Thesis Summary

To the surprise of many, markets have kept rising in 2023. How is this possible?

We are allegedly entering what appears to be the most anticipated recession in history, and yet stocks keep rallying. Perhaps the market is just being irrational, but I feel there’s more to this story.

I’ll explain in this article why I have been, and continue to be, bullish for the medium-term, why I believe a blow-off top will come soon, and why I think a substantial deflationary bust will follow this.

Don’t Say I Didn’t Warn You

After being range bound for a while, the S&P 500 (SP500) finally broke out of its range and above the resistance level of 4,200. We are back below that today, but I can already observe a clear change in sentiment.

The rally we have seen in equities, and also Bitcoin (BTC-USD) has been perhaps one of the most hated in recent history. It seems like everyone has been bearish for the last 6 months. Well… almost everyone.

Last week I published an article showing 4 bullish charts that support my conviction that we are beginning a rally to new all-time highs. A conviction that I have shared with my subscribers for some time.

Why exactly am I bullish? There are both fundamental and technical reasons.

From a fundamental perspective, we have three macro variables that are supporting this rally: Lower inflation, higher global liquidity and a surprisingly resilient economy.

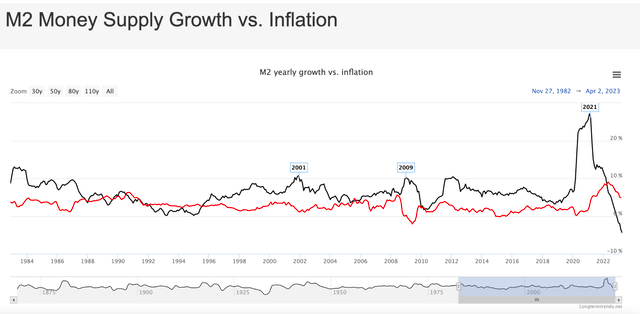

M2 and CPI (longtermtrends)

The disinflation trend has been quite clear in the more recent inflation data. Moving forward, it is the reduction in M2 which makes me sure that inflation will continue to trend down. CPI usually lags M2 by around 12-16 months. Based on how M2 has decreased in recent months, I’d expect CPI to go the same way, at least in the more immediate future.

Looking at liquidity, we saw a big uptick in global liquidity through the beginning of the year.

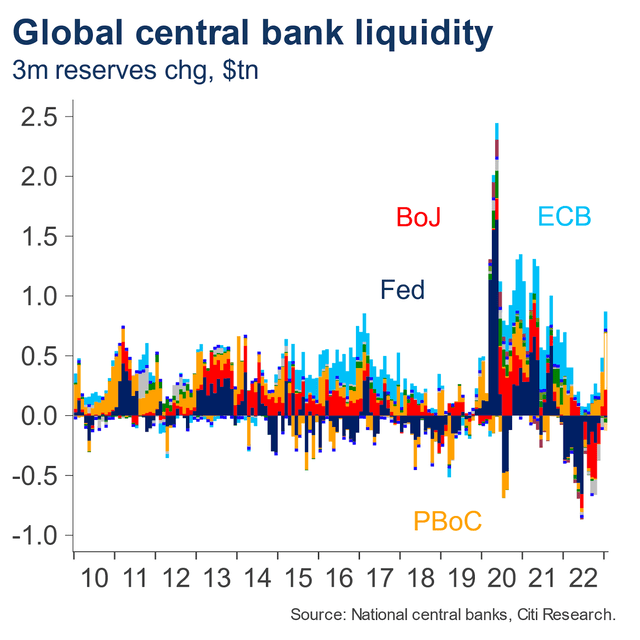

Global liquidity (Citi Research)

Liquidity injections were led by the PBoC and the BoJ, adding close to $1 trillion to bank reserves. This supported a sharp rally early this year. More recently, global liquidity has gone back down, but the US liquidity has picked up.

We had a temporary injection of liquidity as the Fed extended emergency lending to distressed banks. On top of that, the Fed has now paused, and rate cuts are being priced in already this year, so the liquidity expectations are bullish.

Moving forward, US liquidity should face headwinds as the Treasury replenishes its coffers, but global liquidity could soon pick up. The BoJ is now pointing out that it might not scrap its Yield Curve Control policy after all, as “they remain wary”.

Meanwhile, analysts are already expecting the PBoC to become more accommodative, starting with a reduction in reserve requirements.

Inflation down, liquidity good, and the economic outlook? Much better than expected.

A lot of companies reporting earnings have surprised investors, and a lot of economic data continues to come in better than expected.

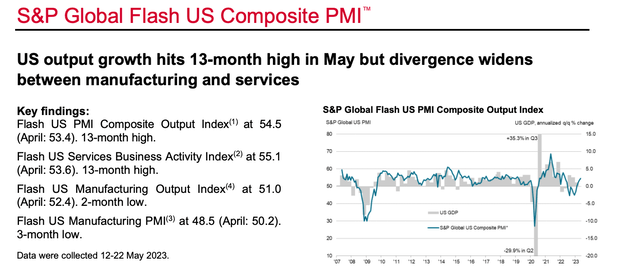

Just recently, the US PMI index posted a 13-month high.

PMI (SPGlobal)

And all this while unemployment remains near historical lows.

Sure, a recession will come eventually, but until then, we are in a period of disinflation, reasonable growth and increasing liquidity. Why wouldn’t the market rally?

A Crash Almost Always Comes

On a long enough time frame, the market almost always crashes. Until it does, though, I believe it will rally and negatively impact the bears.

I am bullish for the time being, but I am also aware that there are a lot of signals that a major recession and deflationary bust could be underway. And this could be followed by yet more inflation and perhaps even stagflation.

Even though inflation is under control now, I expect it to return with a vengeance, as it did in the 70s.

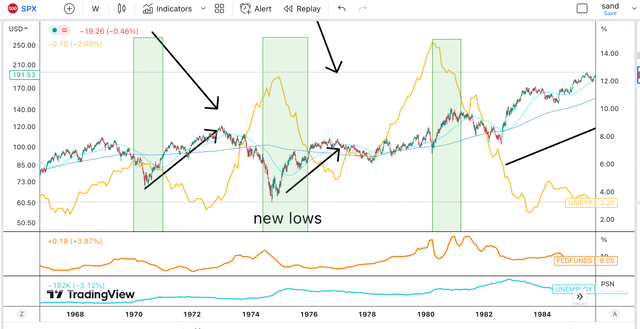

1970s inflation, spx, rates and employment (TradingView)

The 1969 period is quite reminiscent of what we have today. Inflation began to pick up following expansionary fiscal stimulus, and this caused inflation to pick up. The market took a hit as the recession took hold, but a V-shaped recovery ensued as the Fed cut rates.

However, this would eventually lead to even higher inflation in 1974, another recession and new lows for the market. A repeat of this cycle would then lead to even higher inflation in 1980 and another recession.

Three inflationary peaks, and three recessions in a matter of 10 years, with a stock market that could be described as trading sideways.

This is roughly what we could experience in the coming decade. Right now, we are coming off that 1970 low. Inflation is easing, which is always good for stocks, and so are monetary conditions, even though we don’t have cuts yet.

If the economy continues to prove resilient, then like in 1973, markets could top just as inflation begins to pick up again. This would lead to further tightening and an eventual deflationary bust. Following this, I have no doubt we will once again see unprecedented fiscal and monetary stimulus, setting us up for a recovery, but even more inflation further ahead.

Alternatively, we could head directly into a deflationary bust. This kind of depends on what the Fed does moving forward. For now, it seems like the Fed prefers to err on the side of overtightening, so this means that the deflationary recession could come sooner.

While history doesn’t repeat itself, it does rhyme, and I find fundamental similarities between both decades.

Commodity-driven inflation could be a persistent pain point throughout the decade. Spare oil production capacity will likely run out in 2024, and the world is incredibly underinvested in energy production.

Another big feature of the 1970s was numerous credit crunches, which also contributed to stagflation. Moving forward, we should see even more pressure on banks as further tightening cycles take hold.

And in terms of employment, we could expect similar dynamics. A large contraction in credit and economic activity will give rise to unemployment, and the advent of new technologies like AI will also contribute to less demand for jobs. That’s not to say we are doomed to higher unemployment, but the economy will need some time to reach an equilibrium. People will have to adapt, and this takes time.

Final Thoughts

In terms of when to expect this, I am data-dependent, and I am also Fed-dependent. I believe we will likely see markets rally into 2024, and perhaps at some point next year, the recession could start, and markets could top. I’ll stay weary of the data coming out and will likely start selling as soon as everyone turns bullish.

I think there is some juice left to squeeze out of this rally, but downside risk is a lot higher in the long-term, so we must manage risk accordingly.

Lastly, it’s worth noting that if the 2030s are anything like the 1970s, then equities overall will perform poorly, and better returns could be found in areas like commodities and international stocks, which is where I am currently focusing my research.

Read the full article here