Investment Thesis

IonQ, Inc. (NYSE:IONQ) is a leading company in the field of quantum computing, harnessing the power of quantum physics to revolutionize computation.

The business is young and growing very rapidly. That means that its growth rates can be far from stable.

The most recent quarterly result for Q1 highlights that IonQ’s reached its full-year 2023 technical target of 29 algorithmic qubits (#AQ) seven months earlier than expected.

Meaning that the business is growing faster than previously expected. The stock is very far from cheaply valued, at 55x my 2024 estimated revenues. So, it’s safe to say that expectations are already sky-high.

Why IonQ? Why Now?

IonQ is a quantum computing company. Quantum computing is a cutting-edge technology that uses the principles of quantum physics to perform complex calculations. IonQ enables powerful computational capabilities.

IonQ seeks to solve complex problems, with the use of its powerful computational capabilities.

I won’t claim to make much headway in understanding its full value proposition. Rather, I’ll attempt to explain what I do understand. IonQ sells access to several quantum computers via three main cloud providers.

IONQ Q1 2023

Throughout the earnings call, management described the rapid adoption by its customers. Here’s an excerpt,

Potential customers are noticing the superior performance of IonQ Systems.

[…] In addition to bringing on more customers, we’re also seeing strong results from existing customers taking advantage of our increasingly powerful systems.

That being said, IonQ failed to disclose any tangible figures on its customer adoption. (Incidentally, I know that IonQ’s PR team will read this, so please give us some tangible customer figures.)

Moving on, in the Q&A section of the earnings call when IonQ’s management was asked about price hikes, this is what management said:

What we like to see is that we provide more value to our customers. And we want to continue to create more and more value. We don’t think that this is time to start gouging our customers, we want actually to partner with them. But there’s definitely room for price to drift up as we provide more and more value to the market. (Emphasis added.)

Indeed, I concur that this is the right strategy: to rapidly grow the customer base and later on rely on price hikes to drive revenue growth rates. And this is a perfect segue for our next topic.

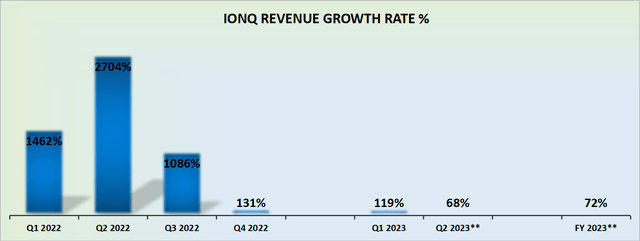

Revenue Growth Rates Remain Very Enticing

IONQ revenue growth rates

At the time of its Q4 2022 report, IonQ guided Q1 2023 revenues to reach $4 million at the high end. And not only did IonQ surpass this revenues target, with Q1 2023 reporting $4.3 million in revenues, but IonQ didn’t waste time and immediately raised its full-year 2023 outlook from $18.8 million at the high end, to $19.2 million.

Hence, this implies that analysts’ current expectations for IonQ to reach around $40 million in revenues in 2024 are within the realm of possibilities.

However, the crucial question for investors is not about its pace of growth, although that is important. What investors truly want to know is whether the business has enough inbuilt flexibility to allow it to reach scale without diluting shareholders too aggressively along the journey.

Profitability Profile Discussed

IonQ’s balance sheet holds no significant debt and about $500 million of cash and equivalents. Given the strength of its balance sheet, this allowed IonQ’s management to state on the earnings call:

We continue to believe that this cash position, which we believe is the strongest of any quantum pure player, gives us sufficient cash reserves to get to profitability without needing to raise additional funds, given our current roadmap. (Emphasis added.)

Accordingly, it does appear to be the case that IonQ won’t need to resort to capital markets to continue on its path of investing for future growth. And that’s a good consideration at the best of times. But right now, with interest rates so high, the importance of that element cannot be overstated.

Next, let’s drill further into IonQ’s path to profitability.

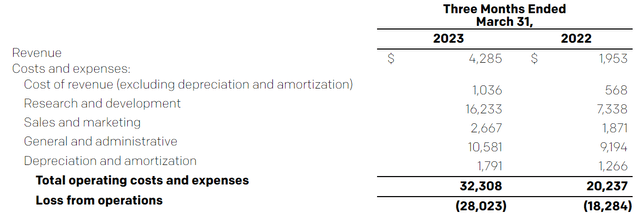

IONQ

Above, we can see that on the back of growing its revenues by more than 100% y/y, IonQ, Inc.’s underlying cost structure has not increased proportionally. That’s exactly the kind of positive operating leverage that investors want to see, that management is heavily investing in R&D, but that its overall cost structure isn’t becoming too bloated.

Again, given that IonQ holds more than $500 million of cash on its balance sheet, at the current rate, IonQ has more than enough cash to continue investing for growth.

The Bottom Line

IonQ, Inc. is a prominent player in the field of quantum computing, leveraging the power of quantum physics to transform computation. As a young and rapidly growing business, IonQ’s growth rates exhibit volatility.

The stock is not cheap. I estimate that the business will remain unprofitable for some time.

And at 55x next year’s revenues, IonQ, Inc. investors require a leap of faith. While animal spirits abound in the market, valuation is not important. But when the markets become less frothy, investors will be quick to highlight its valuation, yet again.

With ample cash on its balance sheet, IonQ, Inc. remains well-positioned to grow in intrinsic value.

Read the full article here