The Americas leading long steel producer, Gerdau S.A. (NYSE:GGB) has lagged the stock market over the last five years, such that the firm is trading at a very low P/E multiple. However, the firm’s dividend issuance has been strong enough to keep returns close to the market’s. In addition, the company is in the right part of the capital cycle, with the firm de-risking as profitability and returns increase. Gerdau’s position on the capital cycle, and its improving profitability, make it a good bet for long-term investment. In addition, to a FCF yield of over 23%, its gross profitability at 0.25 is nearing the 0.33 threshold, and its P/E multiple of 3.97 is very low.

Gerdau’s Business Model

Gerdau is a global steel company with operations in 10 countries. It is the largest producer of long steel in the Americas and the 30th largest steelmaker in the world. Gerdau has an installed capacity of 26 million metric tons of steel per year and offers steel for a variety of markets, including civil construction, automobile, industrial, agricultural, and various sectors.

Gerdau’s core business is to transform steel scrap and iron ore into steel products. The company is also a major recycler of steel scrap, and each year transforms millions of tons of scrap into new steel products. Gerdau is committed to sustainable development and has a number of initiatives in place to reduce its environmental impact.

Gerdau’s operations are based on the integrated regional market mill concept. This means that raw materials are bought from nearby suppliers and products are primarily sold in the same region.

Gerdau operates through three different processes:

-

Mini mills

-

Integrated mills

-

Direct reduced iron plant

Mini mills are small, electric arc furnace ((EAF)-based steel mills that use scrap metal as their primary raw material. Integrated mills are large, blast furnace-based steel mills that use iron ore as their primary raw material. Direct reduced iron (DRI) plants produce DRI, which is a solid form of iron that is used as a raw material in steelmaking.

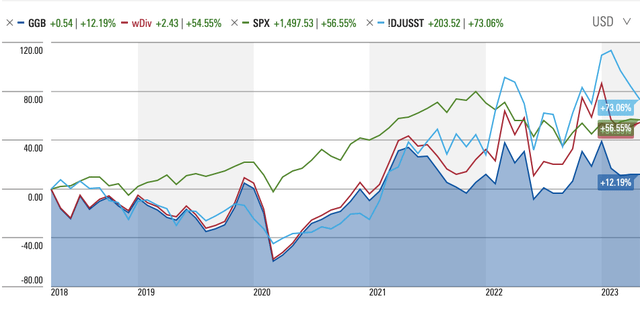

Dividends Help Gerdau Close the Gap on the Market

In the last five years, Gerdau’s share price has risen just over 12%, while the S&P 500 has risen by nearly 57%, and more than 73% for the Dow Jones U.S. Steel (DJUSST). In terms of total shareholder return (TSR), Gerdau has grown by nearly 55%, allowing them to close the gap on the market.

Source: Morningstar

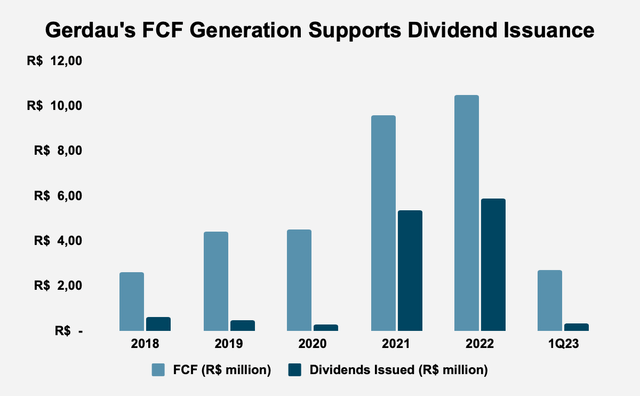

Free Cash Flows Support Dividends

Given the importance of dividends in closing the gap to the market’s performance, Gerdau’s ability to continue to issue dividends and to even increase dividends, is a good place to start our analysis. In the last five years, the company has grown dividend issuance from nearly R$600 million in 2018 to R$5.89 billion in 2022, compounding at 57.96% a year. In total, the company issued R$12.59 billion in dividends. In 1Q23, the company issued over R$330 million in dividends.

The value of a business is a function of the present value of its future cash flows. Growing those cash flows is, therefore, conducive to growing firm value. Free cash flows (FCF) are not just important for building value, they are important for supporting dividend issuance. In the 2018-2022 period, Gerdau grew its FCF from R$2.59 billion in 2018 to R$10.46 billion, compounding at over 32% a year. In that period, the firm generated a total of R$31.56 billion in FCF, or over 72% of its market capitalization (assuming an exchange rate of R$1 to US$0.20). In 1Q23, the firm generated R$2.7 billion in FCF. Simply put, there is ample room for dividends to grow.

Source: Gerdau S.A. Filings

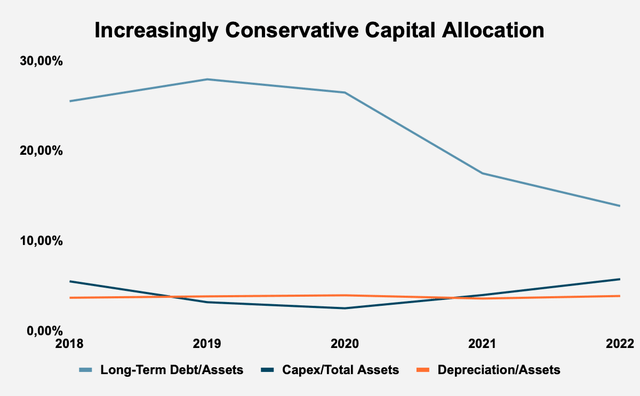

De-Risking the Business and Increasing Profitability

It is tempting for steel producers facing higher commodity prices to raise capital, and spend at higher rates on capital expenditures in order to increase their chances of earning economic profits. Unfortunately, managers often overestimate growth opportunities, invest too heavily, and when prices fall, find themselves overinvested, and needing to sanitize their balance sheets, with capital exiting until profitability returns. Thus, we have an inverse relationship between asset growth and future returns. You want to invest in a business, not when it is raising capital and investing heavily, but when capital is exiting and profitability is increasing. A good way of analyzing how capital is being used and where a business is in the capital cycle, is to see the share that long-term debt, capex and depreciation have of total assets. As the chart below shows, long-term debt’s share of total assets has fallen from 25.5% in 2018 to 13.88% in 2022, while depreciation and capex’ share of total assets has remained within a fairly tight range.

Source: Gerdau S.A. Filings and Author Calculations

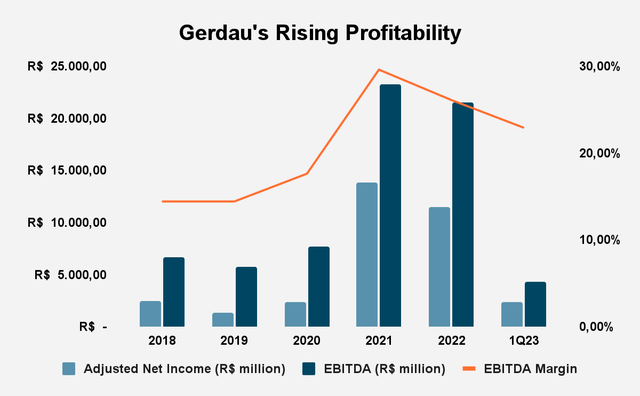

In that time, Gerdau has become increasingly profitable. The firm’s gross profitability, which scales gross profits by total assets, has risen from 0.12 in 2018 to 0.25 in 2022. Although this is below 0.33, which research shows is the level at which a stock is attractive, the trend is clearly positive. Gerdau’s adjusted net income rose from R$2.5 billion in 2018 to R$11.48 billion in 2022 compounding at 35.57% a year. In 1Q23, the firm earned R$2.38 billion in adjusted net income. EBITDA rose from R$6.66 billion in 2018 to R$21.5 billion in 2022, compounding at 26.43% a year. In 1Q23, the firm earned R$4.32 billion in EBITDA. EBITDA margin rose as well, from 14.4% in 2018 to 26.1% in 2022. In 1Q23, EBITDA margin was 22.9%.

Source: Gerdau S.A. Filings

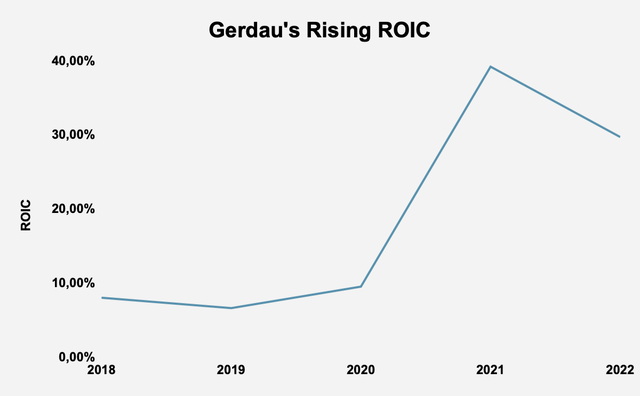

These two factors, prudential capital allocation and rising profitability, have had the effect of increasing the firm’s return on invested capital (ROIC), from 8% in 2018 to 29.7% in 2022. Given the relationship between corporate value and ROIC, Gerdau’s improving ROIC is a good sign. In the TTM period, ROIC remains 29.7%.

Source: Gerdau S.A. Filings and Author Calculations

Valuation

Gerdau’s price/earnings (P/E) multiple is 3.97 compared to 24 for the S&P 500. We have seen that the firm’s gross profitability, at 0.25, is below the 0.33 threshold for attractiveness, but is trending in the right direction. The firm’s FCF yield (R$10.14 billion of FCF in the TTM period/enterprise value) of 23.38% is far above the mean FCF yield of the 2000 largest businesses in America, which New Constructs calculates at 2.7%. This indicates that the firm is producing FCF at a far cheaper price than the market.

Conclusion

Gerdau is the largest producer of long steel in the Americas and the 30th largest steelmaker in the world. The company has been growing its dividends and FCF over the past five years, which has helped it close the gap on the market’s performance. In addition, the firm’s FCF easily supports dividend growth. Gerdau is also de-risking its business and increasing profitability, which is leading to an improving ROIC. The company’s price-earnings multiple is 3.97 compared to 24 for the S&P 500, and its FCF yield is far above the mean for the market. Overall, Gerdau appears to be a good investment with a bright future.

Read the full article here