Last week’s article outlined the next upside targets for S&P 500 (SPY), but also warned of complacency and the potential for a move below 4098 to “flush out late bulls” before resumption of the rally. The weekly low was 4103, which was close, but was it enough?

To answer that, a variety of technical analysis techniques will be used to look at probable moves for the S&P 500 in the week ahead. The S&P 500 chart will be analyzed on monthly, weekly, and daily timeframes. I will then provide my own conclusions and make a call for the week ahead. My calls may not always be correct, but they will be based on solid technical evidence and made without bias.

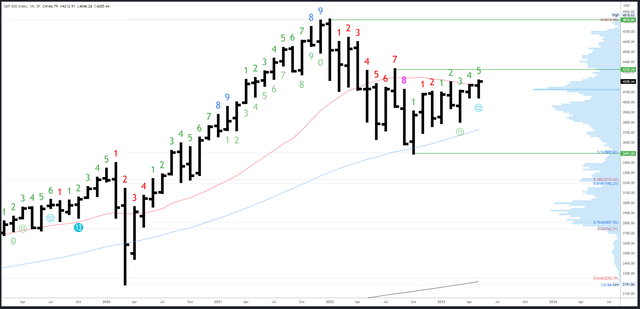

S&P 500 Monthly

With US markets closed on Monday for Memorial Day, there are only 2 trading days left in May. Closing near or above 4195 would be bullish and signal continuation.

Closing around 4170 would create a ‘doji’ bar and signal more indecision – both higher and lower prices (compared to April) were tested in May and both were rejected to eventually settle around the open. A doji forming after a new high is made has the potential to form a reversal signal but the June bar would need to follow through below the 4048 low. Until this happens, the bullish bias remains.

SPX Monthly (Tradingview)

Resistance is at 4212, then 4325 at the high of August.

Support is 4048-49.

An upside Demark exhaustion count will be on bar 6 (of 9) in June.

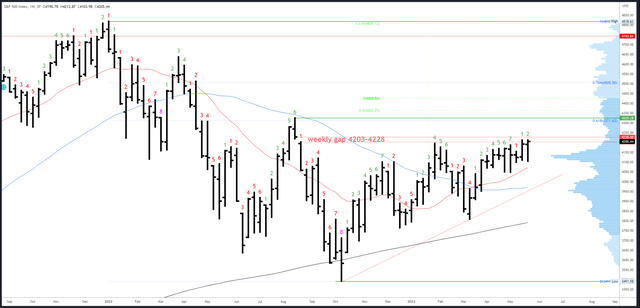

S&P 500 Weekly

The 4205 close is the highest since the October ’22 bottom. It is more bullish than the previous week as not only is the close at the highs of the weekly range, it is above 4195 and the previous resistance. Immediate follow through looks likely.

SPX Weekly (Tradingview)

Gap fill at 4228 is minor resistance and only likely to provoke a mild reaction due to the sustained consolidation below the 4200 area.

The next major targets are the 61% Fib retrace of the 2022 bear market at 4311, with the August high of 4325 just above.

4098-103 is first support, then 4048.

The upside (Demark) exhaustion count has reset and will be on bar 3 of 9 next week.

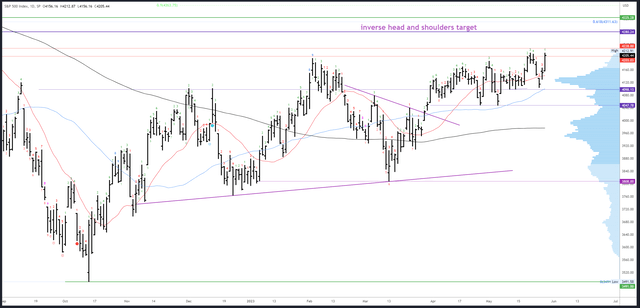

S&P 500 Daily

The bullish reaction from Wednesday’s 4103 tells us the flush lower did its job and cleared the way higher. However, this week’s 4212.87 high was just below the 4212.91 high of the previous week, and until this high is taken out, a second flush lower is possible (if not probable).

SPX Daily (Tradingview)

4130 is initial support, then the obvious 4098-103 and 4048.

Initial resistance is 4212-28.

An upside Demark exhaustion count will be on bar 2 of 9 on Monday, so no exhaustion signals are possible next week.

Events Next Week

US markets are closed on Monday for Memorial Day.

Debt ceiling negotiations will continue as the main driver. Assuming a deal will be reached next week, the issue then will be how high the rally can get before the inevitable ‘sell the news’.

US data is very light until JOLTS Job Openings on Wednesday and NFP on Friday. The odds of a June hike are currently 36% and could rise on a debt deal combined with continued tightness in the job market. Yields continue to rise across the curve and could start to weigh once the debt ceiling fiasco fades.

Probable Moves Next Week

Again, continuation of the rally looks likely and the 4300 area remains the next major target. Now that there has been a flush lower, I don’t expect another one, and if 4212.91 can be exceeded, 4103 should hold all dips until a top is reached.

Once 4300 target has been reached, I will re-assess. 4363 is the next potential target, so 4300 is not necessarily a place to close longs and go short.

In the very near-term, it is not yet clear if the S&P500 can move directly higher to 4300 or takes a more roundabout way. Assuming a deal on the debt ceiling is struck before Tuesday’s re-open and we see a gap higher, it could either be a continuation gap or a short-term exhaustion gap.

A continuation gap would need to hold and consolidate the gains (the gap must not fill), and should then continue to 4300 with only minor dips.

An exhaustion gap would fade back in to gap fill at 4203 in a ‘sell the news’ move. It should then hold the 4180s and rebuild for a second stage of the rally towards 4300.

I cannot predict which scenario will unfold (and there are many other possibilities) but prepared with a bias, targets and important levels, the market should present opportunities.

Read the full article here