Intro

We wrote about Cohu, Inc. (NASDAQ:COHU) back in October of 2022 when we stated that shares were close to completing a bottom. The one disclaimer we gave investors at the time was to wait for shares to rally above their respective 200-day moving average. Luckily, this took place not long after our October commentary with shares having returned close to 40% or $11 a share in the interim period.

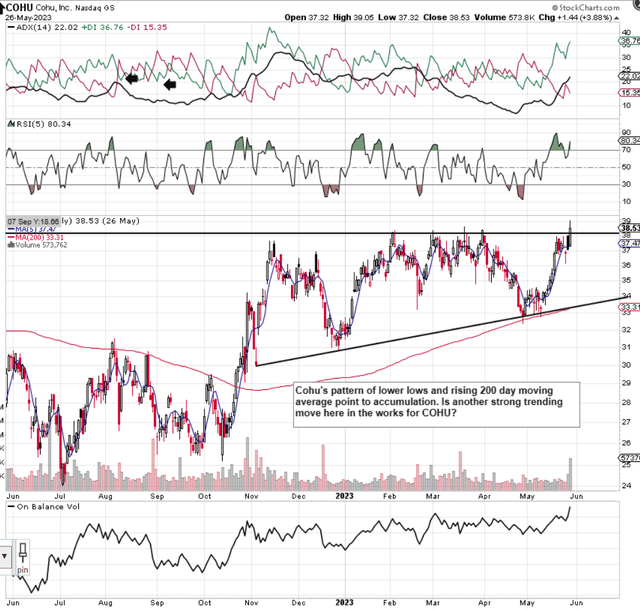

Despite Cohu’s very strong returns over the past 7 months or so, investors continue to be attracted to this play as we can see from the stock’s bullish technicals below. In fact, Cohu’s recent share-price action (where shares have trading in a range for many months now) has all the hallmarks of an ascending triangle being played out here. These patterns are invariably bullish wherever they appear on a technical chart as consistent lower highs inevitably lead to mounting upward pressure to take out overhead resistance over time.

Shares of Cohu at present are once more attempting to take out the overhead resistance trendline of this triangle. In fact, the breakout may already be in here as buying volume spiked in recent trading sessions sending shares of Cohu higher. Therefore, let’s see if the fundamentals of Cohu are aligned with another potential sizable move in its share price. As always, it will boil down to the relationships between the company’s valuation & profitability trends which will demonstrate whether investors will continue to buy shares in droves even at prices much higher than we have today.

Cohu Technicals demonstrate buyer accumulation (Stockcharts.com)

Recurring Business Growth Trend

In the company’s most recent first quarter, Cohu’s Non-GAAP earnings of $0.56 beat the consensus estimate by $0.02 per share. Revenues of slightly under $180 million missed estimates by a slight margin. Despite the negative top and bottom-line growth rates over Q1-2022, there were plenty of encouraging trends in the quarter which we see below.

Cohu’s recurring business continues to grow and its margins continue to outpace the company’s average. The company’s recurring business made up 43% of the top-line take in the first quarter this year which means this revenue stream has grown by well over 6% on average per year over the past three years. Furthermore, the gross margin in this business hit 53% in Q1 against a gross margin of just over 48% for the company overall. The retention rates among customers in the recurring ‘Services’ segment are now approaching 90% and strong demand in the company’s test interface business has meant that contactor manufacturing is set to expand rapidly in the Philippines.

Suffice it to say, these trends (which point to sustained growth in the company’s recurring segments over time) along with ongoing development in the software segment bode well for strong forward-looking cash-flow generation going forward. If trends continue (with respect to growing recurring sales and margins), it is a dead certainty that investors will reward the stock by pricing shares higher.

Value

The problem though is that if we take the company as a whole, by including all of the company’s businesses, it still remains very difficult to predict forward-looking growth rates. Just look at the mobility and computing segments for example. The market expects a strong recovery in both of these segments but timing these uplifts remains a difficult endeavor indeed.

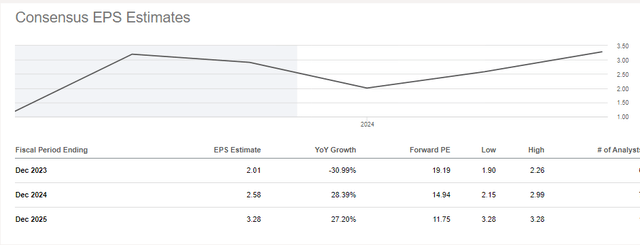

Once we get past this year, we see that consensus is predicting almost 30% bottom-line growth rates next year as well in fiscal 2025. Given that, next year’s forward non-GAAP earnings multiple comes in at a very attractive 14.94, shares continue to look cheap at present when compared to the growth that is ‘expected’ of Cohu.

Cohu Forward Looking EPS Estimates (Seeking Alpha)

Suffice it to say, over the near term, as long as near-term EPS revisions continue to be dialed up, we see the ascending triangle alluded to above most likely playing itself out in due course. This means overhead resistance (upper trendline) would convert into long-term support for the stock over time. A downward move in revisions however would be detrimental as downside support would most likely be lost. This is why caution is required at present until the market established a fresh trend.

Conclusion

Therefore, to sum up, Cohu’s technicals, rising margins, and rising recurring revenue all point to gains in the company’s stock over time. Despite the 40% capital gain in the share price since late last year, shares indeed may continue to be cheap here if indeed present trends continue. Let’s see how the stock trades over the next week or so. We look forward to continued coverage.

Read the full article here