Thesis

The Invesco Ultra Short Duration ETF (NYSEARCA:GSY) is a fixed income exchange traded fund which we covered before. The vehicle focuses on very short duration investment grade bonds, and has had a positive annual performance each year for the past decade. As per its literature, the vehicle:

is an actively managed exchange-traded fund (ETF) that seeks maximum current income, consistent with preservation of capital and daily liquidity. The Fund will invest at least 80% of its total assets in fixed income securities of varying maturities, but with an average duration of less than one year.

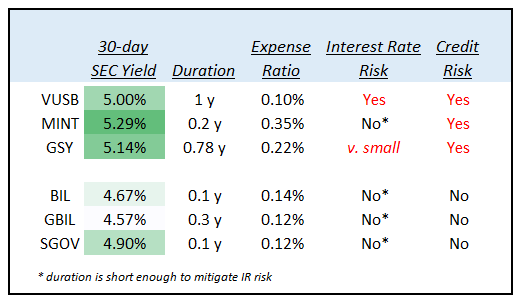

The prevailing question today in investors’ minds is whether to keep cash in government bond funds or money market funds, so we are going to have a look at how short term corporate bond funds benchmark. GSY is all investment grade collateral, with a very granular build (the vast majority of issuers are below 1.5% of the fund), which gives it a robust build in terms of credit risk. The question at hand though is whether it is worth it to take the additional credit risk (albeit small), and how much would an investor get compensated. Let us have a look:

Comparison (Author)

We can see that most short duration bond funds yield somewhere in the 5% to 5.3% range, with a low overall duration. Duration at this stage of the cycle is a bit less important, since we believe we are witnessing peak rates. It does, however, mitigate credit risk a bit as well, especially for industrials and ABS paper. The government fund cohort, however, has very high 30-day SEC yields nonetheless. Comparing the funds at hand it does not seem wise to take any sort of credit risk for an additional 30 to 40 bps in returns.

GSY is a very robust fund that has managed to post a positive annual performance each year in the past decade. That is an impressive feat, especially considering how fixed income performed in 2022. The fund does what it is supposed to, but currently its 30-day SEC yield is not compelling enough when compared to SGOV (which we covered here) to warrant a Buy rating. We are therefore on Hold with respect to GSY.

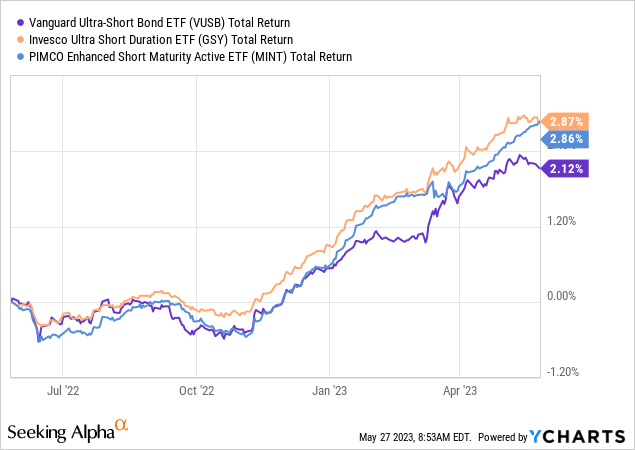

Performance

The fund managed to beat (on a total return basis) its peers from the short bond space, namely the Vanguard Ultra-Short Bond ETF (VUSB) and the PIMCO Enhanced Short Maturity Active Exchange-Traded Fund (MINT):

As rates stay high this year do expect GSY to post something closer to 5% for 2023.

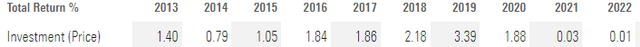

What is interesting about this fund, and is a reflection of its robust management team, is the fact that it has never lost money on an annual basis in the past decade:

Historic Performance (Morningstar)

Even in 2022, with all the carnage in the fixed income space, the fund managed to yield a positive number (albeit small). The factors behind this performance are represented by its short duration and high credit quality. The idea behind short duration funds is that they tend to roll bonds fully during a calendar year, thus mitigate interest rate risk.

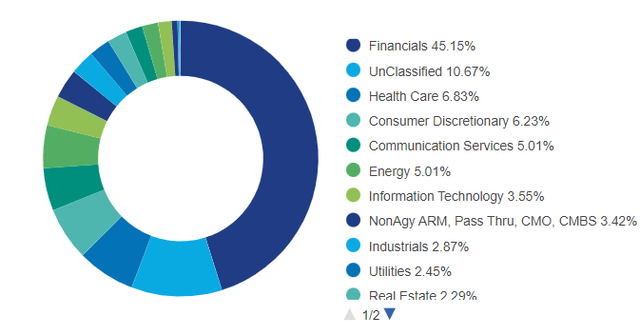

Holdings

The fund holds mainly corporate bonds, with an ABS sleeve and a Treasuries one:

Holdings (Fund Fact Sheet)

This fund is exclusively investment grade as per its rating grid. The only concern here is the Financials sleeve. We have seen how some of the regional banks that were rated investment grade managed to go under quite quickly. In the financials space, it is more about ability to generate faith in the business model, since defaults come in very fast. In the industrials space for example it can take years for a company to default (an investment grade one that is), because the operating business degrades slowly. In the financials space most of the funding is done some sort of deposits, which means investors’ faith in the company is paramount to survival. The fund mitigates this aspect via granularity:

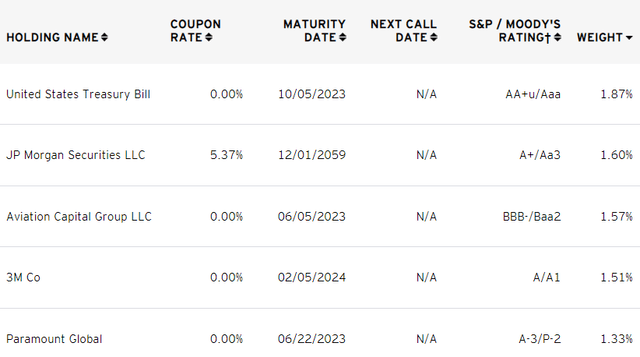

Top Holdings (Fund Website)

We can see that most names have weighting below 1.5%, which means any one default will not sink this fund. In effect, outside Financials, we should also see a 40% recovery on any one defaulted name.

Conclusion

GSY is a fixed income exchange traded fund. The vehicle purchases only investment grade collateral, with a focus on corporate bonds. The fund has a low duration of 0.78 years and has been able to navigate rising rates very well. This fund has been able to post a positive annual total return each year in the past decade. Currently the fund has a 5.14% 30-day SEC yield, which is only 25 bps higher than what SGOV yields. SGOV is a treasuries only fund we have covered here. GSY is a robust fund to be held, but not compelling enough from a yield perspective to warrant a buy when a retail investor can obtain credit risk free yields via SGOV and the associated cohort.

Read the full article here