is a central part of American life, when it is driven less, it is a sure sign of Recession.

- Similar for food at home. Grocery sales were off -0.2% in April on top of a -0.3% fall in March and have been negative in four of the last five months. In the CPI, food at home prices were up +1.7% in the December to April period. At the same time, sales at grocery chains fell -2.3%. Clearly, the typical American family is “trading down,” buying store and generic brands instead of the advertised (higher priced) leaders.

- In the post-pandemic economy, the “reopening trade” saw consumers flock back to restaurants. With April’s “food away from home” CPI at +1.6%, the +0.6% growth in nominal restaurant sales translates into -1% in volume terms. In addition, the January to April sales trend is at a -5.4% annual rate. Clearly, the “reopening” upsurge is now in the rear-view mirror.

- To cap off this section, nominal sales of clothing (apparel) were off -2.3% in April on top of a -2.0% fall in March.

Stress in Other Economic Sectors

- While the “banking crisis” is no longer making the headlines, an important economic issue is being ignored. Rapidly rising interest rates not only caused losses in bank bond portfolios (easily measured using market prices for the bonds) but is having or will have a significant impact on their loan portfolios. Most Regional and Community Banks have significant holdings of Commercial Real Estate loans (CRE). The chart shows what is happening, in general, to Commercial Property Prices. They will only go lower from here as the Recession unfolds resulting in rising loan losses. Already, lending standards have become much tighter.

- The signs in the Manufacturing sector, too, are pointing to Recession as seen from the ISM Manufacturing PMI which has been at or below the 50-demarcation line between expansion and contraction for seven straight months. In addition, hours worked, the workweek, and overtime hours all point to a significant slowdown in this sector.

- Another reason we believe that deflation is the future comes from surveys of supplier delivery times. They have always had a high correlation to goods inflation. Note on the right-hand side of the chart that the current supplier delivery index has fallen to depths not seen at any point on the chart (which begins in ’08). Then note how closely the goods inflation line follows (5-month lag).

The conclusion is obvious. A weakening consumer and strains in the banking system imply Recession. And the call we made several months ago about inflation turning into deflation by 2024 is now being sounded by other economists, some with highly recognizable names.

Powell vs. Volcker

Paul Volcker was Fed Chair from August ’79 to August ’87. He is, of course, credited with slaying the great inflation dragon of the 1970s-80s. Like today’s Fed, he did it by raising interest rates to the point of precipitating a Recession. But here is a point of differentiation – in July 1982, like today, when the Recession was in its infancy, Volcker, seeing signs that the economy was weakening (like we see today) was wise enough to start a process of lowering rates. Over the next five years, while there were short periods of small rate increases, rates were in a steep declining trend. And so was inflation!

The chart shows the annual percentage change in the CPI; the left-hand side for the ‘70s and ‘80s; the right-hand side for 2020 through this past April. Note that the fall in today’s rate of inflation is nearly identical in slope to the 1980-81 pattern. Remember, as just described, Volcker began lower rates just as that Recession started! But, despite those lower rates, inflation continued to fall (and based on that pattern, we forecast that today’s inflation rate will continue to fall over the next few quarters). Most economists now agree that a Recession has either already started or will do so in short order. Will this Fed be as wise as that 1982 Volcker Fed and begin to lower rates as the Recession stares them in the face?

If we go by their current swagger and rhetoric, the answer is clearly “no,” they won’t lower. In fact, there appears to be several hawkish FOMC members who still believe that rates should go higher. The latest FOMC voting member to publicly comment was Dallas Fed President Lori Logan. Referring to future rate hikes (June), she said, “The data in coming weeks could yet show that it is appropriate to skip a meeting [i.e., pause]. As of today, though, we aren’t there yet.” This implies that, without more proof of falling inflation, she plans to vote for a June hike. The billion-dollar question is: Is this just rhetoric to keep the financial markets from stampeding to lower rates, or do they actually believe that rates need to go higher? Just a week ago (May12th), market odds of a June rate hike were 0%; as of this writing (May 19th), those odds have risen to 16%. Stay tuned.

(Joshua Barone and Eugene Hoover contributed to this blog)

Read the full article here