President Joe Biden and House Speaker Kevin McCarthy seemed to be reasonably close to reaching a deal over raising the debt ceiling.

That’s good news, since the point where the U.S. can no longer pay its bills is projected to arrive on Thursday. In between, there’s a long weekend for Memorial Day.

An outline of a deal has emerged that would raise the debt ceiling for the next two years and that would cap overall federal spending. It may possibly claw back some of the $80 billion that Congress had approved to strengthen tax collection by the Internal Revenue Service, The Wall Street Journal reported, citing unidentified people familiar with the talks.

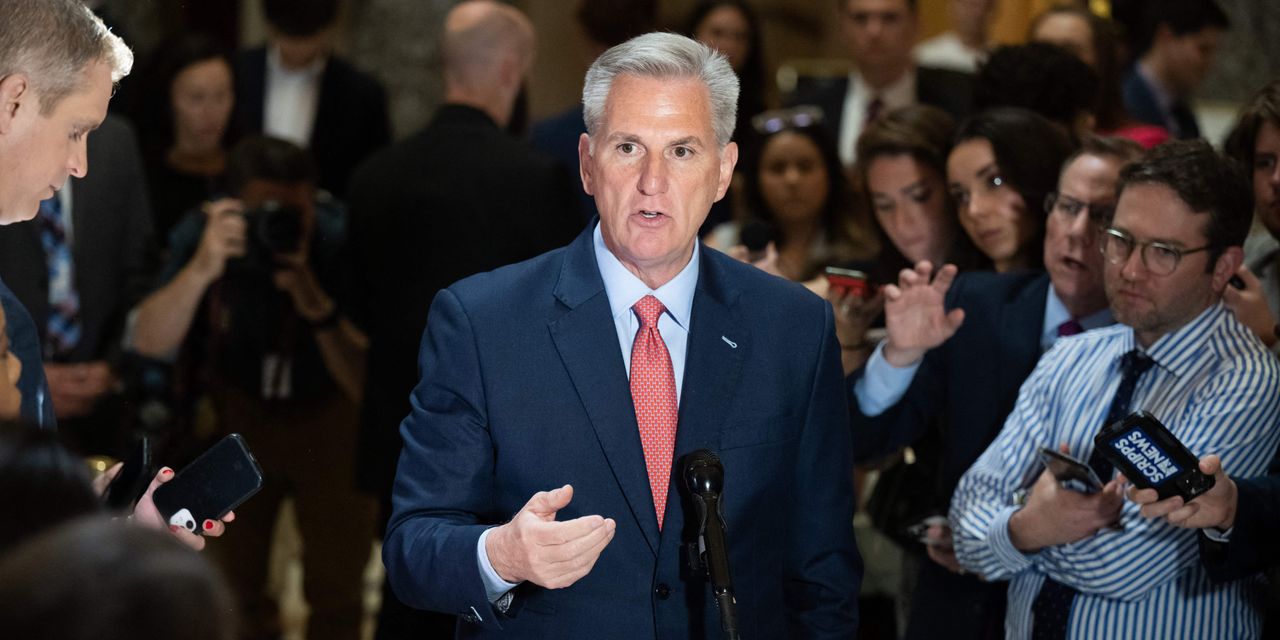

McCarthy and Biden said Thursday that the two sides are making progress. “There’s still some outstanding issues, and I’ve directed our teams to work 24/7,” McCarthy told reporters. Another Republican representative, Kevin Hern of Oklahoma, told Reuters a deal could happen Friday afternoon.

Treasury Secretary Janet Yellen says that June 1 is the key date for an agreement. After that, the Treasury’s “extraordinary measures,” which it has been doing since early this year, won’t be able to cover the government’s bills. That date might be a little flexible, depending on how the Treasury manages.

Goldman Sachs

economists on Friday said that June 1 nevertheless looks “very accurate.” They predict that a deal will be announced Friday or Saturday.

The uncertainty over an agreement has created jitters for the $4 trillion municipal bond market, since cities rely on the federal government for funding.

Fitch Ratings on Thursday put

Fannie Mae

and

Freddie Mac

on its “ratings watch negative” for a possible downgrade. The ratings firm issued a warning earlier this week about U.S. bonds as negotiations continued without a resolution.

Fannie Mae and Freddie Mac are government-sponsored enterprises that provide liquidity to the mortgage market by buying home loans from mortgage originators, companies that make loans directly to home buyers.

The two enterprises “benefit from meaningful financial support from the U.S. government,” Fitch said, and are aligned to the U.S. rating “due to their mission critical function to the U.S. housing finance system.”

However, Fitch said it believes Fannie Mae and Freddie Mac “continue to execute on their mission to provide liquidity, stability and affordability to the housing finance industry.”

Fannie Mae and Freddie Mac didn’t immediately respond to Barron’s request for comment.

Write to Brian Swint at [email protected]

Read the full article here