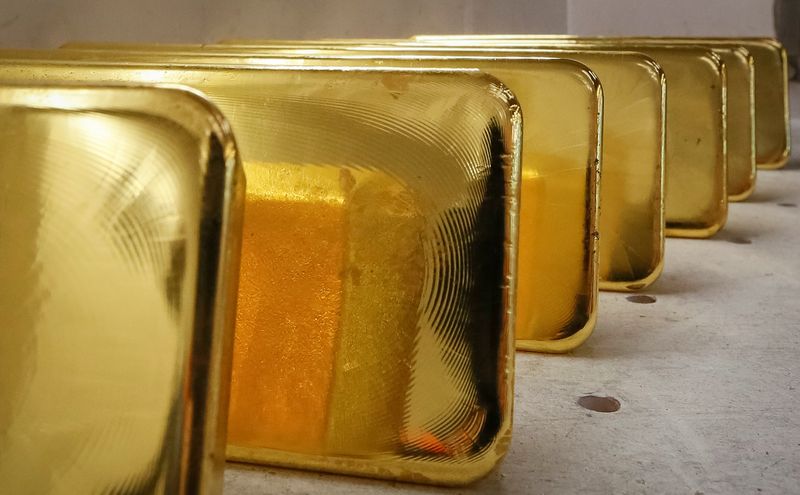

Investing.com– Gold prices ticked lower on Tuesday, negating a short-lived recovery as markets remained focused on negotiations over raising the U.S. spending limit, while copper steadied after logging steep losses in recent sessions.

Positive comments from Democrat and Republican lawmakers over reaching a potential deal also kept safe haven demand for the yellow metal limited, as House Speaker Kevin McCarthy said that a U.S. default was unlikely.

Gold has seen little support over the past week as uncertainty over the debt ceiling crept into markets, although a heavy dose of profit taking pulled the yellow metal down from record highs hit earlier in May.

fell 0.1% to $1,970.45 an ounce, while fell 0.3% to $1,972.25 an ounce by 20:32 ET (00:32 GMT).

Other precious metals also retreated, with and futures down in a flat-to-low range.

Among industrial metals, copper prices rose slightly on Monday, but were trading close to a seven-month low as uncertainty over the debt ceiling and fears of a global recession weighed heavily in recent sessions.

rose 0.1% to $3.6822 a pound. The red metal was trading down over 5% for May after a string of disappointing economic readings from China pointed to a weak outlook for copper demand.

Fears of slowing economic growth had battered industrial metal prices in recent weeks, as weak readings from the U.S. and China continued to trickle in.

Resilience in the dollar also weighed on metal prices, with the greenback strengthening in recent sessions as markets bet that U.S. interest rates will likely remain higher for longer.

show that while traders are positioning for a pause in the Federal Reserve’s rate hike cycle in June, they are also dialing back their expectations for any rate cuts this year. The Fed has largely downplayed any possibility of a rate cut this year.

The prospect of high U.S. interest rates bodes poorly for non-yielding assets such as metals, given that it increases the opportunity cost of investing in them. This trend had battered metal prices through 2022, especially as U.S. interest rates rose sharply.

Focus this week is now on more U.S. economic indicators, as well as the of the Fed’s May meeting, which are due on Wednesday. Markets will be watching for any more signs that the Fed plans to pause its rate hike cycle in June.

Read the full article here