Stocks traded mostly higher Thursday and tech shares rallied after chip maker

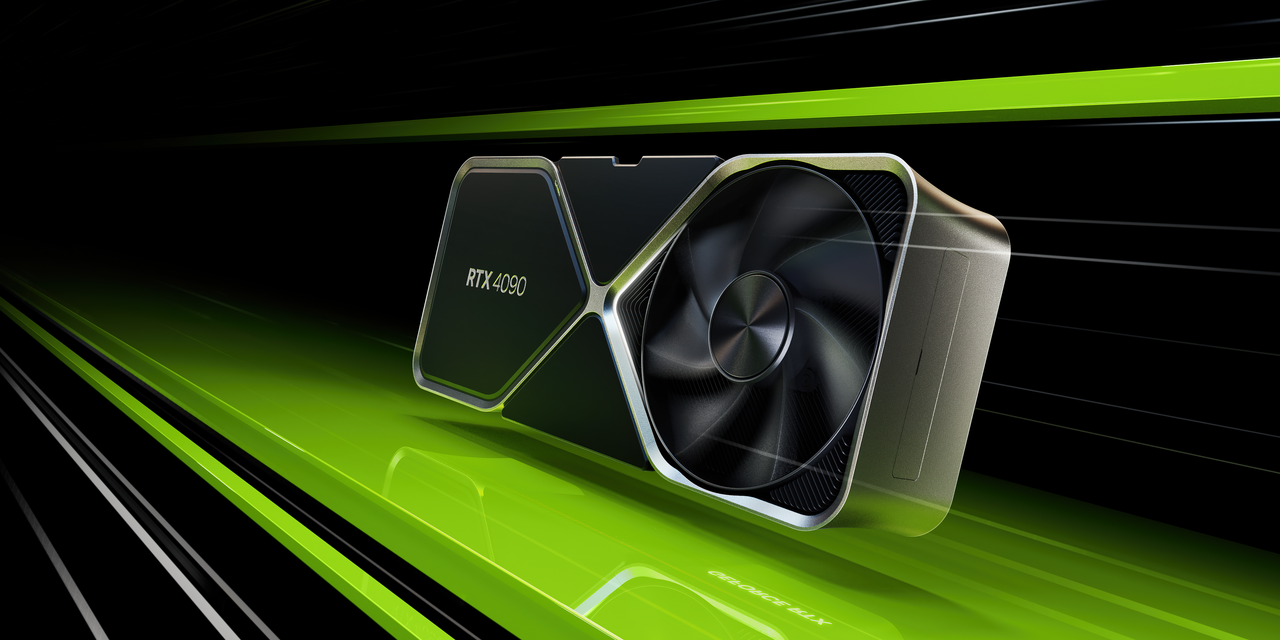

Nvidia

issued a bullish revenue forecast. The

Dow Jones Industrial Average

declined as negotiations to raise the U.S. debt ceiling continued in Washington.

These stocks were making moves Thursday:

Nvidia

(ticker: NVDA) reported fiscal first-quarter earnings and sales that topped analysts’ expectations. The stock surged 26% after the chip maker said it expects fiscal second quarter revenue of $11 billion at the midpoint of its forecast range, well above consensus of $7.2 billion. Nvidia cited surging demand for its chips that enable artificial intelligence applications.

Nvidia’s report sent shares of fellow chip company

Advanced Micro Devices

(AMD) rising 9.8%, while

Intel

(INTC) shares fell 5.8% as investors sold shares amid competitive concerns.

e.l.f. Beauty

(ELF) posted fiscal fourth-quarter adjusted earnings and revenue that beat Wall Street expectations and provided strong guidance, showing no sign of slowing spending among its consumers. The stock jumped 19%.

Cloud specialist

Snowflake

(SNOW) was falling 16% after saying it expects fiscal second-quarter product revenue of $620 million to $625 million, below Wall Street estimates of $647 million. For the fiscal year, the company said it expects product revenue of $2.6 billion, an increase of 34%, but below the previous guidance target of $2.7 billion. The company now sees non-GAAP operating margin for the year of 5%, down from a previous forecast of 6%.

Nutanix

(NTNX), the cloud-platform company, said it expects fiscal fourth-quarter revenue of $470 million to $480 million in revenue, higher than analysts’ estimates of $452 million. Shares rose 15%.

American Eagle Outfitters

(AEO) was falling 13% after the retailer said it expects fiscal second-quarter revenue “down low-single digits to last year.” In the same quarter a year earlier, American Eagle reported revenue of $1.2 billion.

UiPath

(PATH), the automation-software company, declined 12% after issuing fiscal second-quarter revenue guidance of between $279 million and $284 million vs. analysts expectations of $284 million.

Illumina

(ILMN) fell 11% after activist investor Carl Icahn failed to topple the CEO of gene-sequencing giant in a proxy battle that ended Thursday afternoon.

Icahn

succeeded in getting one of his three nominees onto the company’s board, and knocking out its chairman.

Dollar Tree

(DLTR) declined 10% after the discount retailer missed first-quarter earnings estimates and slashed its fiscal-year profit outlook.

Dish Network

(DISH) gained 8.3% after The Wall Street Journal reported the company was in talks to sell wireless plans for its mobile phone service through

Amazon

(AMZN).

American depositary receipts of Chinese electric-vehicle start-up

XPeng

(XPEV) fell 7.8% to $7.98 after receiving a downgrade to Sell from Hold and a price target trim to $6 from $8 by analysts at Barclays.

Write to Joe Woelfel at [email protected]

Read the full article here