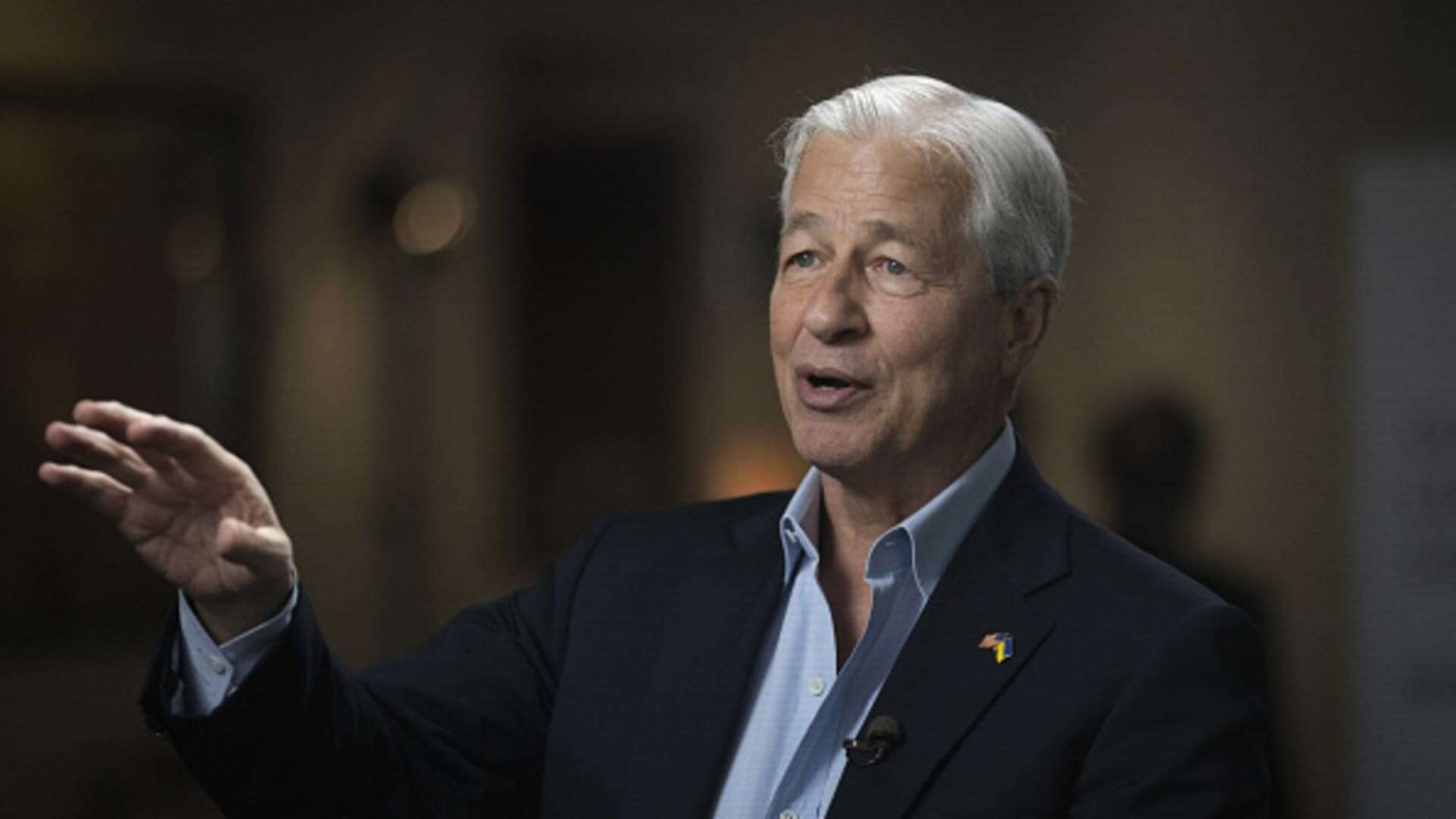

Jamie Dimon, chairman and chief executive officer of JPMorgan Chase & Co., during a Bloomberg Television interview at the JPMorgan Global High Yield and Leveraged Finance Conference in Miami, Florida, US, on Monday, March 6, 2023.

Marco Bello | Bloomberg | Getty Images

JPMorgan Chase raised a key performance target on the heels of its government-brokered takeover of First Republic earlier this month.

The bank will generate about $84 billion in net interest income this year, the New York-based bank said Monday in slides for an all-day investor presentation.

That’s $3 billion higher than guidance given in April. At the time, JPMorgan raised its net interest income outlook by $7 billion, a move that spurred JPMorgan’s biggest earnings-day stock bump in 20 years.

The bank added that “sources of uncertainty” around deposits and the economy could impact its forecast. Net interest income is the difference between what banks earn from loans and investments and what they pay to depositors.

JPMorgan, the biggest U.S. bank by assets, has emerged as a beneficiary of the recent regional banking tumult. It was one of the only banks to see deposits climb in the first quarter as panicked customers sought safety at big institutions; then it won a weekend auction for First Republic, a move expected to boost earnings and advance its push for wealthy clients.

The bank on Monday also disclosed expectations that expenses would rise to $84.5 billion, unchanged from previous guidance, excluding $3.5 billion in costs to integrate First Republic.

Longtime JPMorgan CEO Jamie Dimon is expected to speak in a question-and-answer session at the investor day this afternoon.

He will likely be asked about the U.S. debt ceiling negotiations, as well as succession planning after rival CEO James Gorman of Morgan Stanley last week announced plans to step down within a year.

This story is developing. Please check back for updates.

Read the full article here