Ingersoll Rand (NYSE:IR) has shown tremendous revenue growth and profitability. The company may have a long runway of growth ahead of it. But I think the company will have to pay a higher dividend, and its valuation needs to be more reasonable. This industrial company may be a must-own for a long-term investor at the right price.

Organic growth and acquisitions are driving stellar revenue growth

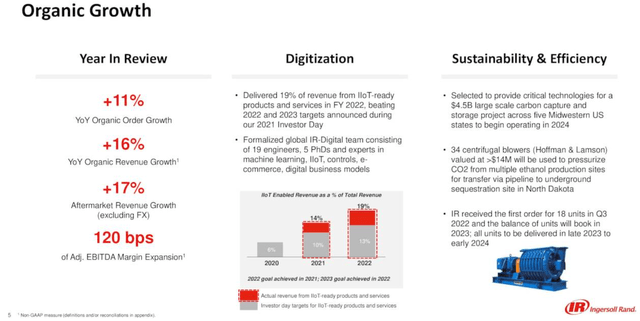

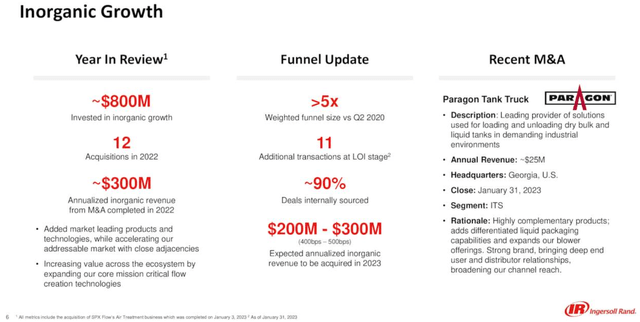

In 2022, the company reported organic revenue growth of 16% (Exhibit 1). The company completed 12 acquisitions in 2022 for approximately $800 million, contributing to about $300 million in revenue (Exhibit 2). The company wants to drive another $200 million to $300 million in revenue growth via acquisition in 2023. This acquisition-driven revenue could potentially amount to 400 to 500 basis points in revenue growth in 2023.

Exhibit 1:

Ingersoll Rand FY 2022 Growth (Ingersoll Rand Investor Presentation)

Exhibit 2:

Ingersoll Rand FY 2022 Inorganic Growth (Ingersoll Rand Investor Presentation)

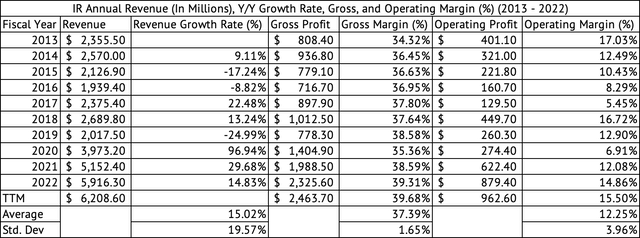

In Q1 2023, the company accelerated its revenue growth showing a 20% organic growth. Overall revenue grew by 22% in Q1. But, without the headwinds of a strong dollar, revenue would have increased by 26%. The management has improved gross margins in 2021 and 2022. The company averaged a gross margin of 37.3% over the past decade (Exhibit 3). This period includes the time before the merger between Gardner Denver and Ingersoll Rand Industrial. The merger was completed in February 2020.

Exhibit 3:

Ingersoll Rand Annual Revenue, Gross, Operating Profits, and Margins (%) (Seeking Alpha, Author Compilation)

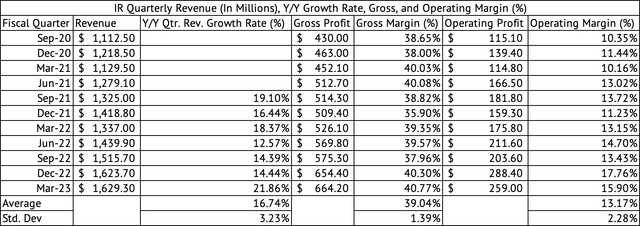

Exhibit 4:

Ingersoll Rand Quarterly Revenue, Gross, Operating Profit, and Margins (%) (Seeking Alpha, Author Compilation)

The company’s quarterly gross margins have averaged 39% since September 2020 (Exhibit 4). The company has shown remarkable stability in its margins, with a low standard deviation of 1.3% in its quarterly gross margins. In comparison, Flowserve (FLS), for example, has lower gross margins and higher variability. The company enjoys good operating margins but has higher variability than the gross margins due to increased variability in selling, general, and administration expenses (SG&A). The company registered 13.1% in average operating margins since September 2020.

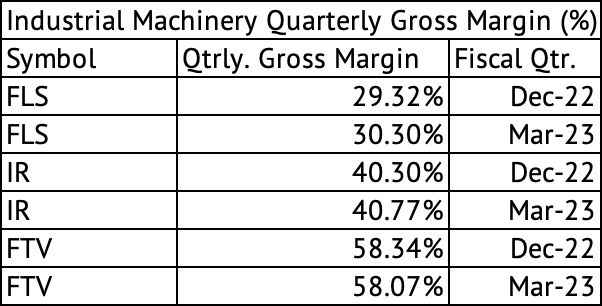

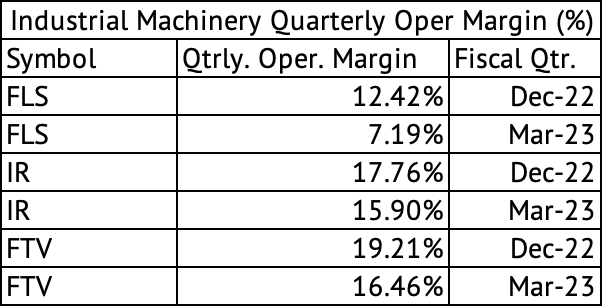

Comparing the margins across a few other industrial companies, Ingersoll Rand comes in the middle of the pack with a respectable gross margin above 40% and an average operating margin above 16% in the past two quarters (Exhibits 5 & 6).

Exhibit 5:

Industrial Machinery Gross Margin (%) (Seeking Alpha, Author Compilation)

Exhibit 6:

Industrial Machinery Quarterly Operating Margin (%) (Seeking Alpha, Author Compilation)

Increased inventory is limiting cash flows

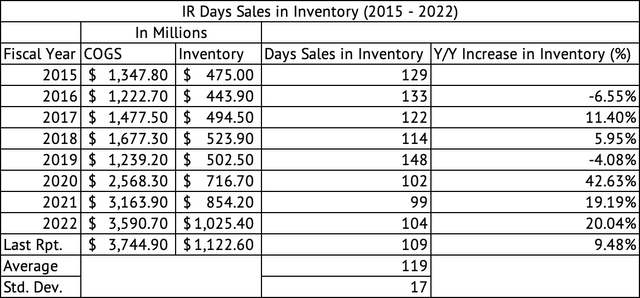

The company has seen its inventory costs increase, lowering operating cash flows. The company saw a 42%, 19%, and 20% y/y increase in its inventory in 2020, 2021, and 2022, respectively. The company carried 109 days of sales in inventory compared to its average of 119, with a standard deviation of 17 (Exhibit 7).

Exhibit 7:

Ingersoll Rand Day’s Sales in Inventory (Seeking Alpha, Author Compilation)

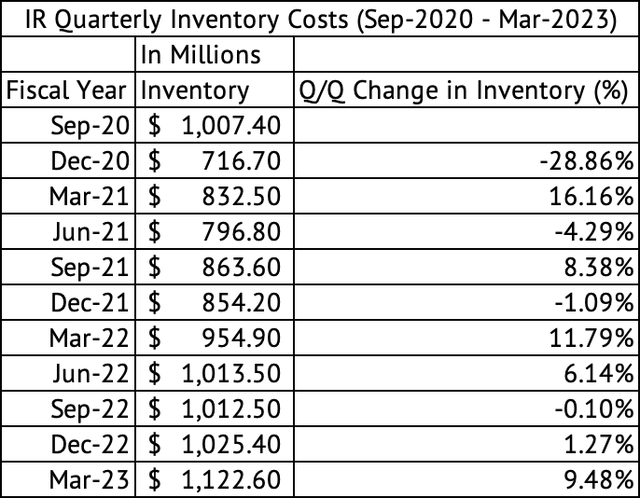

Many industrial companies build inventory in their March quarter to prepare for increased construction and industrial activity in the spring and summer months. Ingersoll Rand has consistently increased its inventory going into its March quarter. March 2021, 2022, and 2023 saw a q/q jump in the inventory of 16%, 11%, and 9% (Exhibit 8). Besides increased inventory costs, increased accounts receivables pressured operating cash flows in the March quarter. There may be a seasonality factor associated with the increase in receivables. The company probably ships more products in the March quarter and is waiting to be paid in my view.

Exhibit 8:

Ingersoll Rand Quarterly Inventory (Seeking Alpha, Author Compilation)

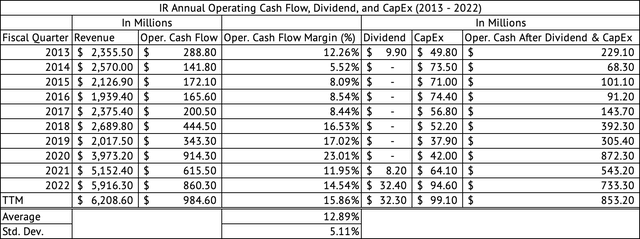

The company booked significant cash flows even after seeing an increase in inventory and outstanding receivables. It generated $984 million in operating cash in the trailing twelve months (Exhibit 9). The company registered an operating cash flow margin of 15.8% during the past twelve months compared to its average of 12.8% over the past decade. The company has registered a stellar operating cash flow margin since 2018.

Exhibit 9:

Ingersoll Rand Operating Cash Flow (Seeking Alpha, Author Compilation)

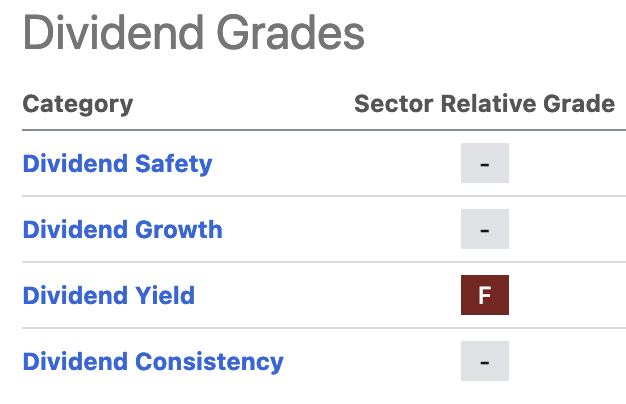

Cursory dividend payment

The company generates a lot of cash and can support a higher dividend payout. It would not be a surprise if the company increased its dividend payments consistently over the next few years. The company’s current payout ratio is 2.3%. The stock’s forward yield is a nanoscopic 0.14%. It seems like the company pays a cursory dividend to align itself with the rest of the industrial sector concerning the dividend policy. No wonder Ingersoll Rand gets an “F” grade from Seeking Alpha for its dividend yield (Exhibit 10).

Exhibit 10:

Seeking Alpha’s Dividend Grades for Ingersoll Rand (Seeking Alpha)

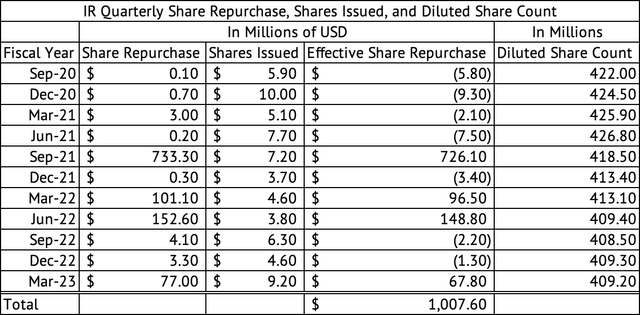

The management may have prioritized share repurchases instead of dividends. The company has repurchased $1 billion in shares since September 2020 (Exhibit 11). The company generated $2.24 billion in operating cash during this period. The diluted share count has reduced from 422 million to 409.2 million for an effective per-share repurchase price of $78.71. The stock currently changes hands at $58.89.

Exhibit 11:

Ingersoll Rand Share Buybacks (Seeking Alpha, Author Compilation)

Valuation

I believe the company is overvalued now, and investors appear willing to pay a massive premium for revenue growth in an era where growth is decelerating globally. The stock trades at a forward GAAP PE of 31.6x compared to the weighted average PE of 18.9x for companies in the Vanguard Industrials ETF (VIS). The Vanguard S&P 500 Index ETF (VOO) companies trade at a weighted average PE ratio of 21.5x.

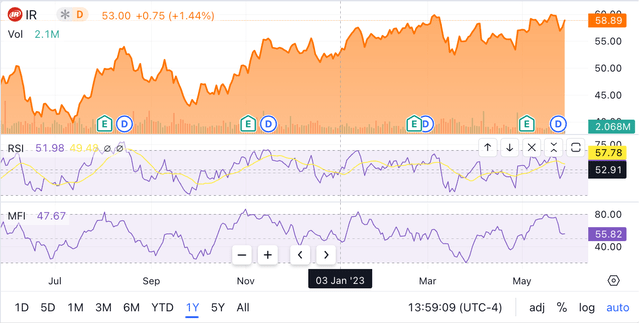

The stock has had much positive momentum, returning 24.4% over the past year compared to a 6.7% return for the Vanguard Industrials ETF and a 3.6% return for the Vanguard S&P 500 Index ETF. However, the stock’s momentum may fade after such a mammoth run. The stock returned 2.1% over the past three months, and its RSI and MFI technical indicators have weakened to a mid-fifties reading (Exhibit 12). Investors should be cautious when chasing a red-hot stock such as Ingersoll Rand.

Exhibit 12:

Ingersoll Rand Technical Indicators (Seeking Alpha)

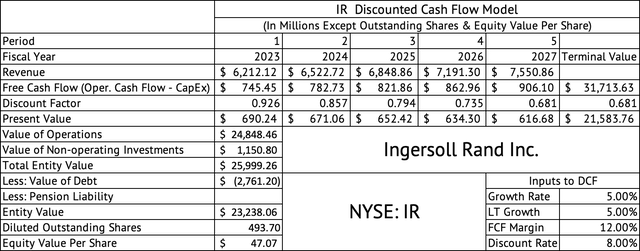

A discounted cash flow model estimates a per-share equity value of $47 (Exhibit 13). This model assumes a revenue growth rate of 5%, a 12% free cash flow margin, and a discount rate of 8%. All of these assumptions are a bit on the optimistic side. But, overall, the company offers tremendous potential and can be a great value creator in a long-term portfolio when purchased at a much lower valuation. The stock’s dividend yield is also low at this time. The stock may have to get closer to $45 before I consider opening a position.

Exhibit 13:

Ingersoll Rand Discounted Cash Flow Model (Seeking Alpha, Author Calculations)

Ingersoll Rand plays in attractive end markets and has good margins and cash flows. The stock’s dividend is too low for me since the management has prioritized buybacks over dividend payments. But, the company will likely increase its dividend consistently over the next few years. However, the stock is too overvalued, and long-term investors should wait for an attractive valuation before adding to their portfolio.

Read the full article here