Thesis

Sun Country Airlines Holdings (NASDAQ:SNCY) operates Sun Country Airlines which has a strategy of flying routes with high demand and switching routes when the demand goes down. Their low acquisition cost of aircraft, paired with operating only on high-demand routes and days, translates to huge profit margins for SNCY. Although the stock price has not reflected my expectations, I maintain my view that the company has been successful since my initial posting. When taking 1Q23 results into account, this becomes even more apparent. To begin, management has provided a revenue outlook that is much better than what I had anticipated. This is due in large part to lease revenue related to its recent aircraft acquisitions, as well as management’s observation of strong 2Q23 demand trends. Particularly, 2Q23’s aircraft utilization and pricing are outpacing 2019’s levels, and that this strength is widespread across the network. While there are some cost inflation pressures, management is aware, and is already rolling out initiatives to ease them. I still believe the stock is cheap if the current growth trend continues, as such, I reiterate my buy rating.

Demand outlook

Overall, I think it’s good news for SNCY and investors that demand and booking trends are returning to normal. SNCY can now better manage its inventory and streamline its operational processes. Management stated that certain demand patterns were returning to pre-pandemic levels, while others were undergoing changes. They specifically noted that although peak periods remained robust, the usual seasonal low periods were experiencing declines that align more closely with historical trends. In light of this, I anticipate further volatility prior to a full normalization, which is likely to occur in 2H23 or FY24 as SNCY cycles through FY23 booking trends. Management also noted a rise in demand for secondary markets, which they attribute in part to the rise of the working remotely. While this won’t drastically alter the market for SNCY, it does increase the variety of markets from which it can draw demand.

Manpower

In my opinion, the best way for management to alleviate the strain on costs is to invest in additional pilot training. From January to April of 2023, the number of SNCY trainee pilots was 33% higher than in the corresponding period in 2022. However, I believe this initiative will keep margin under pressure in the near future because training pilots takes time. Even though the company’s capacity for training pilots has increased, they are still struggling to clear the significant backlog of trainees they’ve amassed, which has a negative impact on both fleet utilization and employee productivity. Specifically, daily utilization dropped from 9.7 hours in 1Q19 (pre-covid levels) to 7.3 hours in 1Q23. In my opinion, the company is ready for growth, with the exception of the pilot shortage. Other areas like the availability flight attendants, airport workers, and mechanics are all already in place.

Strategy

In April, SNCY purchased five 737-900ERs, all of which are now leased to Oman Air. After the leases end in 2024 and 2025, SNCY is expected to start using the planes in 2Q25 after they have been reconfigured. In the short term, the acquisition will add $3 million of lease profits to SNCY financials quarterly. Since the 737-900ERs will soon be reconfigured to seat around 200 passengers instead of 186 like its older 737-800s, I expect this to have a positive effect on SNCY’s profit margins in the medium to long term. Importantly, despite the increased potential for revenue generation attributable to these planes’ larger seating capacities, passengers can expect relatively similar trip costs, with the exception of minor increases in the price of fuel and landing fees – which I read as higher revenue per plane but at lower fixed cost (more passengers per lane). Also, management has made it clear that they intend to remain opportunistic in their acquisition of used aircraft, despite noting that the current pricing environment has become less attractive as a result of continuing delays in the delivery of new aircraft.

Valuation

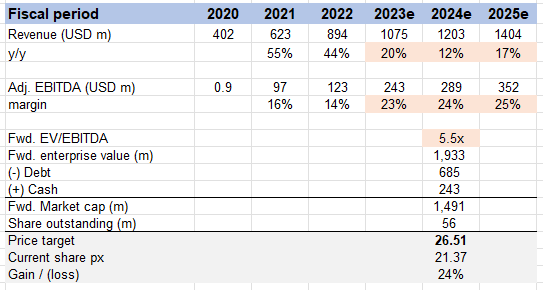

I decided to change my model’s approach from potential upside via multiple change to potential upside at the current multiple. Given the positive outlook and normalization of demand/booking trends, my growth expectations are also higher this time around. Combined with continued margin expansion as fuel prices normalize, SNCY is expected to generate EBITDA of around $350 million in FY25. I believe there is a 24% upside from here at the current forward EV/EBITDA multiple of 5.5x.

Own estimates

Conclusion

SNCY has shown resilience and success in navigating the challenges posed by the pandemic. The management’s revenue outlook, supported by strong demand trends and increased aircraft utilization, has exceeded expectations. However, SNCY faces challenges in terms of manpower, particularly in pilot training. While efforts to increase the number of trainee pilots have been made, the backlog of trainees is impacting fleet utilization and employee productivity. I expect the recent acquisition of additional aircraft, with plans for reconfiguration, to positively impact profit margins in the medium to long term. Considering the positive outlook, normalization of demand, and expected margin expansion, my revised valuation model suggests a potential 24% upside from the current forward EV/EBITDA multiple of 5.5x.

Read the full article here