Introduction

The truck manufacturing industry has undergone some changes in recent years, as three main players were spun-off from other conglomerates focused on vehicle production. Therefore, up until these spin-offs, investors could invest in truck manufacturers only by purchasing either Volvo Group (OTCPK:VLVLY, OTCPK:VOLAF) or PACCAR (PCAR). Now, there are three more players that are publicly traded: Traton (OTCPK:TRATF, OTCPK:TRATY), Iveco Group (OTCPK:IVCGF) and Daimler Truck (OTCPK:DTRUY, OTCPK:DTGHF).

The reason for these spin-offs is quite clear. While being part of a larger conglomerate, these three companies were not as profitable as the other two players. While the latter reported solid results with double-digit margins, the former used to be barely profitable.

Since they have been sent to stand on their own, these companies need to execute their business in a better way. I kept on monitoring the progress of the three, and after a year, I saw that Daimler Truck is on its way to leave behind the other two players and catch up with the leading two. This is why I recently initiated a small position in the company that couples my investment in Volvo Group. There is, in fact, enough evidence to show our economies can’t do without a growing use of trucking. In this environment, Daimler Truck is an industry leader, especially in North America, that has yet to be detected by many investors’ radars and search tools.

In this article, I would like to go through the most recent earnings report to understand if the company keeps on being on track or not.

Q1 Earnings Report

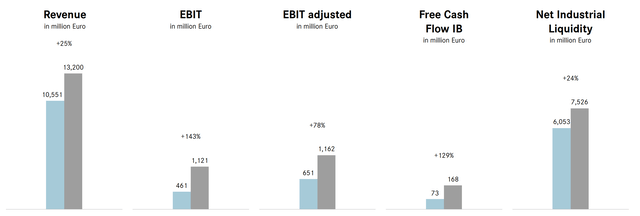

Daimler Truck released its earnings report for the past quarter and disclosed these main facts:

- unit sales compared to prior-year’s quarter increased by 15% to 125,172 units (Q1 2022: 109,286).

- as a consequence, revenue rose by 25% to €13.2 billion (Q1 2022: €10.6 billion).

- unsurprisingly, adj. EBIT increased by 78% to €1,162 million in the reporting period (Q1 2022: €651 million).

- net profit came in at €795 million (Q1 2022: €275 million).

- industrial free cash flow was up 129% YoY to €168 million (Q1 2022: €73 million). This had an impact on

- return on sales (margin) reached 8.8% (Q1 2022: 5.9%)

To help us visualize these data, we can use the slide Daimler Truck showed during its earnings presentation. In light blue we have the results of the same quarter in 2022, in grey we see this past quarter’s results.

Daimler Truck Q1 2023 Results Presentation

Overall, we are before a trend showing a growing and expanding company. To help who is reading, let me give a little explanation about one data: industrial FCF. Usually, companies such as Daimler have a seasonality where they build up inventory in the first quarter(s) of the year. This leads to poor, if not negative FCF. The fact Daimler Truck more than doubled its FCF this quarter shows how its operations are becoming once again smooth with less supply chain hiccups.

Being able to generate positive cash flow, the company is initiating an annual dividend paying 40% of the company’s net profit. This year, on July 21, the company will thus pay a dividend of €1.3 per share. This is a 4.4% yield, but keep in mind the German withholding tax on dividends is around 26%.

Now, these results were widely expected for two reasons. First of all, many machinery manufacturing are releasing results that have easy comparables. I believe Deere (DE), though in another industry, explained the situation in a clear way: in Q1 2022, due to supply chain disruptions, many manufacturers were, on one side, increasing their inventories because of unfinished materials (thus damaging the overall free cash flow), on the other, the vehicles that were being shipped were sold with 2021 prices. This is why the first half of 2023 will see, generally speaking, more than one of these companies with blow-out results.

As a result, these manufacturing companies are indeed now harvesting the results many other companies achieved last year at the peak of the post-Covid recovery.

Therefore, since investing uses past results to forecast what could come next, we need to ponder two aspects:

- In a favorable environment, is Daimler Truck performing in line with its peers or is it outperforming them in terms of financial results?

- How is Daimler Truck order book doing?

Daimler Truck is improving its profitability

To answer the first question we have the aid of two different data that we can compare. First of all, we know Daimler Truck declared that its spin-off was aimed at achieving double-digit margins.

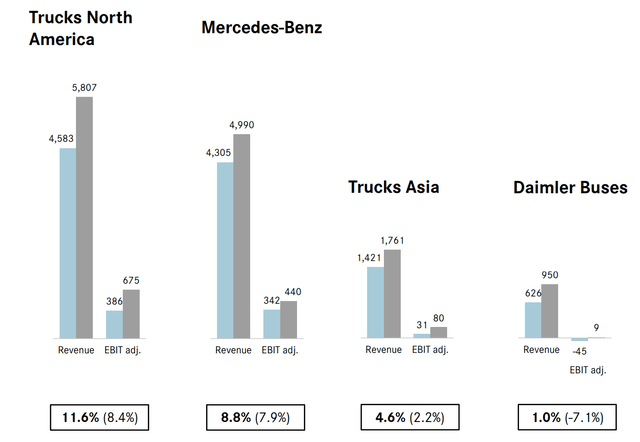

As a matter of fact, we know from the report how profitable each segment of the company is. We see how Trucks North America is already well above 10% in terms of margins. Mercedes-Benz, which covers Europe, is getting closer to this threshold, though it is not there yet. The two smaller segments are improving, too, with Asia more than doubling its margins and buses becoming profitable once again after the pandemic.

Daimler Truck 1Q 2023 Results Presentation

Indeed, among the three companies recently spun-off, Daimler Truck has been more profitable than its two other peers Traton and Iveco since the beginning. Nonetheless, we need to acknowledge that Traton’s recent quarterly report was ahead of expectations and brought the company to a 8.4% return on sales that comes close to Daimler Truck’s 8.8%. However, Traton is still largely dependent on Scania (1Q revenue of €4.17 billion with 13.3% RoS), while Navistar, its North-American brand is still a lagger (€2.74 billion in revenue and 6.3% RoS) compared to Daimler Truck’s North-American segment where Freightliner and Western Star making up together € 5.8 billion in revenue for the quarter with a 33% market share in the heavy-duty truck segment.

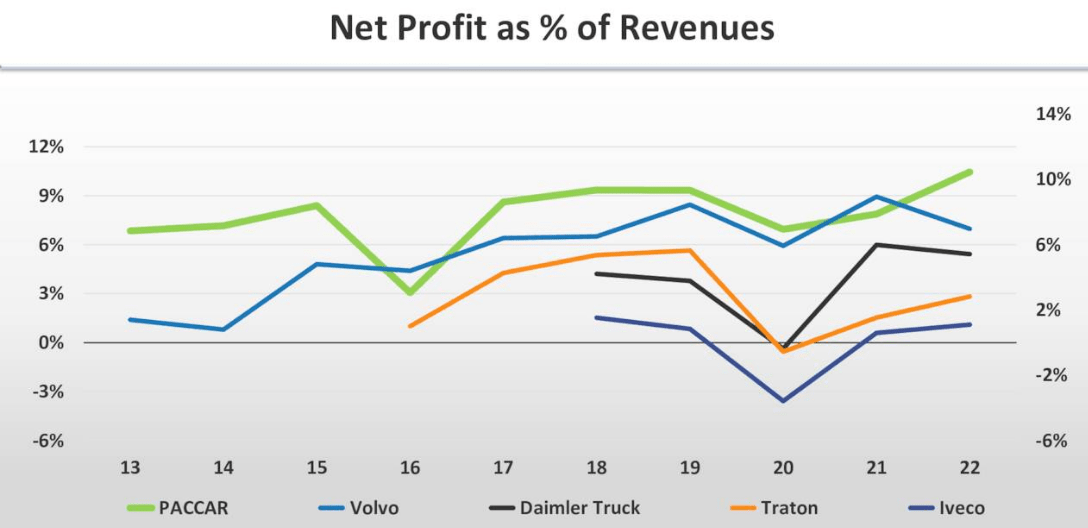

To help us visualize how Daimler Truck seems to be racing at a fast speed to join the two leading companies in the industry, we can use this graph taken from a direct competitor, Paccar. Here we see how, since the pandemic, Daimler Truck has been able to leave Traton and Iveco behind, while catching up with Paccar and Volvo.

Paccar Q1 2023 Results Presentation

The speed Daimler Truck showed in its execution is one of the facts that made me initiate a position in the stock, forecasting we will see that company achieve its double-digit goal over the next two years.

Income orders

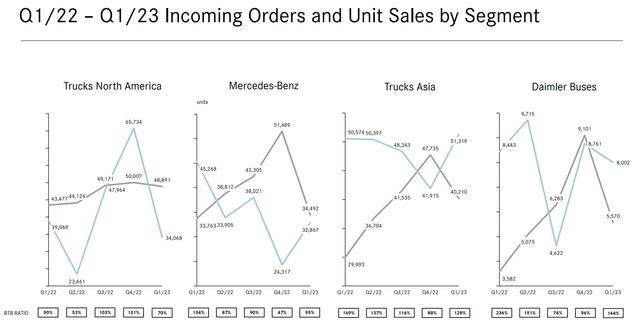

We have already seen how strong sales were to be expected. But the question is: can these levels be sustainable? To answer we need to know how order intake is performing. Daimler Truck is quite transparent when speaking of this metric and it allows us to monitor quarter after quarter the book-to-bill ratio.

Daimler Truck 1Q 2023 Results Presentation

In light blue, we see incoming orders in grey unit sales. We see how North America orders decreased sharply by almost 50% QoQ but if we zoom out and look at the same quarter in the past year, the decline is a bit over 10%. This is acceptable, considering how 2022 was an exceptional year in terms of demand for machinery in general. Mercedes-Benz seems to be recovering QoQ, even though it is well below its Q1 2022 highs. However, Trucks Asia and Daimler Buses are still on recovery mode and partially offset the order intake decline in the Western world. This shows a well-diversified company.

However, we need also to consider one aspect which is not shown by these numbers. Last year, seeing strong inflationary pressure, many manufacturers, starting with Volvo Group, decided to restrict their order books in order to keep them under control in terms of cost management and margin protection. Daimler Truck did this, too. In fact, during the last earnings call we heard its management state that

“Demand for trucks in every of our Industrial segments remained on a very strong level as the pent-up demand in all our key regions continues to be high. This is clearly visible in the demand and sales of our products as well as in our still high order backlog.

In our key regions, we are more or less sold out for this year. While the supply chain certainly has improved compared to last year, we still have challenges and we still expect some more periodic supplier shortages affecting production. However, we are converting our increasing unit sales into strong financials.”

In other words, even though we see demand a bit down this year, it is still high enough to have the company already booked for the remainder of the year. I have been saying for many months that this situation may lead many cyclical companies such as Daimler Truck to live the expected-to-come mild recession in a unique way. While this mild economic pullback should take place, these companies will be focused on fulfilling their orders and shortening their lead time. Meanwhile, a recession of a couple of quarters may go by without these companies almost noticing it. As demand picks up again, they may be ready to fulfill it without the supply chain disruptions we saw last year.

In addition, Daimler Truck seems to be learning Paccar’s lesson. The latter, in fact, is well-known as a leader in terms of monetizing its truck base through after-sale service and spare parts sales. Daimler Truck just announced it will do something similar in Europe, too, with Mercedes-Benz Trucks setting up central logistics hub for the global supply of spare parts. A new hub, in fact, will be built in Halberstadt, Saxony-Anhalt and it should be able to deliver, as explained during the earnings call, “up to 300,000 different items to almost 3,000 vehicle dealers in over 170 countries around the world”.

Conclusion

Given these results, I still see it reasonable for a company whose growth in profitability is likely to start trading at a bit higher multiples. In my past coverage, I ran my discounted cash flow model and gave a target price of €39. Given the most recent results and a forecast that sees the company achieving a margin around 9%, the company is still trading around 51% lower than the sector average. Considering the company is catching up with Paccar and Volvo, it could be expected to trade at a higher fwd PE compared to the current 7 it is being given by investors. Daimler Truck is expected to do around €55 billion in revenue this year. With a net profit margin of 9% we are talking about a net income of almost €5 billion. Divided by current market cap of €23.7 billion we are talking about a fwd PE below 5, which I consider low, considering the multiples Paccar and Volvo are trading at. Therefore, I keep my buy rating and my target price of at least €39 per share, which equals to a possible 34% upside.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here